Want unlimited access to top ideas and insights?

Despite the ability to deliver short-term outperformance, funds with heavy concentrations in any one sector can be problematic for long-term investors. Analysis of the decade’s worst-performing mutual funds is a case in point.

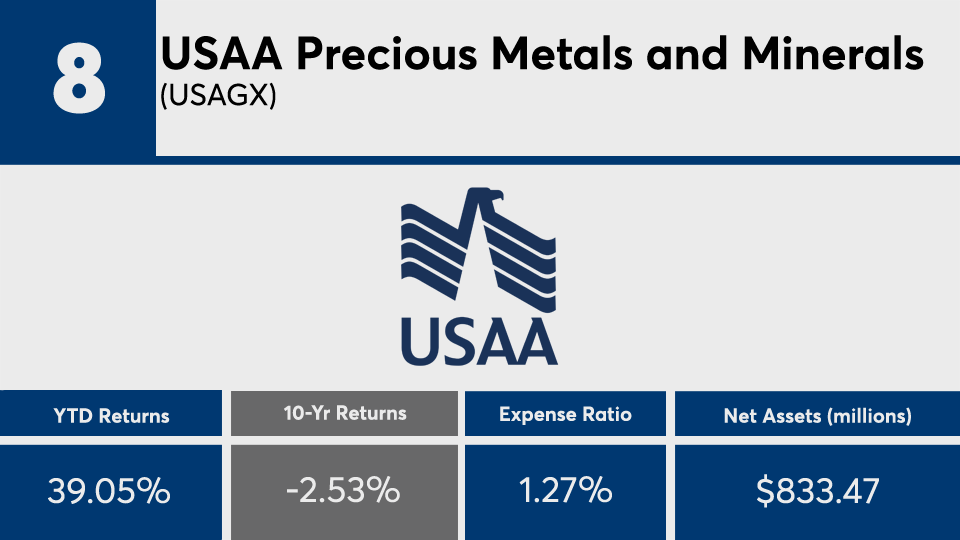

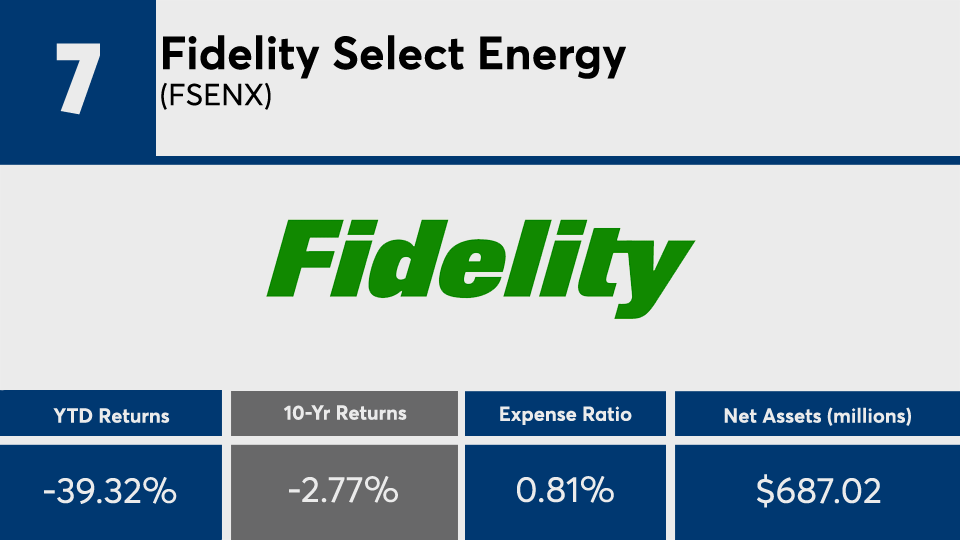

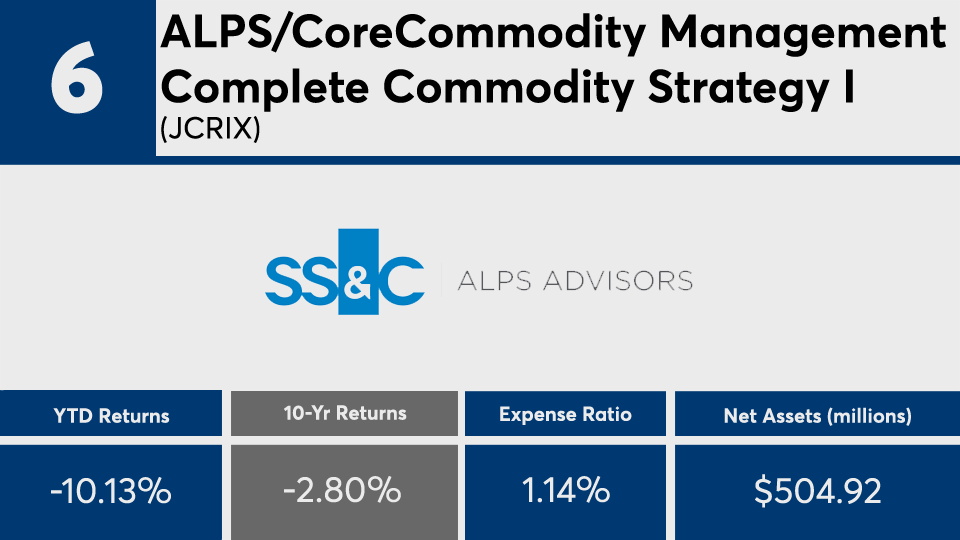

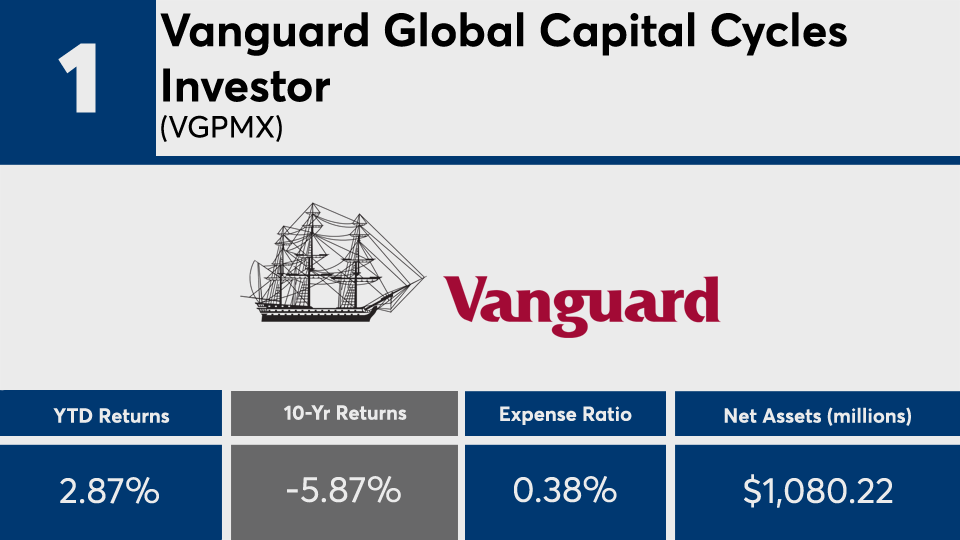

Though a handful of the 20 mutual funds with the worst 10-year returns managed some impressive short-term gains, their average returns over both the near- and long-term periods have underwhelmed. With an average loss of more than 2% over the past decade, the mutual funds on this list undershot index trackers such as the SPDR S&P 500 ETF Trust (SPY) and the SPDR Dow Jones Industrial Average ETF Trust (DIA), which have posted 10-year gains of 14.90% and 13.55%, respectively, according to Morningstar Direct data.

