Advisors are giving their clients a vote of confidence.

Wealth managers surveyed in Financial Planning’s latest Financial Wellness Report gave clients high marks for saving for retirement, knowledge of fee structures and familiarity with tax strategies, including capital gains, estate tax exemptions and charitable contributions deductions.

There was some concern, however, about client’s

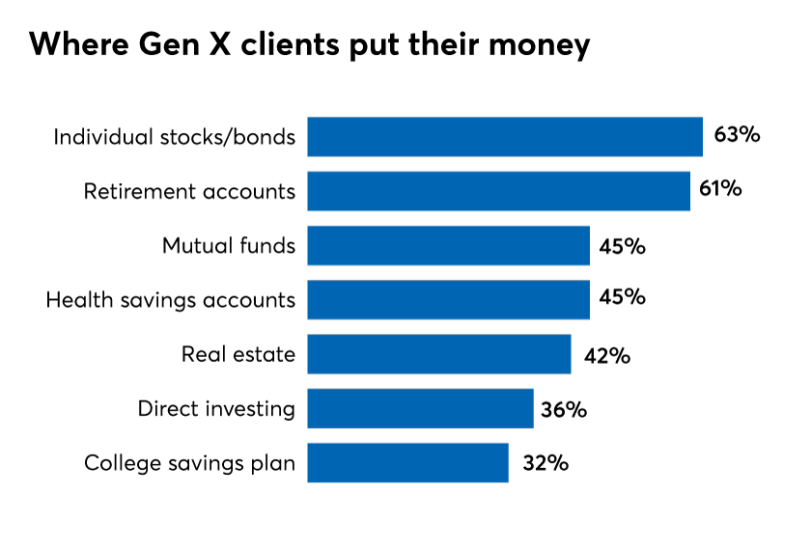

The report also examined the demographic breakdown of how clients invested. Advisors were surely pleased to disclose that retirement accounts were the highest investment priority for their millennial, Gen X and baby boomers clients.

But there was one surprise: ETFs were among the least popular investments for millennials and Gen Xers, but scored considerably higher among boomers.

Here are some of the report's key findings: