All of the industry’s worst-performing high-yield bond funds managed to post positive annualized returns over the last 10 years.

The 20 mutual funds and ETFs in the high-yield bond sector with the lowest returns recorded gains of at least 6%, Morningstar Direct data show. The funds, which together hold roughly $96 billion in assets under management, have all benefited from the last decade of steady market growth, according to Greg McBride, chief financial analyst at Bankrate.

“Even the high-yield bond funds that lagged over the past 10 years showed solidly positive returns,” McBride says. “This isn’t altogether surprising with the backdrop of a 10-year economic expansion and bull market for risk assets.”

The industry’s largest high-yield bond fund, the Vanguard High-Yield Corporate Bond (VWEAX), which has nearly $23.9 billion in assets under management, posted a 10-year return of 9.39%, with a 0.13% expense ratio, data show. The average expense ratio among the 20 worst-performers, 0.77%, was 25 basis points more than the industry average. More broadly, investors paid an average 0.52% for fund investing in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs. That was up 8 basis points from 2016.

A similar screen of the 20 largest high-yield bond funds, while carrying a slightly lower expense ratio, posted higher returns, on average. Those funds, which have a combined $135 billion in AUM, had an average 10-year return of 10.16% and expense ratio of 70 basis points.

The 20 worst-performers recorded an average 10-year return of more than 9%, nearly 6 percentage points lower than the S&P 500, which returned 15.15% over the same period. When compared to the Barclays Capital U.S. Aggregate Bond Index, which returned 3.52% over 10 years, the risk versus reward paid off. McBride, however, warns advisors that momentum can shift in the high-yield bond sector.

“Fortunes will turn in the high-yield bond universe when the economy tumbles,” McBride says. “Many companies that can make those hefty coupon payments when the economy is good will have trouble doing so and face limited refinancing options the next time the economy is in the gutter.”