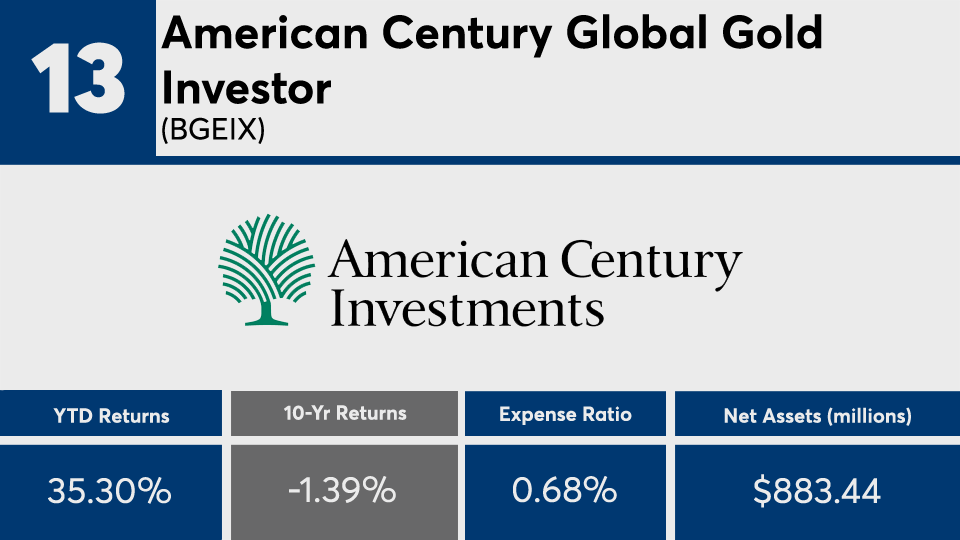

This year, some of the mutual funds with the biggest long-term losses managed gains of more than 40%, data show. When looking at their overall average, however, they returned less than 1%, well below the broader indexes — SPY and DIA managed a YTD gains of 10.01% and 2%, over the same period. In bonds, the iShares Core U.S. Aggregate Bond ETF (AGG) has reported YTD and 10-year gains of 6.52% and 3.59%, respectively.

A similar screen of the broader mutual fund industry, meanwhile, reported YTD- and 10-year gains of 7.11% and 10%, respectively, data show.

Analysis of the mutual funds with the worst long-term gains may provide the platform advisors need to discuss portfolio diversity with clients, particularly because these funds are heavily concentrated in commodities, MLPs and precious metals, says Stephen Cavagnaro, director of private clients at Anchor Capital Advisors, a value-focused asset manager and wealth advisory firm based in Boston.

“It’s no surprise ... that the bulk of these portfolios are commodity related,” Cavagnaro says when looking at the industry’s worst performers over 10 years. “This concentration of underperforming funds is a key example of the need to diversify around specific sectors or investment trends as opposed to chasing returns.”

Similar to the

“As you’ll see with the most specialized product, there is typically a fee premium, and in the case of most commodity portfolios, this is no different,” Cavagnaro says. “An active approach to asset allocation comes with the responsibility to obtain exposures at reasonable costs and with an eye towards future return potential. It’s been hard to own some segments of the market for an extended period of time, but it’s also important to remember why and how it's important to remain diversified.”

