More than two-thirds of clients under 40 years old are interacting more with their wealth managers during the pandemic, and they’re not always happy with the results.

At least 71% of clients in their 30s or younger are speaking with their financial advisor and firms more often during the coronavirus, and 58% changed their portfolios in the past year, according to the J.D. Power 2021 U.S. Full-Service Investor Satisfaction Study. In contrast, only 38% of clients aged 40 or older increased their engagement and just 28% altered their portfolios. The market research firm released its annual survey of wealth management clients on April 15.

Perennial contender Edward Jones jumped over

“Investors under age 40 are changing much more quickly in terms of their wealth management preferences and priorities — and they look increasingly different from boomers,” Mike Foy, the senior director of wealth intelligence at J.D. Power, said in a statement. “Wealth management providers are making a mistake if they assume that the emerging affluent investors will simply evolve into boomers over time. Firms with the ability to recognize and address these changing needs will define success through the great wealth transfer.”

In addition to contacting their wealth managers more often during the pandemic with a stronger inclination towards “digital channels” such as email, mobile apps, websites and texting, younger investors are much more open to alternative fee models, J.D. Power found. By wide margins, clients younger than 40 are likelier than older investors to prefer one-time fees for specific services (74% to 42%) and subscription payments (73% to 34%).

Among the firms, Edward Jones ranked No. 1 in the categories of “trust” and “manage wealth how and when I want,” as well as being the only wealth manager placing in the top 5 for all seven criteria. The other top 5 firms overall each came in at or below the industry average in one of the categories, showing areas for improvement even at the most highly rated firms.

To arrive at the results in the 19th year of the survey, J.D. Power polled 4,392 investors who make some or all of their investment decisions with a financial advisor between December 2020 and February 2021. The firm used a new scale it says is “more inclusive with factors related to trust, value and convenience” in seven weighted categories: Trust (19%), people (18%), products and services (15%), value for fees (14%), manage wealth how and when I want (14%), problem resolution (12%) and digital channels (9%).