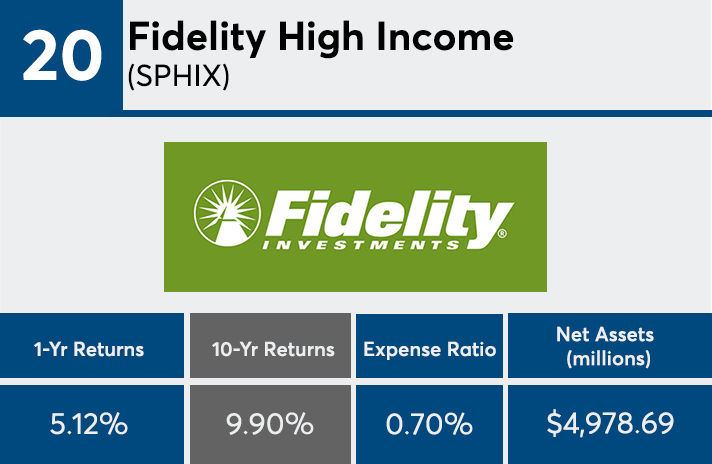

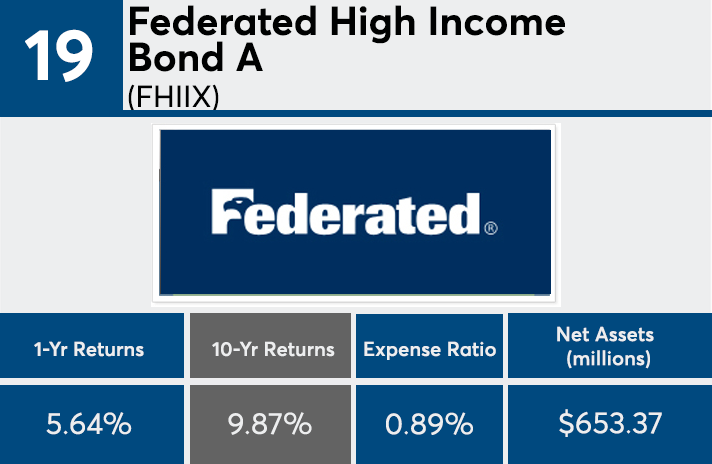

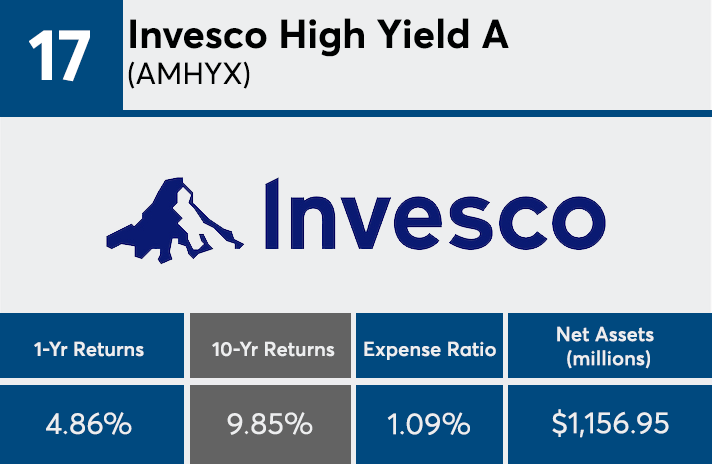

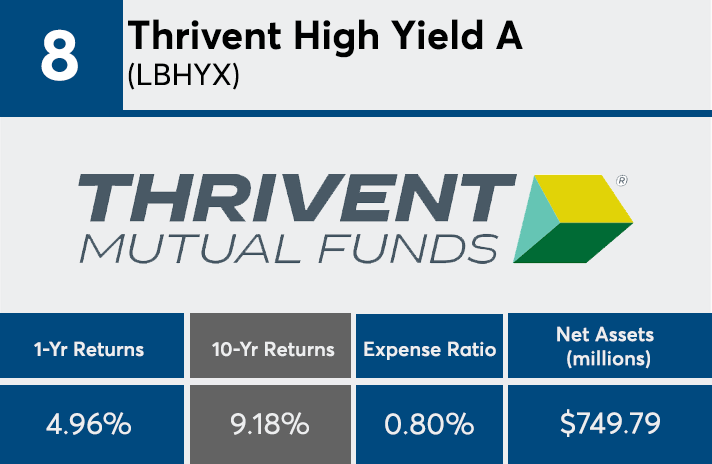

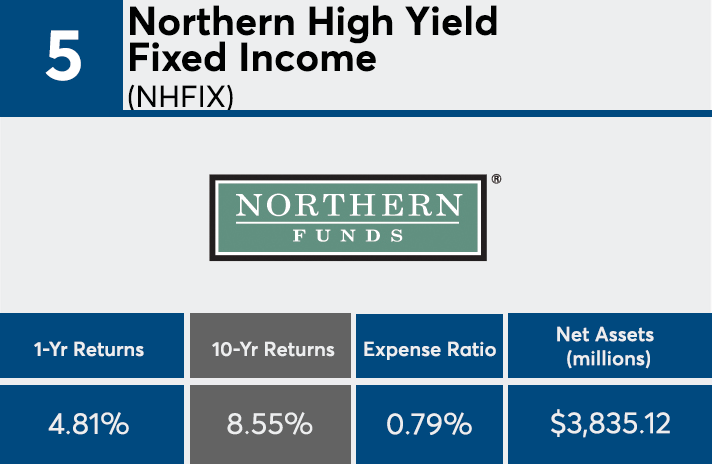

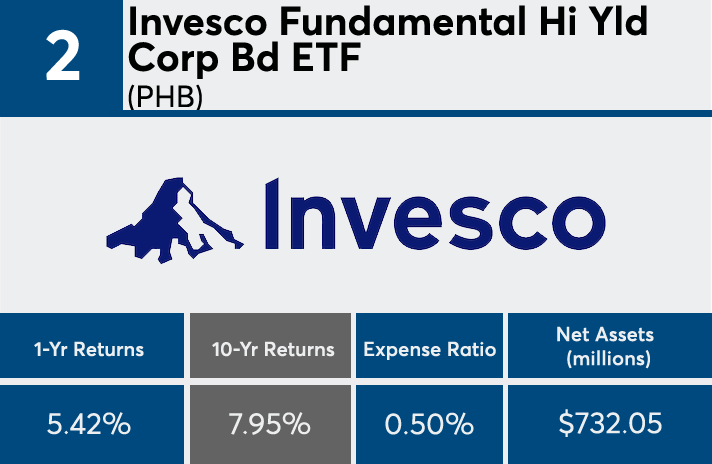

Scroll through to see the 20 high-yield category mutual funds and ETFs ranked by the highest 10-year returns through April 11. Funds with less than $500 million in AUM and investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund are also listed. The data shows each fund's primary share class.