In a year marked by the coronavirus pandemic and a hotly contested presidential election, it’s no surprise that flows to mutual funds and ETFs in 2020 have largely gone to safe havens.

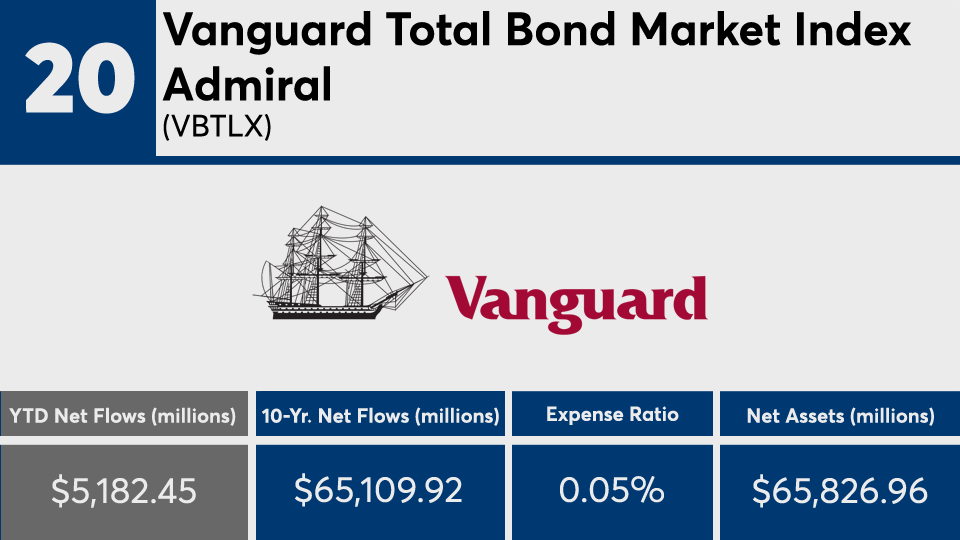

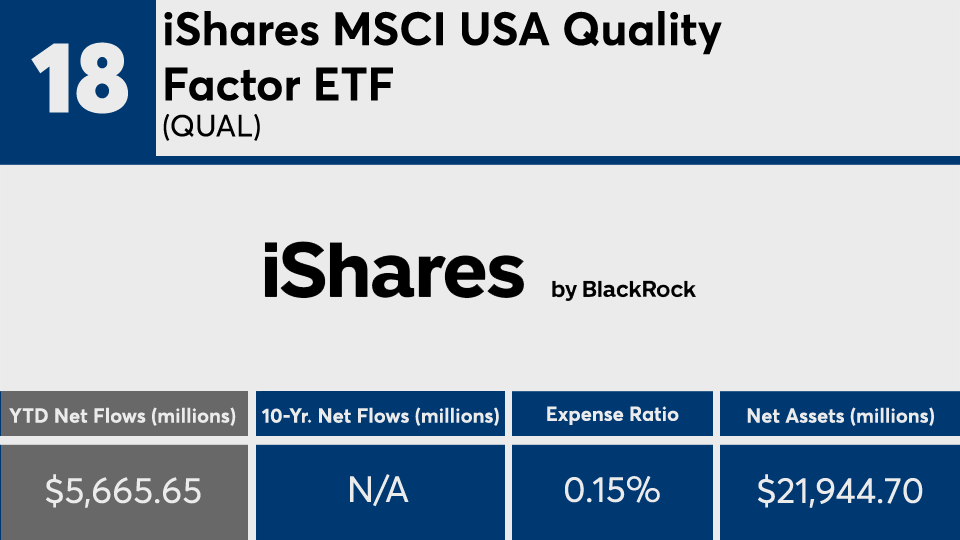