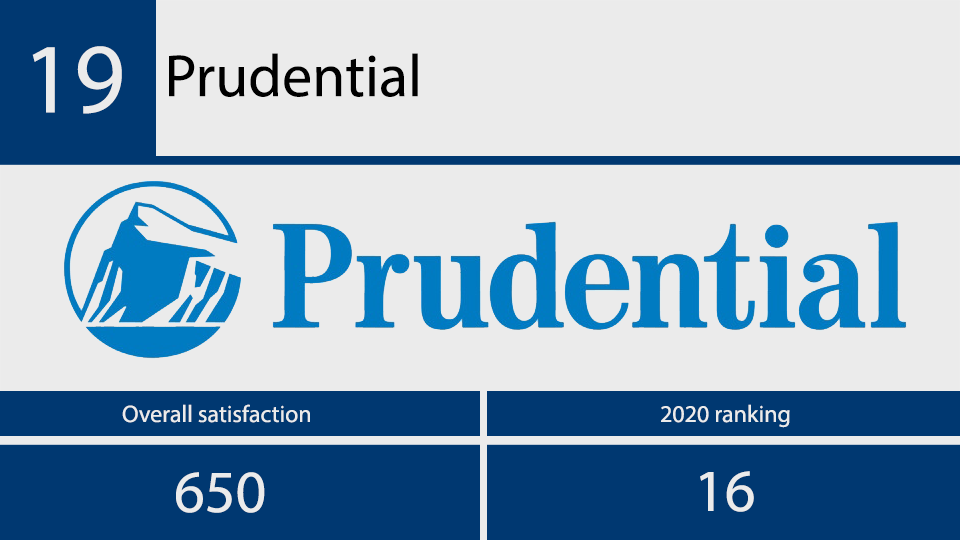

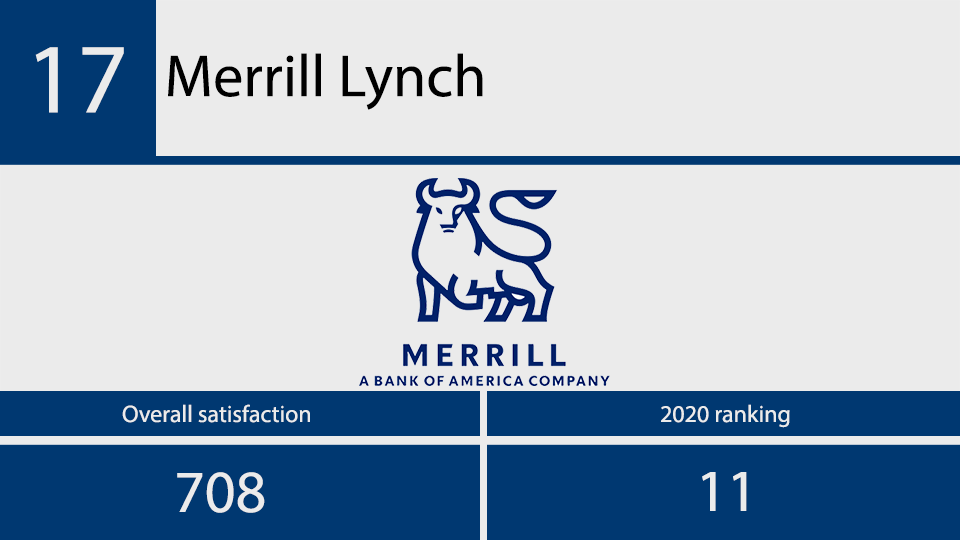

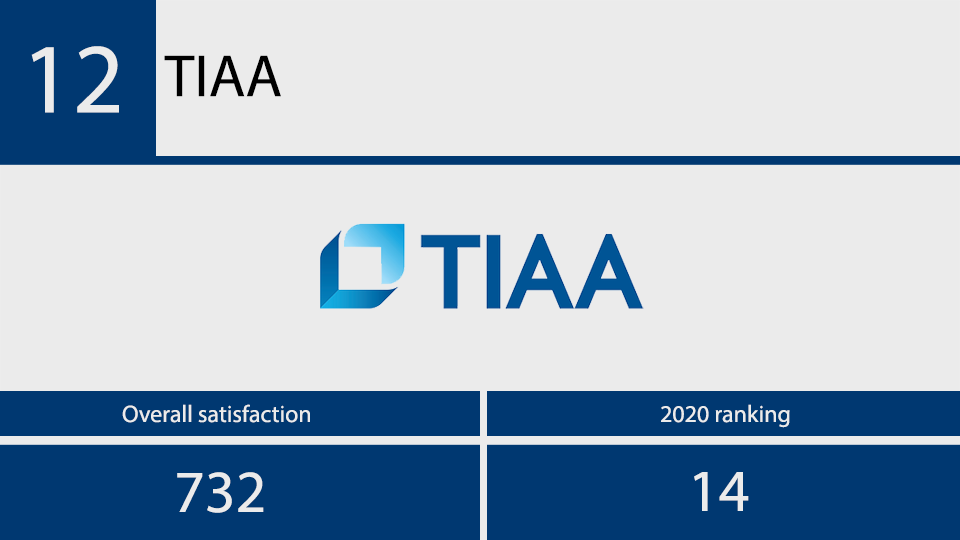

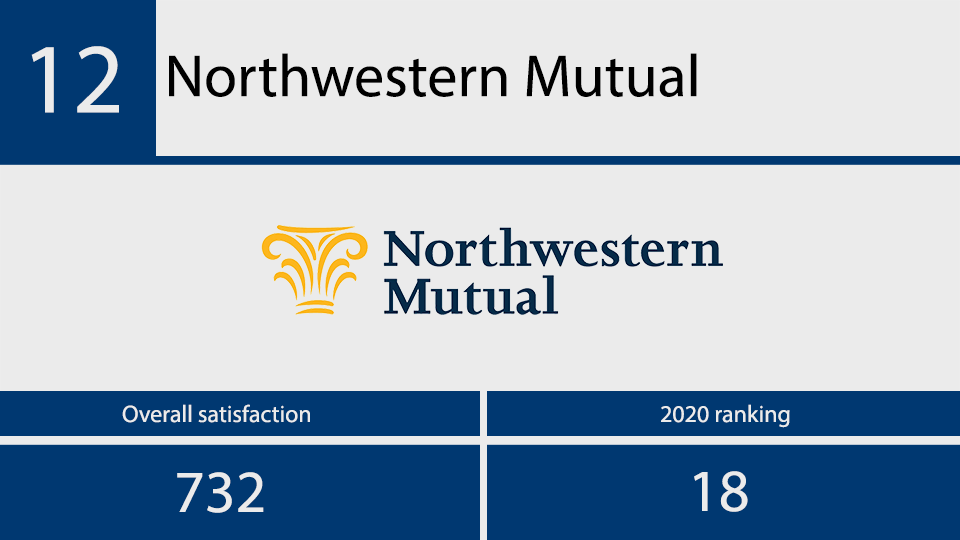

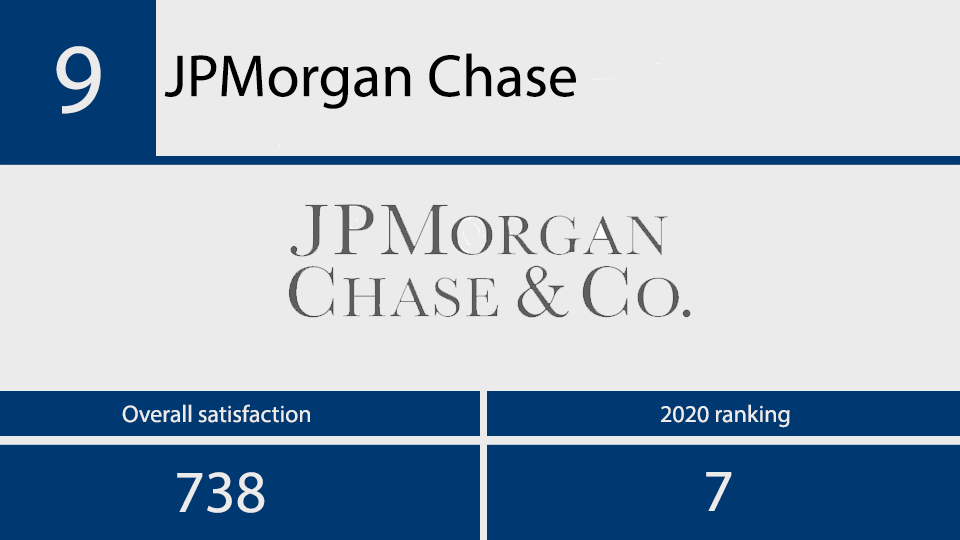

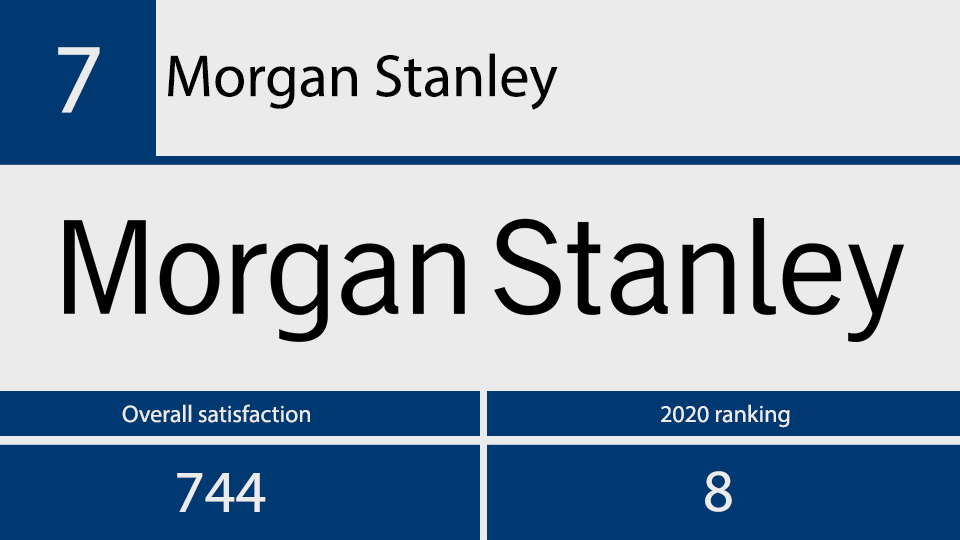

