Financial advisors are the happiest they've been with their broker-dealers in the past five years — but the firms have a lot of work to do to win over the next generation, according to J.D. Power.

Employee and independent BD advisors reported the highest rates of satisfaction since at least 2013 in the consumer research firm’s

The top firms’ rivals also reeled in positive results: LPL Financial, Ameriprise’s employee channel and Wells Fargo Advisors achieved the largest year-over-year gains of any of the 16 firms.

However, all firms face a major demographic challenge as the advisor population ages. Just 11% of the advisor population is 40 or younger, according to J.D. Power. Some 20% of advisors are at least 65 years old, and the average age for the industry is about 55. The younger advisors gave much lower satisfaction scores when asked about technology.

“Leadership and culture are important to everyone, but technology was an area we identified with a big gap generationally,” Mike Foy, senior director of wealth and lending intelligence, said in an email. “Younger advisors (and younger clients) have higher expectations.”

The ability to tap mobile tools and social media is a key area of improvement for firms eager to attract and keep younger talent, the J.D. Power data show. Firms are also ramping up succession services like consulting, financing and matchmaking, says recruiter Jodie Papike of Cross-Search.

Most independent BDs, however, still lack training programs that could help make it easier to enter the field, she adds. The expense of such an investment often causes firms to balk at the idea in favor of the traditional approach — placing the onus on advisors to build their book.

“You're making what you bring in,” Papike says. “It's very difficult for someone to come in and not have the security of a salaried position. So it makes sense why those numbers are so low.”

Advisors tend to have fewer pain points in general when stock markets perform well, Papike notes of the higher scores across the board. Vastly improved advisor satisfaction at large firms like Ameriprise, Wells Fargo and LPL also drove up the overall indices, according to Foy.

Those firms would need to boost their marks at an even greater level to catch up with perennial leaders Commonwealth and Edward Jones. Cultures marked by a supportive or “even familial” approach from the home office put them at the top of every metric, Foy says.

Edward Jones’s brand, infrastructure and involved level of service often win approval from reps, according to Papike. And Commonwealth’s approach of making “very difficult decisions” regarding the advisors it recruits makes them appreciate the firm’s resources all the more, she says.

“It's their commitment to adding a lot of value to their advisors, not just being a firm that processes and pays on time,” Papike says. “They put a tremendous amount of focus in looking at the future and how they can help advisors get to the next level.”

The J.D. Power survey covered seven factors: client help, compensation, leadership, operations, problem resolution, professional development and tech support. The consumer research firm spoke with 3,571 employee and independent advisors between January and May to collect the data.

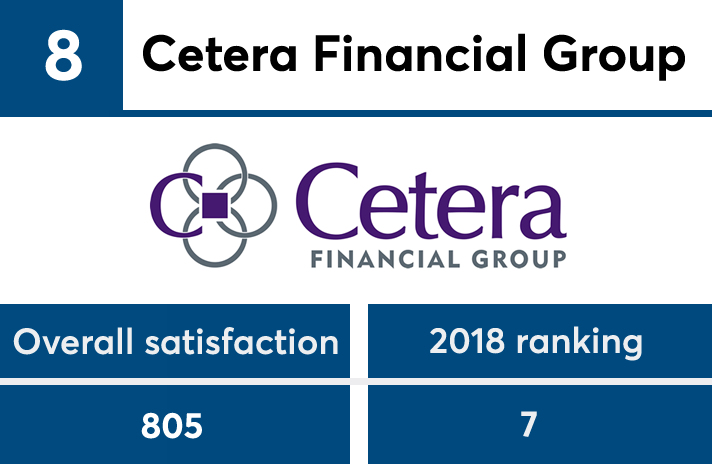

To see which firms ranked highest in the survey among those with at least 100 participating reps, scroll down the list. For last year’s rankings,