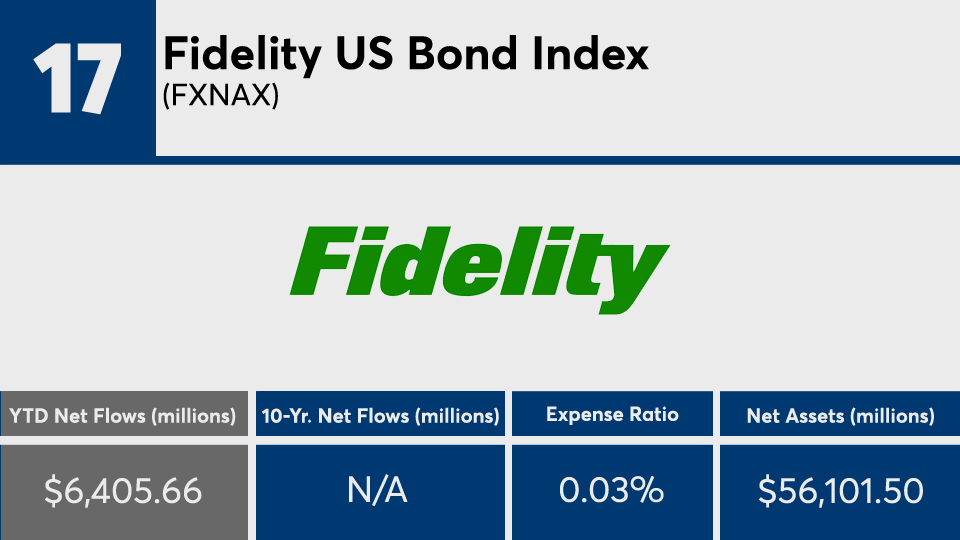

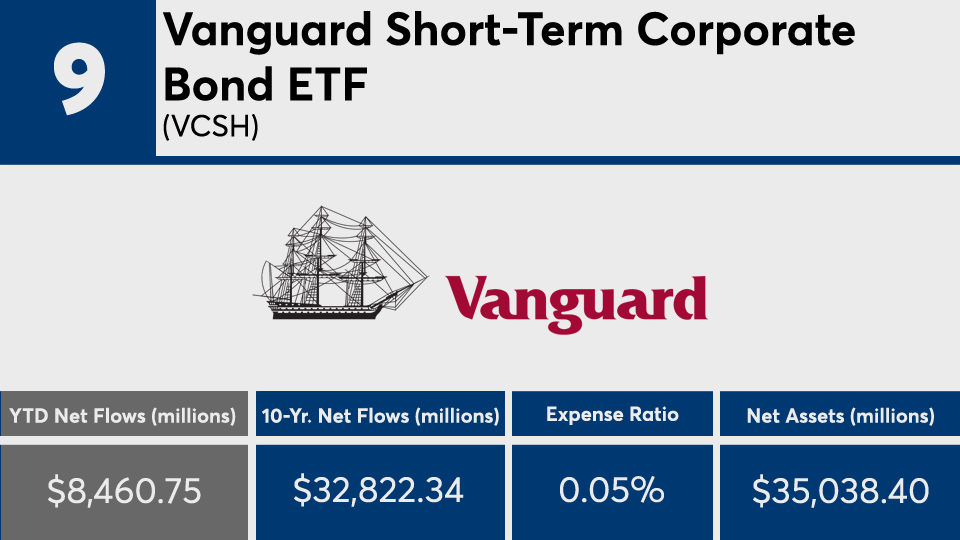

The 20 funds with the biggest year-to-date inflows, and at least $500 million in assets, added a combined $189 billion, Morningstar Direct data show. They also generated an average gain this year of nearly 19%.