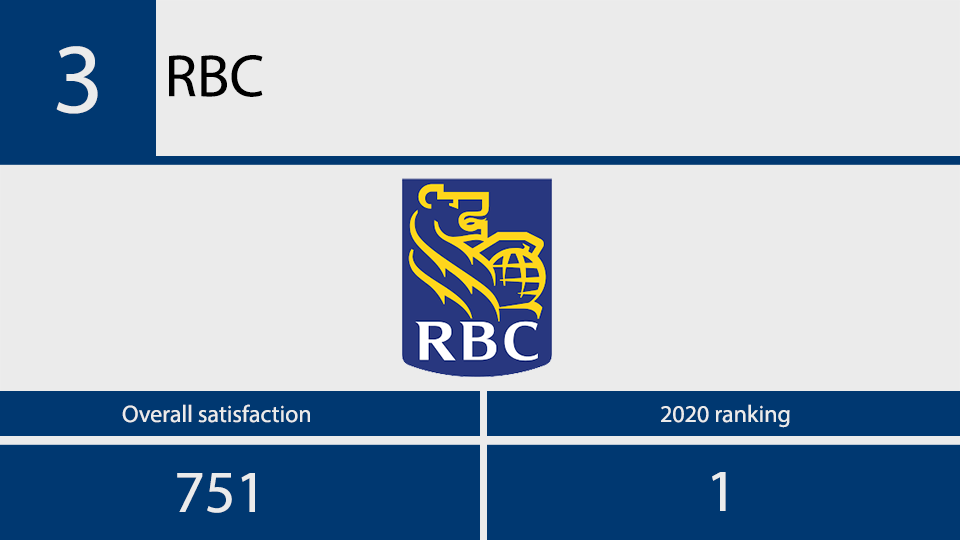

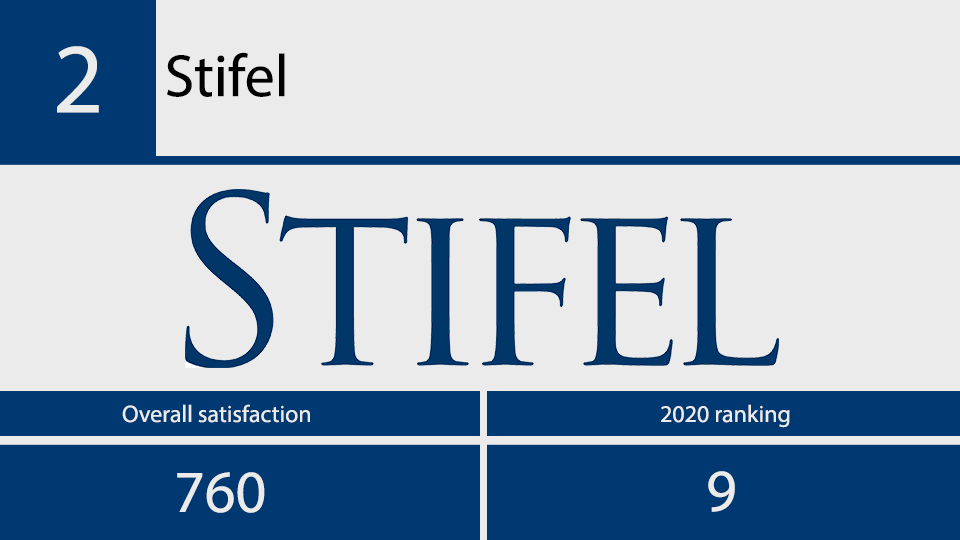

On the new scale in 2021, every firm’s overall satisfaction index on a 1,000-point scale fell by at least 84 points, and the distance between the firms at the top and bottom of the list doubled to 120 points. J.D. Power cautions that the new design means that the numbers from previous years are not comparable to those in the latest survey. For results from prior years, see our slideshows from