If you were to analyze the decade’s 20 best-performing municipal bond funds by their one-year returns, it would be easy to think you were in the wrong place.

Taking the longer view, though, can add more clarity. The average annualized return of those same 20 funds over the last 10 years was more than 6.5%, Morningstar data shows. The more recent push from the Fed to increase interest rates is one factor turning the tide, says Greg McBride, chief financial analyst at Bankrate.

“Bond funds are not immune to losses, and that is particularly the case when interest rates are rising,” McBride says. “The benefit of holding bond funds in your portfolio is that the price swings are more muted than what is seen in equities, reducing risk for the investor. While the losses are more muted than equities, over time, the gains are more muted, as well.”

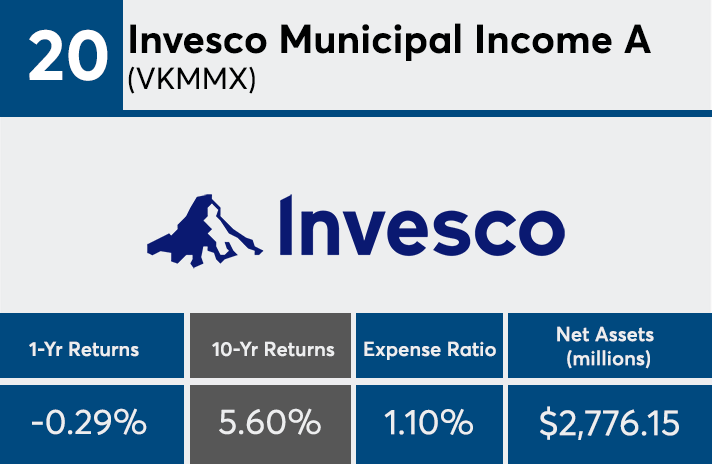

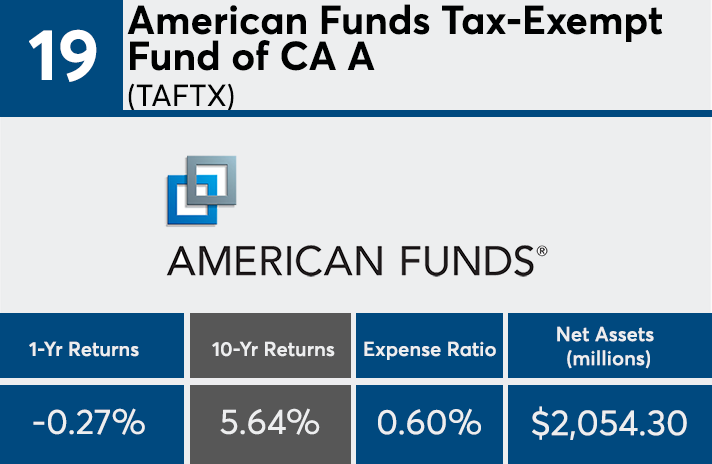

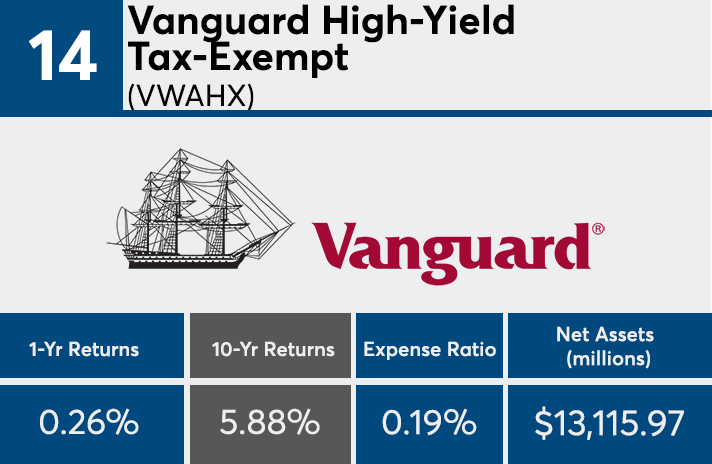

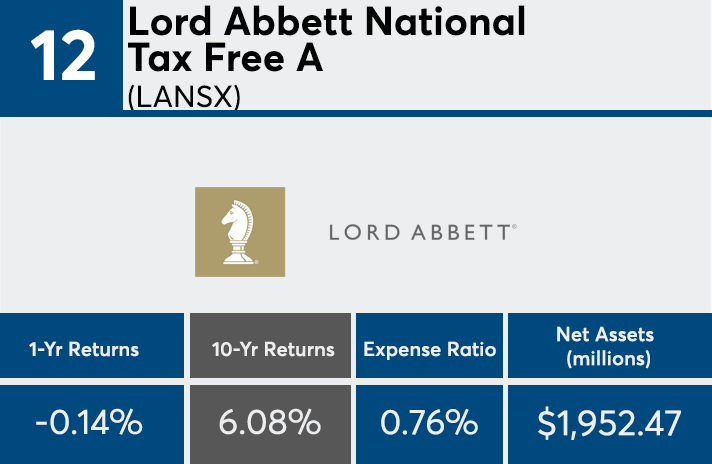

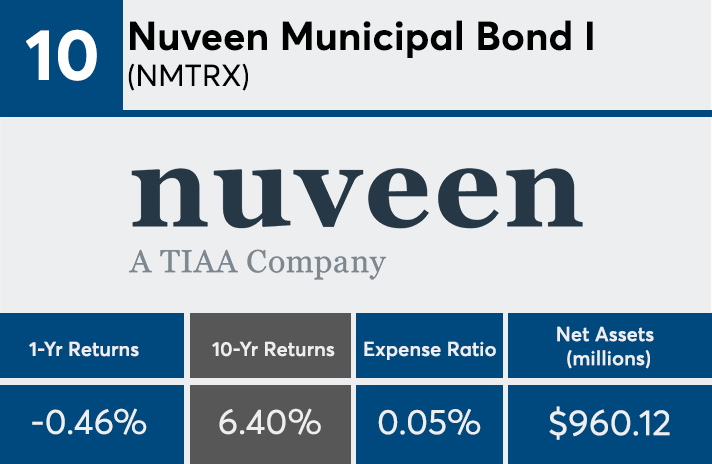

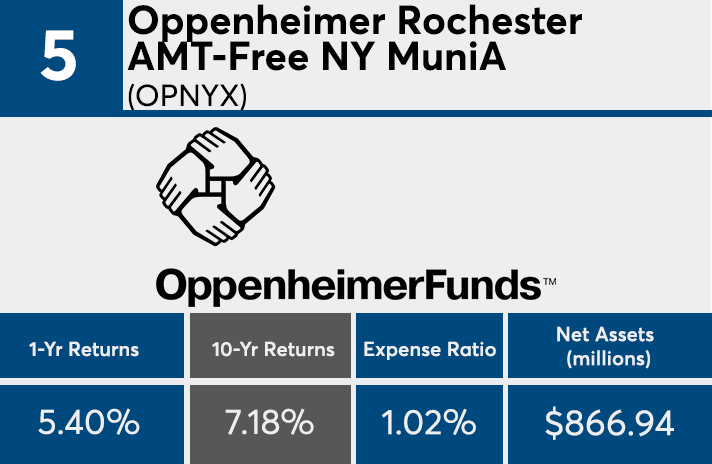

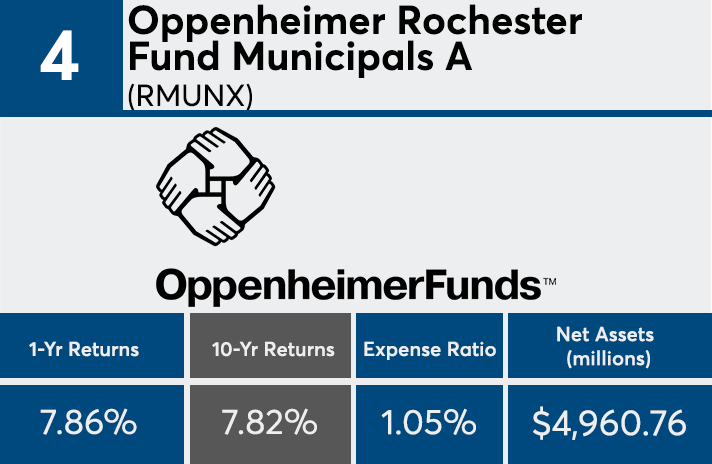

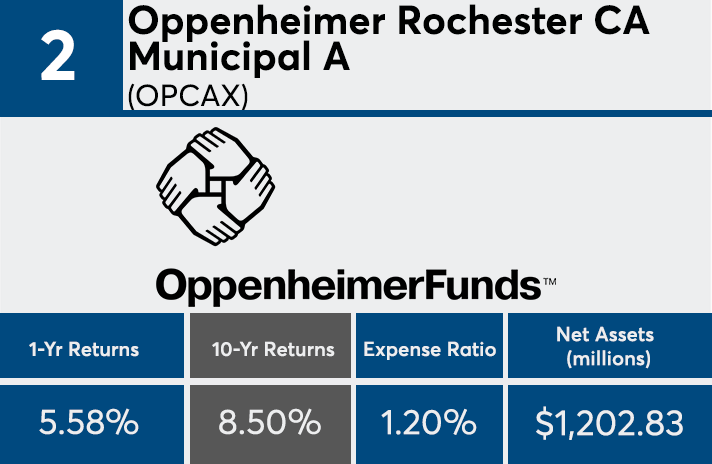

The funds on this list, which hold a combined $46.9 billion in assets, have expense ratios that range from 5 basis point to 1.20%, with an average of 0.70%. The overall muni fund universe, which has $606.2 billion, has an average expense ratio of 0.65%; just slightly lower than that of the top-performers.

What drove the top-performing returns? McBride suggests it was a combination of favorable employment figures and low interest rates.

“The last 10 years have seen the economy rebound and post consistent growth, unemployment fall from double digits to the lowest levels in nearly 50 years, and through much of that time, further declines in interest rates,” he says. “This favorable backdrop facilitated solid returns for municipal bond funds, particularly those holding bonds of marginal credit quality, over the preceding decade.”

Looking ahead, however, McBride expects the bond industry to more closely reflect the one-year returns as interest rates continue to rise.

“Bonds funds will perform much differently now that interest rates are rising rather than falling,” McBride explains. “Don’t expect these returns to be replicated.”

When compared to the industry’s worst-performing muni bond funds, data shows investors paid more for their returns. Those offerings, which hold even more client assets at $77.01 billion, had an average expense ratio of 0.51% and 10-year return of 0.73%.

Scroll through to see the 20 top-performing muni bond funds over the past 10 years. Only funds with at least $500 million in assets were included. Institutional, leveraged and funds with over $100,000 investment minimums were excluded. We also show one-year returns, assets and, as usual, expense ratios for each fund. All data from Morningstar Direct.