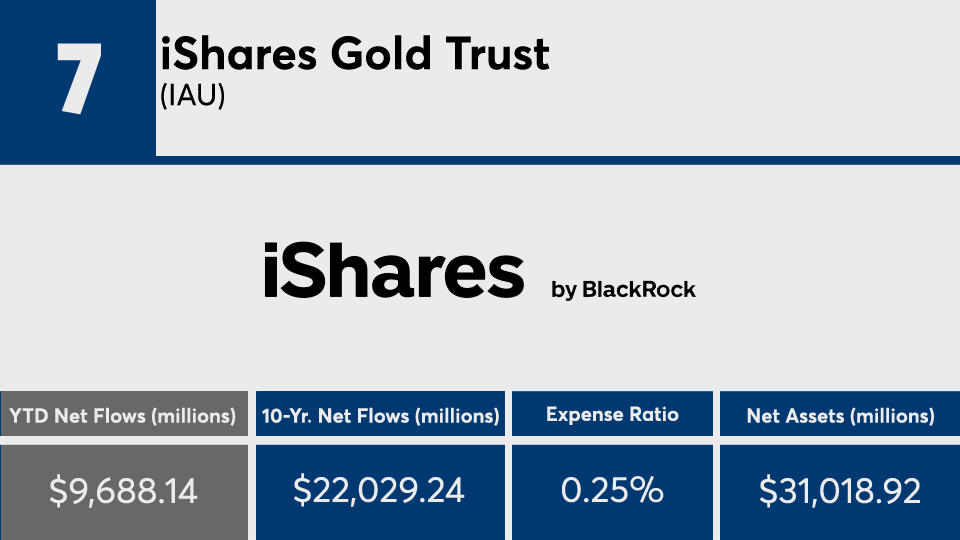

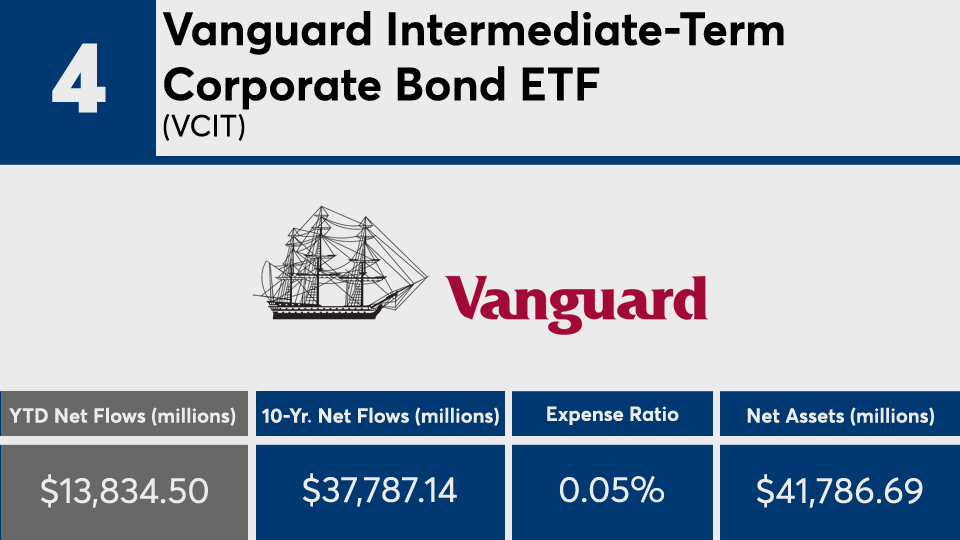

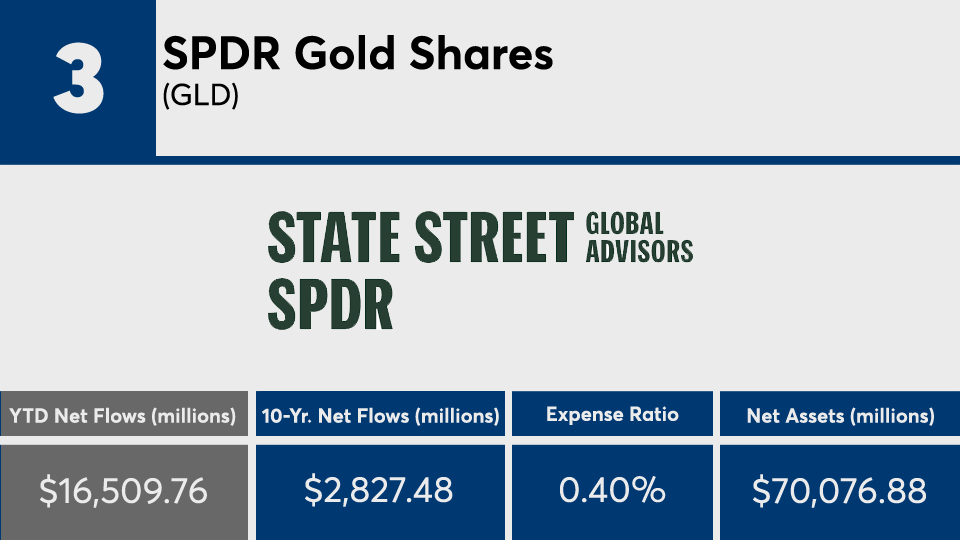

“Despite the massive rally in equities, the individual investor hasn’t seemed to buy into it,” says John Lynch, chief investment officer for Comerica Wealth Management. “Three of the top five were bonds and the other was gold. This tells me investors are still scared — buying into bonds — therefore may not fear inflation. But, they’re still buying gold as a store of value, just in case.”

The 20 funds’ growth this year has been well above index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA), which delivered YTD gains of 16.28% and 7.67%, respectively. Over the longer term, SPY and DIA have 10-year gains of 13.89% and 12.82%. While SPY recorded outflows of $22.84 billion this year, DIA had $1.68 billion in inflows, over the same period.

