Which firms pay advisors the most?

It’s a hot topic at any time — but even more so today following recent changes in compensation policies at some brokerages.

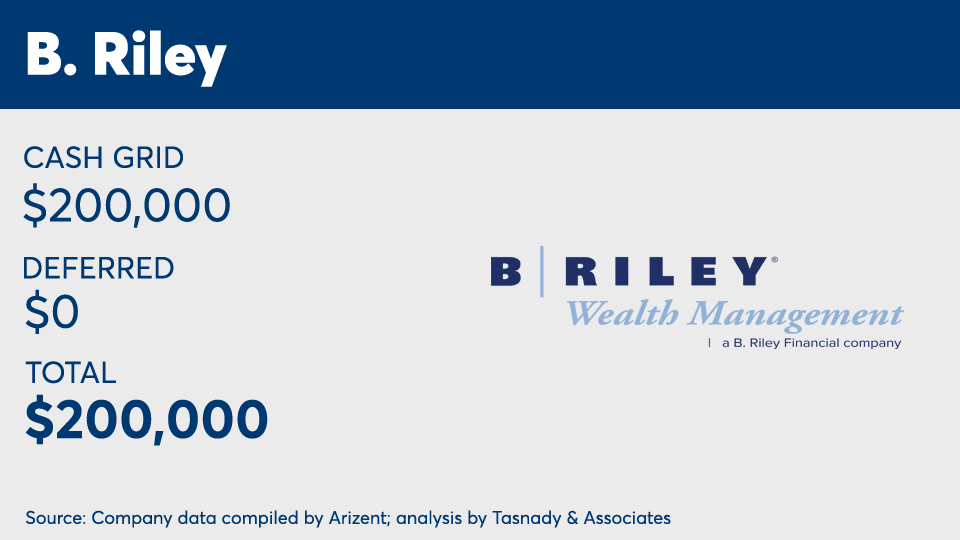

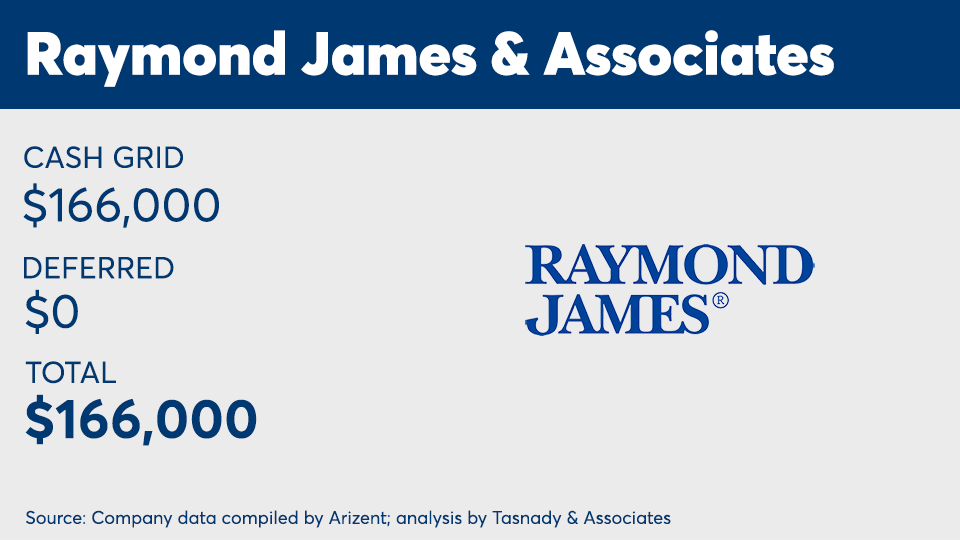

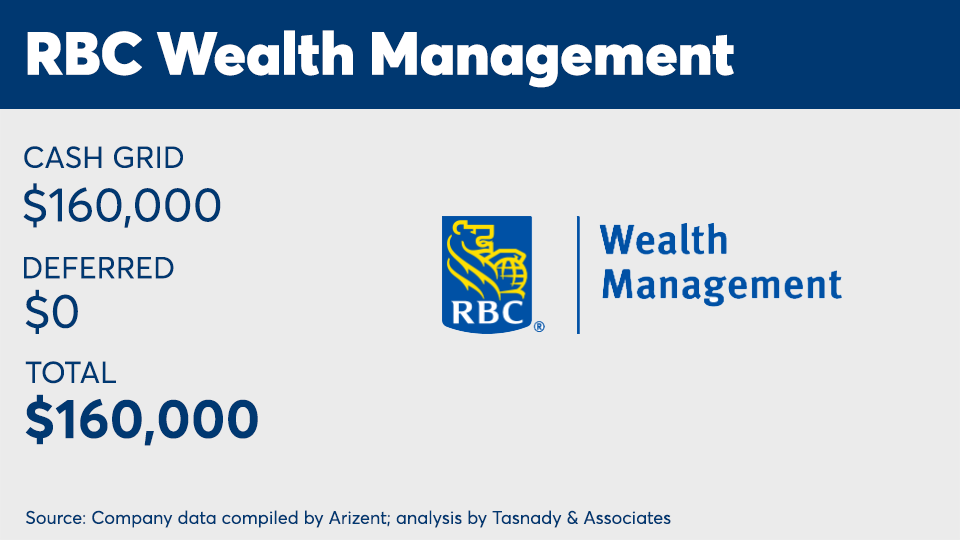

To help advisors find the plan that best suits them, On Wall Street conducts an annual analysis of compensation at wirehouses, national and regional broker-dealers.

While a majority of core components remain the same as last year, key policies changed at several firms, and then changed again.

In its 2020 comp plan,

Typically, pay changes target lower-producing advisors, says compensation consultant Andy Tasnady, who helped prepare this year’s analysis.

“The changes Wells Fargo made affected people above $600,000. That’s interesting — but it wasn’t a dramatic change,” Tasnady says.

It’s also critical to note that some planned changes for 2020 have been put on hold in light of the economic fallout from the coronavirus.

And that is a key point, according to Tasnady. Advisors will likely face bigger pay cuts this year from the negative impact and upheaval wrought by the pandemic.

“Everyone annuitized their business,” he says, noting the explosion in fee-based business among advisors and brokers. Markets go up, your income goes up.”

But now, advisors and firms alike are facing a revenue reduction that undercuts the rationale for a grid stretch, Tasnday says.

Data was collected by Arizent and analysis conducted by Tasnady & Associates.

A note about this year’s analysis: A number of special policies are not included here because they do not affect 100% of the advisor population evenly and therefore are more haphazard to compare. Individual results can vary dramatically, based on the mix of business and policies at each firm. For example, pay can rise from special bonuses and fall from penalties such as discount sharing, small client limits and ticket charges.

Assumptions for basic pay (prior to special policies/contingent bonuses):

- 25% in individual stocks; 25% in individual bonds; 25% in mutual funds; 25% in fee-based (wrap accounts, managed accounts, etc.)

- Year-end basic bonuses are shown in deferred totals.

- Length of service is assumed to be 10 years.

- Assumes no impacts from bonuses based on growth, asset-based bonuses or other behavior-based awards.

- Excludes voluntary deferral matches, 401(k) matches or profit-sharing contributions, unless otherwise noted.

- Does not include: T&E expense allowance, discount sharing or ticket charge expense assumptions, small household or small ticket policy assumptions, or value of any options awards.