Want unlimited access to top ideas and insights?

Is active management dead? While their gains came at a hefty price, the biggest returns in active fundland nearly doubled the broader markets last year.

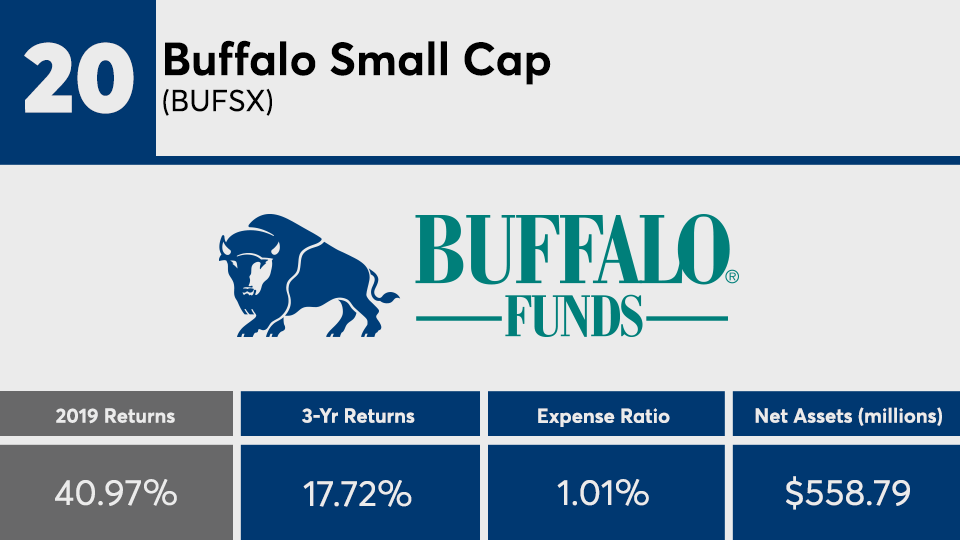

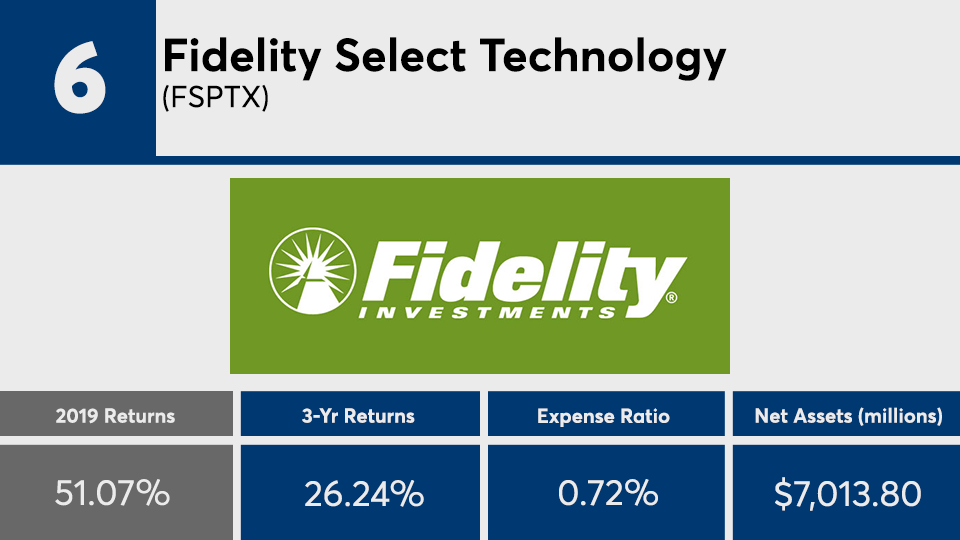

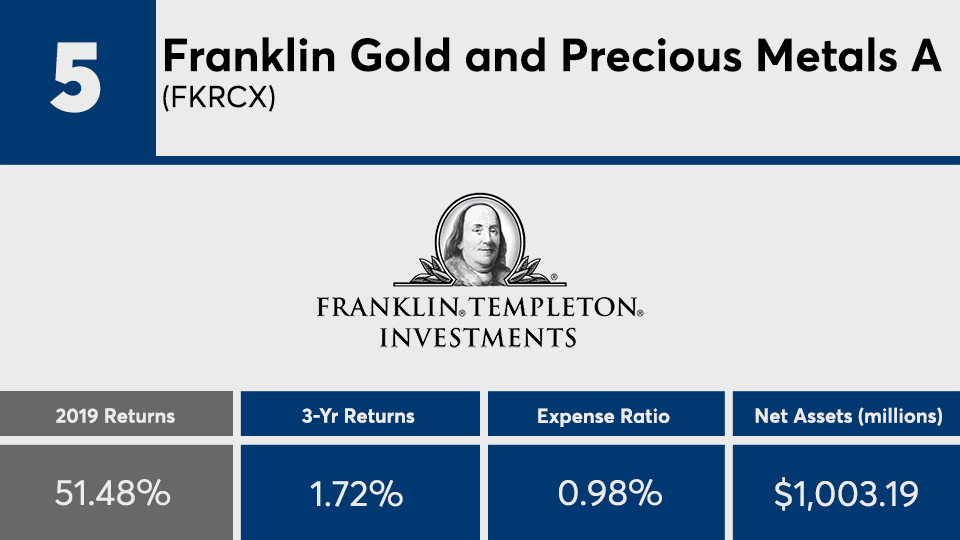

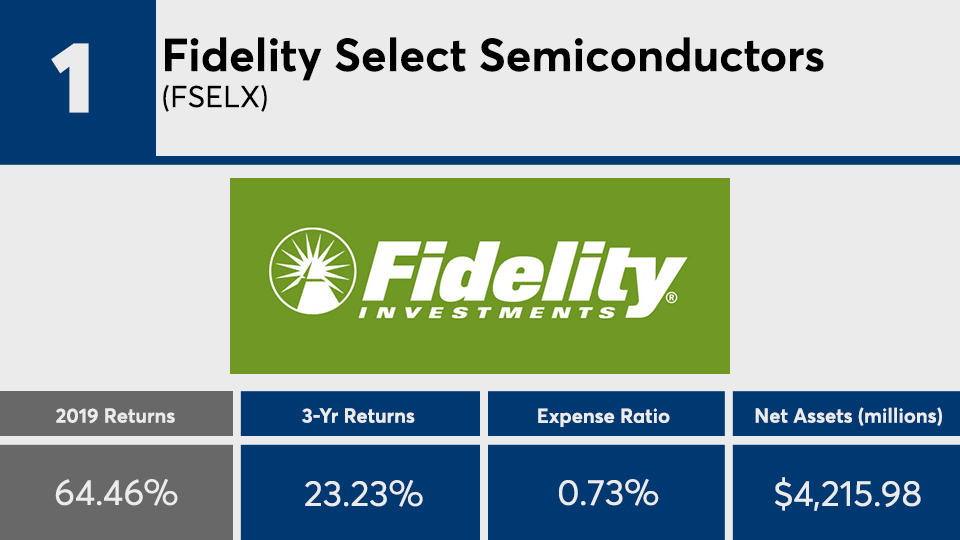

With an average gain of 47.83%, the 20 actively managed funds with the best returns of 2019 — and at least $500 million in assets under management — posted an average gain well above the S&P 500’s 31.22%, as measured by the SPDR S&P 500 ETF Trust (SPY); and the Dow’s 25.01% gain, as measured by the SPDR Dow Jones Industrial Average ETF (DIA), according to Morningstar Direct.

“Around 40% of active funds generated higher net returns than their benchmark indexes in 2019, 53% before fees,” Jeffrey Ptak, head of global manager research for Morningstar, wrote in his analysis of active management in 2019. “This does represent an improvement from a dismal 2018 campaign when fewer than one third of active funds beat their bogies net of fees.”

While it's seemingly all roses at the top, a deeper dive into the performance of the active fund industry tells a thornier story. Analysis of a similar screen of the broader active fund universe shows an average gain of 19.94% in 2019. Though up significantly from a 5.56% loss in 2018 and a 16.01% gain in 2017, the active fund industry continues to lag benchmarks: The Dow posted a loss of 3.74% in 2018 and 28.08% gain in 2017, while the S&P 500 had a 4.56% loss a 21.70% gain, over the same periods, data show.

“Unfortunately, when we drill-down further, we find that active U.S. stock funds remained mired in a slump,” Ptak wrote. “Only 29% of such funds beat their indexes after fees (39% pre-fee), down from 37% in 2018 and well below the 37% 15-year average success rate.”

Fees among the top-performers are high, as expected. At 1.09%, the top-performers are more than twice the price of the 48 basis points investors were charged, on average, for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs.

The industry’s largest overall fund, the $901.9 billion Vanguard Total Stock Market Index Fund Admiral Shares (VTSAX), had a 0.04% expense ratio and a 30.08% return in 2019, data show. Meanwhile, the largest actively managed fund, the $207.4 billion American Funds Growth Fund of America (AGTHX), recorded a 28.12% gain last year, with a 0.65% expense ratio.

“Active funds generated strong absolute returns for investors, but the clear majority of those funds lagged their benchmarks,” according to Ptak. “This was especially true of active U.S. stock funds, before and after adjusting for risk. Success rates were higher in other asset classes, but the average payoff of investing in successful funds didn’t exceed the average penalty associated with investing in unsuccessful funds.”

Scroll through to see the 20 actively managed funds with the biggest gains of 2019. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as three-year net flows and year-to-date returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.