Reports of the death of the proverbial “rep-as-portfolio manager” appear to have been exaggerated.

Even as the wealth management industry moves to

High-net-worth clients also rated their investment performance 66 points lower than the previous year on a 1,000-point scale, the market research company reports. Between November and January, J.D. Power spoke to more than 4,600 investors who have advisors.

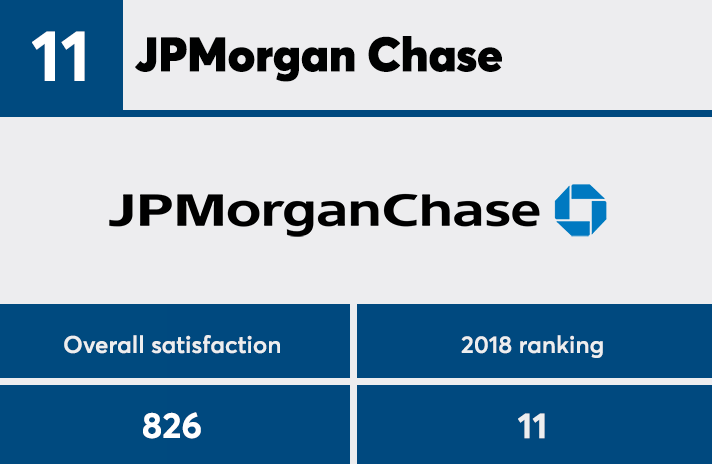

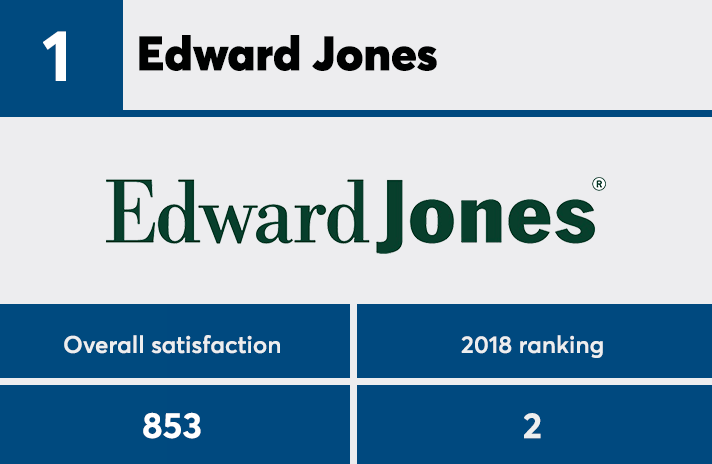

The volatility also played a role in lowering satisfaction on the overall 1,000-point index among clients of two-thirds of the 18 firms covered in the survey. Charles Schwab, which

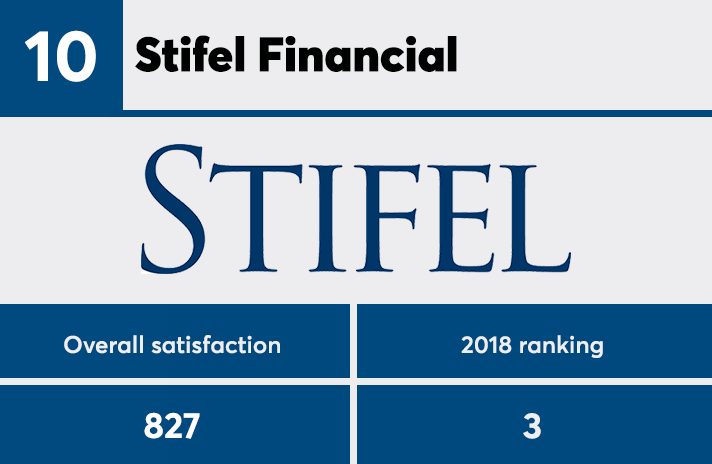

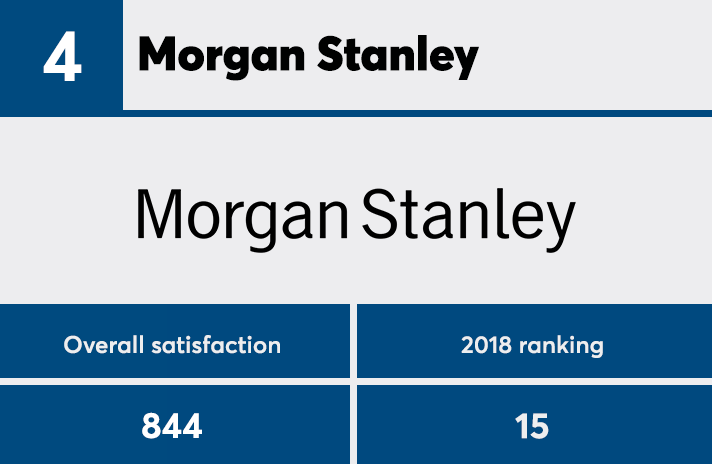

Other notable risers in the survey include Morgan Stanley and Advisor Group. Morgan jumped from 15th to 4th in the rankings. Advisor Group improved its score by double the amount of any other firm and surged up to near the top from last place in 2018. Stifel Financial (38 points) and LPL (37) suffered the largest blows to their client satisfaction scores.

Advisors vary both in the amount they outsource modeling and other portfolio construction services, as well as in the degree they would like support from their broker-dealer on investment research or talking points for volatile markets, notes recruiter Jodie Papike of Cross-Search.

“It's just something that, from the beginning, has been a very big challenge for advisors,” Papike says. “The true test is, are your clients prepared for when things aren't going that well? Are they prepared to remain patient with you, with the broker-dealer, with the market, with everything that's involved in this business?”

The question of whether clients' advisor explained their 2018 investment performance displayed a stark difference in possible flight risk and referrals. Some 53% of clients who said their advisor did so reported they “definitely will” recommend their advisor.

Only 24% of clients who said their advisor didn’t explain it said they definitely will recommend the advisor. Also, just 10% of clients who received explanations said they definitely or probably will consider switching firms, compared to 20% who didn’t have such a discussion.

“It can be a difficult conversation when clients are losing money, but advisors who fail to have those hard conversations are putting at risk both their future growth opportunities, resulting in reduced client referrals and, in more extreme situations, losing their current clients either to other advisors or to alternative service models,” Mike Foy, J.D. Power’s senior director of wealth intelligence, said in a statement.

Some clients come down with a case of “convenient amnesia” when asked if they have discussed certain things with their advisor, says Diane MacPhee, a CFP and former advisor who now coaches advisors at DMAC Consulting Services.

She favors using memorable phrases — like reminding clients in bull markets that the party doesn’t go on forever, for example. Advisors should also avoid pitfalls in the future by indulging a prospect’s focus on investment returns and ask clients if they have any questions about their portfolio, she says.

“They can explain it over and over again and they'll still get the jittery, skittish client,” she says, suggesting advisors wait to remind clients of their financial plans and the 365-day year after letting the clients vent a bit. “I always say to them that, ‘This is where you earn your fee.’”

J.D. Power has conducted the survey for 17 years. Participating clients said they make some or all of their investment decisions with a financial advisor. At least 1,000 clients of each full-service firm participated in the study.

In addition to investment performance, the survey tracked categories like the clients’ advisors, account information, firm interaction, products and fees. The advisors themselves were the most important factor in the weighted index, followed by account information and investment performance.

To see the results of the 2018 survey,