Small-cap funds with the worst returns over the last year still struggled to lose money.

The 20 poorest performing small-cap mutual funds and ETFs, with at least $500 million in assets under management, were home to just over $35 billion, Morningstar Direct data show. Those products, despite their ranking at the bottom of the barrel among sector peers, managed an average return of 1.09%. Over the last year — marked by heavy market volatility and trade tensions between the U.S. and China — some of the characteristics of small-cap holdings may be part of the reason for their positive performance, says Greg McBride, senior financial analyst at Bankrate.

“Even the worst-performing small-cap funds fared OK relative to larger company stocks that were buffeted by trade disputes and currency fluctuations,” McBride says. “Small-cap stocks are not immune to rising import costs, but they may be less impacted than larger companies with global supply chains.”

For comparison, the largest small-cap fund — excluding leveraged and institutional products — has a one-year return of 8.99%, data show.

Fees, in the case of small-caps, were not entirely reflective of performance. Among the funds with the worst returns — most of which were actively managed — the average expense ratio of 1.02% was 11 basis points lower than their top-performing counterparts, according to data.

“The differential between top-performing and worst-performing actively managed small-cap funds boils down to stock-picking,” McBride says. “Minor differences in expense ratio can’t offset the benefit of good stock-picking.”

Across the larger fund universe, investors paid an average of 0.52% for fund investing in 2017, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of nearly 25,000 U.S. mutual funds and ETFs. That was 8% less than they paid in 2016.

While many investors are increasingly focused on finding funds with the lowest fees, McBride says small-cap holdings are attractive for different reasons.

“Small-cap stocks by nature tend to be more volatile, and that is a perspective investors should maintain after a year of solid relative performance,” McBride says. “The ups and downs are inevitable, but smaller company stocks offer the prospect of faster growth and more capital appreciation over time for investors with the stomach to hang in there throughout periods of volatility.”

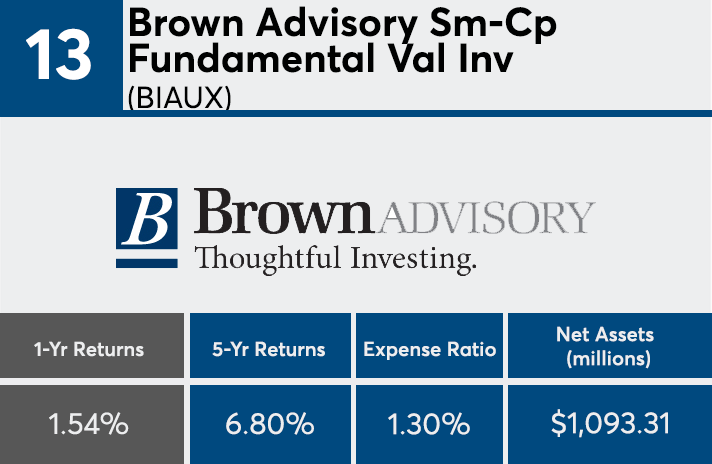

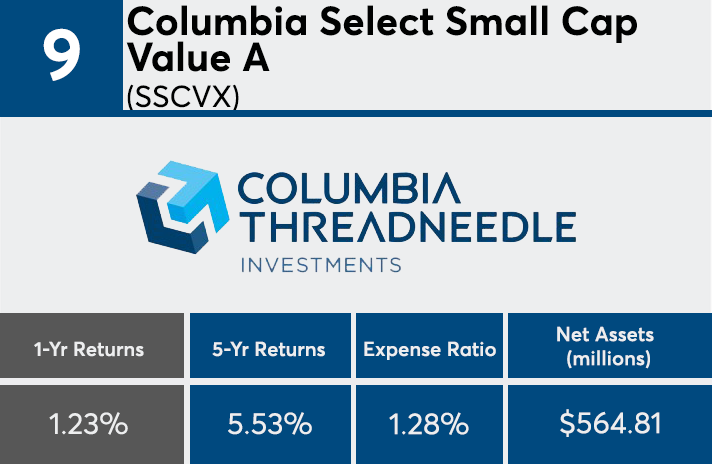

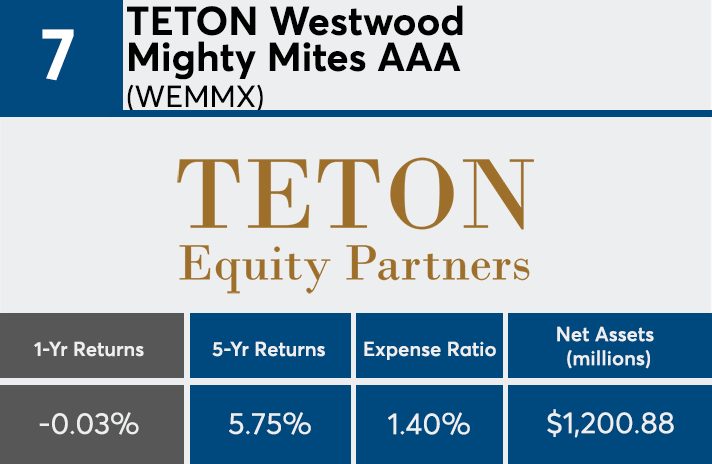

Scroll through to see the 20 small-cap category mutual funds and ETFs with the highest one-year returns through Feb. 20. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each fund are also listed. The data includes funds in which assets were transferred from one share class to another. All data from Morningstar Direct.