After more than a decade of steady returns, large-cap funds that posted consistent double-digit gains have started to show vulnerability.

Following the last year of market turbulence, funds with impressive returns over the last three and 10 years are now reporting losses. The 20 large-cap mutual funds and ETFs with the worst one-year returns (among those with at least $500 million in assets under management) had an average loss of 6.81%, Morningstar Direct data show. Yet those same funds racked up an average 10.28% return over the last three years and an average 13.62% return over the last 10 years, data show.

“Many of the weak performances over the last 12 months come from funds with strong, double-digit annualized returns for the past three years,” says Greg McBride, a senior financial analyst at Bankrate.

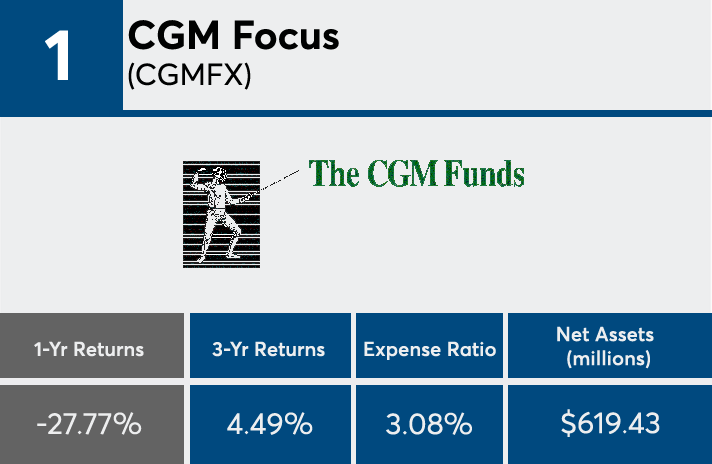

The worst-performers, home to a combined $83.09 billion in AUM, carried higher management fees than the industry average. With net expense ratios ranging from 15 to 308 basis points, these funds had an average net expense ratio of 0.88%, data show. That's more than 30 basis points higher than the industry average of 0.52% for fund investing in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs.

Despite the high fees, McBride notes, “there were also some very low expense ratio funds in that group,” adding that “the underperformance was due to stock picking or an out-of-favor investment style — like value — much more so than being weighted down by a higher expense ratio.”

The 20 largest large-cap funds, in a similar ranking, posted slightly lower returns at a lower price to investors, data show. With roughly $3.1 trillion in AUM, the biggest funds of the past year had an average return of 4.06% and an average expense ratio of 0.36%. With more than $757 billion in AUM, the biggest large-cap fund — the Vanguard Total Stock Market Index Fund Admiral Class (VTSAX) — had a 4.62% return over the last year, and a 0.04% expense ratio, data show. That return was down 9.16 percentage points over the last three years.

In the case of the worst-performers, McBride said the blame often rests in the hands of the funds’ managers. As a result, advisors must select their clients’ actively managed holdings with caution.

“The wide dispersion of returns on the worst-performing funds illustrates that when the fund manager gets it wrong – particularly in funds with concentrated holdings — they can get it really wrong,” he said. “Know why you bought a fund and the role it fills in your portfolio before bailing on it for short-term underperformance.”

Scroll through to see the 20 large-cap category mutual funds and ETFs with the lowest one-year returns through March 13. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund are also listed. The data shows the individual funds’ primary share class. All data from Morningstar Direct.