In bonds, the iShares Core U.S. Aggregate Bond ETF (AGG) had gains of 6.78% and 3.65% over the YTD and 10-year periods. AGG saw YTD inflows of $10.6 billion, data show.

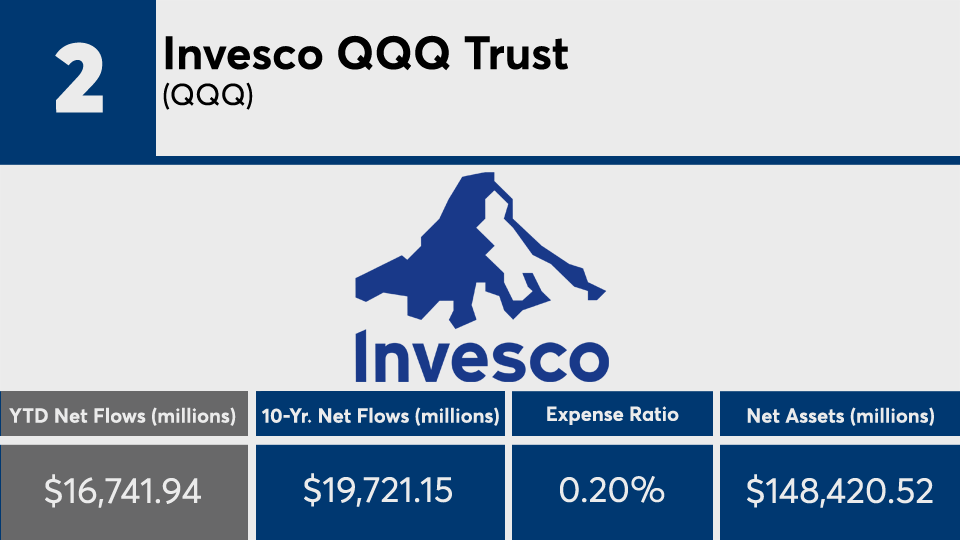

The 20 funds with the biggest inflows cost a fraction of their peers. With an average net expense ratio of 18 basis points, the funds were far below the 0.45% investors paid last year, according to

“Monetary policy has been extraordinarily accommodative and low interest rates have been a tailwind for growth style and passive strategies,” Lynch says. “The reopening/rotation trade is something financial advisors should be ready for.”

Scroll through to see the 20 mutual funds and ETFs with the biggest YTD month-end inflows through Dec. 7. Funds with less than $500 million in AUM were excluded, as were funds with investment minimums above $100,000, leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three- and five- returns and flows are also listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.