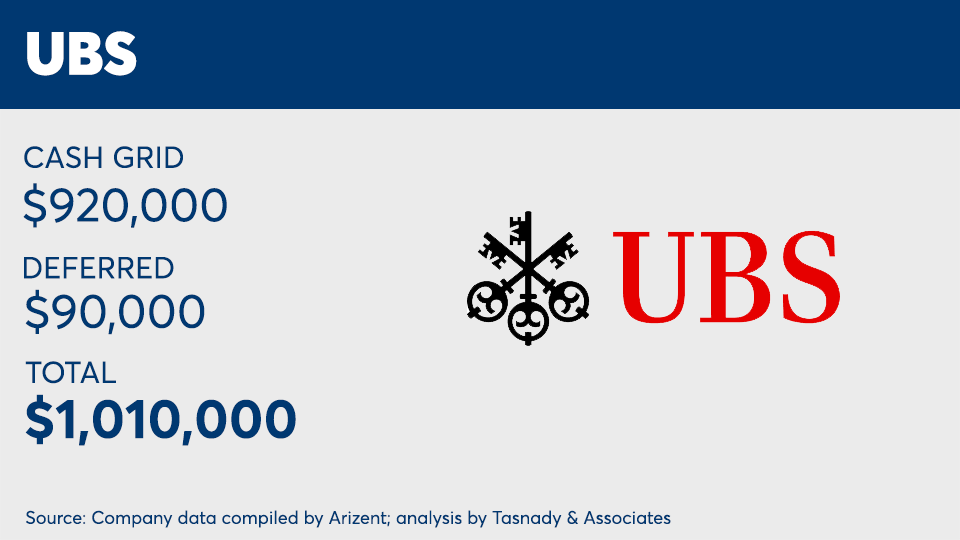

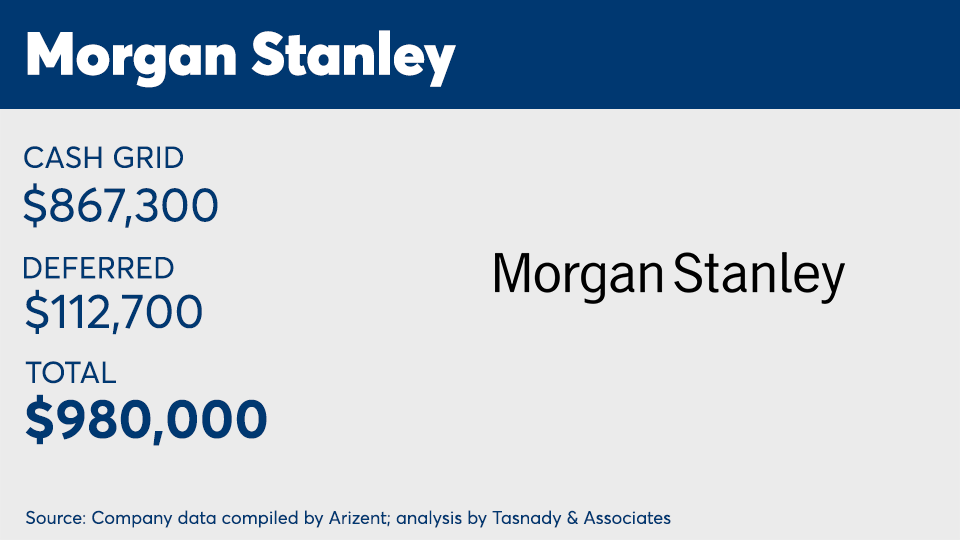

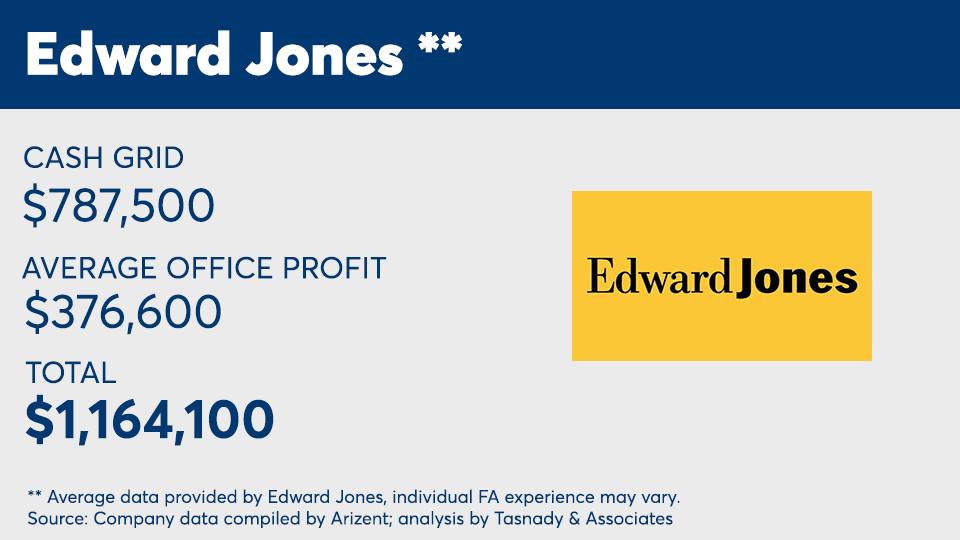

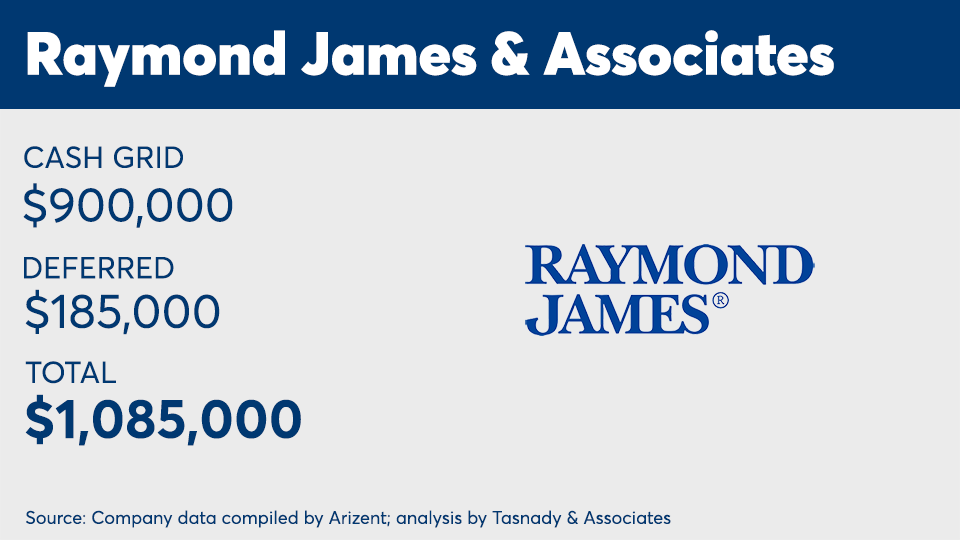

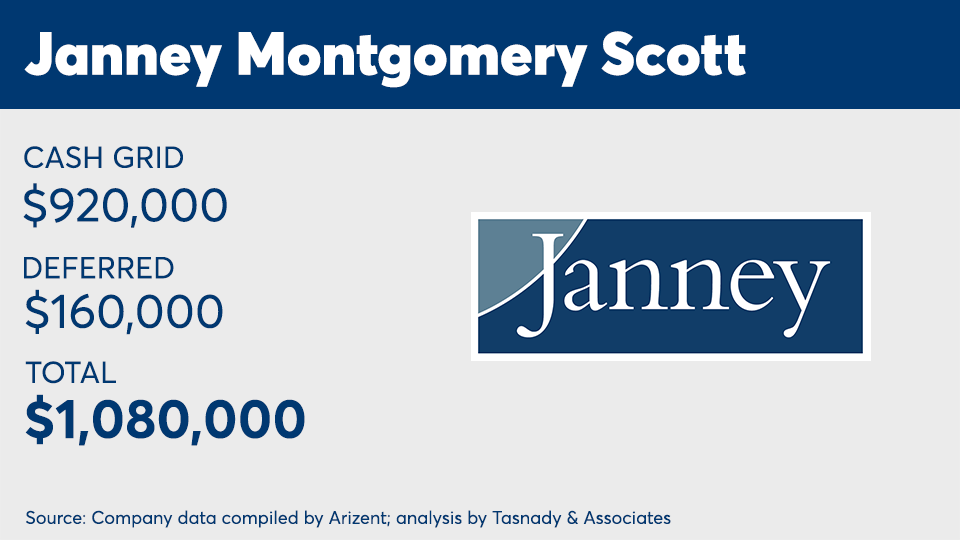

On Wall Street continues its annual analysis of base pay for advisors by looking at payout rates for those with $2 million in production.

For our analysis of other categories, please see below.

Data was collected by Arizent and analysis conducted by Tasnady & Associates.

Assumptions for basic pay (prior to special policies/contingent bonuses):

- 25% in individual stocks; 25% in individual bonds; 25% in mutual funds; 25% in fee-based (wrap accounts, managed accounts, etc.)

- Year-end basic bonuses are shown in deferred totals.

- Length of service is assumed to be 10 years.

- Assumes no impacts from bonuses based on growth, asset-based bonuses or other behavior-based awards.

- Excludes voluntary deferral matches, 401(k) matches or profit-sharing contributions, unless otherwise noted.

- Does not include: T&E expense allowance, discount sharing or ticket charge expense assumptions, small household or small ticket policy assumptions, or value of any options awards.