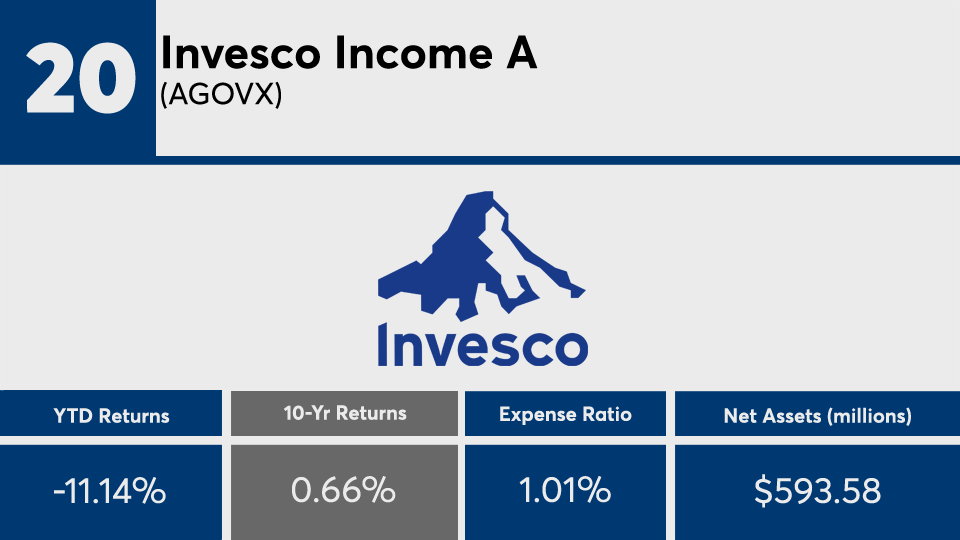

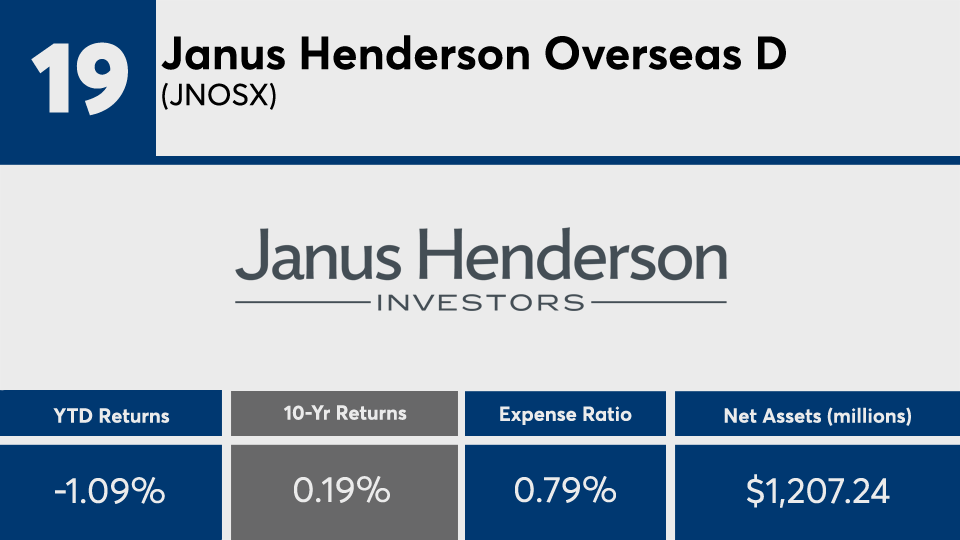

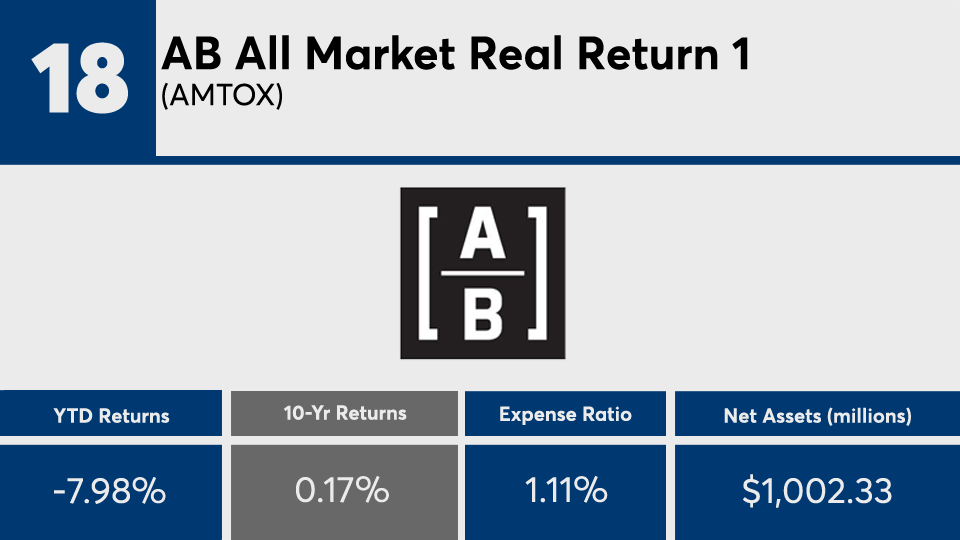

Scroll through to see the 20 mutual funds with the worst 10-year returns through Aug. 28. Funds with less than $500 million in AUM and with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios, as well as YTD, one-, three-, five- and 10-year returns are listed for each. The data show each fund's primary share class. All data is from Morningstar Direct.