Fee-based assets managed by the 10 independent broker-dealers with the highest AUM have surged by nearly $300 billion in the past five years.

The shifting group of the top 10 IBDs in AUM boosted their combined fee-based assets by 60% to $771.2 billion between 2014 and 2018, according to data submitted by firms participating in

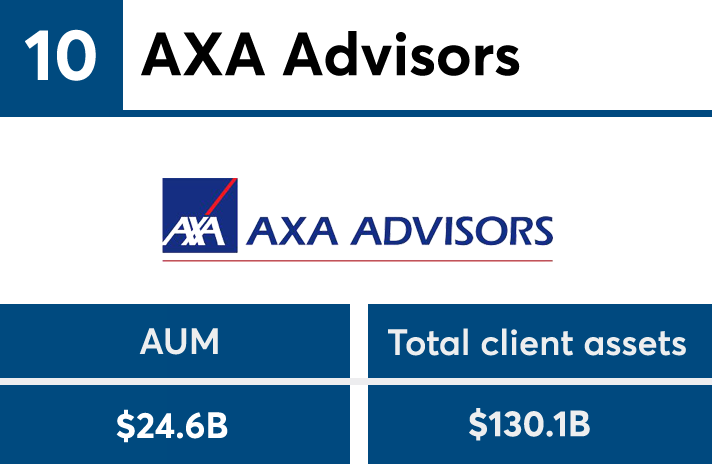

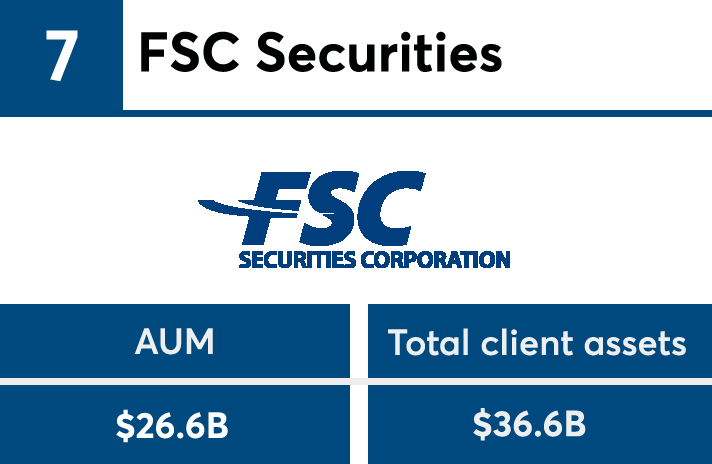

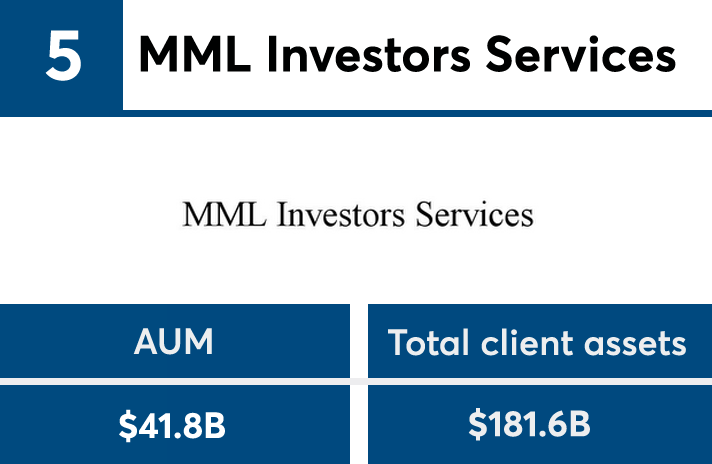

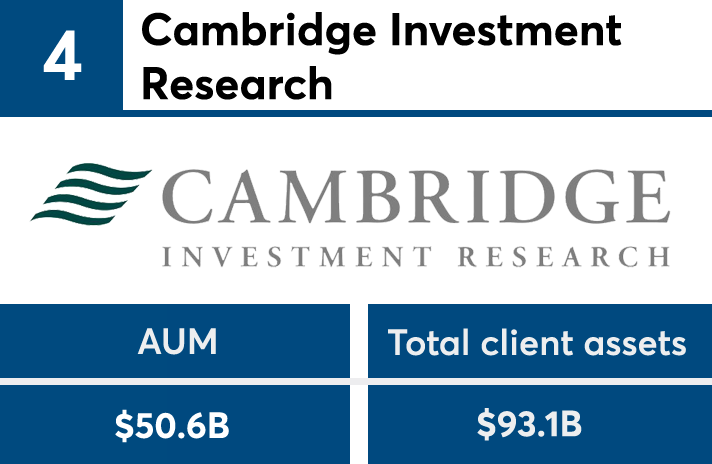

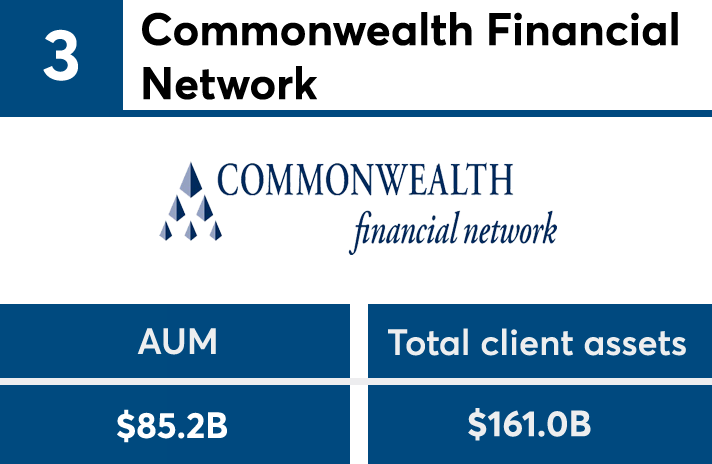

LPL Financial and Raymond James Financial Services each had more than double the fee-based assets of any amount disclosed by any other firm at the end of 2018. Privately-held stalwarts Commonwealth Financial Network and Cambridge Investment Research also made the top 10 list, alongside one Ladenburg Thalmann firm and two Advisor Group IBDs.

With IBDs

AUM has emerged as a key metric — and firms aren’t always eager to share it: three of the top 10 firms in the space didn’t submit their total advisory assets. The self-reported AUM includes those of hybrid RIAs and firms’ other advisory platforms, in addition to their corporate RIAs.

To see the list of IBDs ranked by their fee-based assets, scroll down our slideshow. To view the firms with the largest fee-based mix of business in 2018,