Encompassing a wide range of industries, nearly all technology funds with the biggest gains since 2016 have outpaced even themselves this year.

The 20 top-performing tech sector mutual funds and ETFs had an average 3-year return of 23.75% — outpacing the Dow’s 16.84% gain, as tracked by the SPDR Dow Jones Industrial Average ETF (DIA), and the S&P 500’s 14.77% gain, as tracked by the SPDR S&P 500 ETF (SPY), over the same period, Morningstar Direct data show. Robby Greengold, senior manager research analyst at Morningstar, notes the funds on this list benefited from whatever corner of the broadly defined technology category that they track.

“I would caution that the track records of tech funds are hard to compare,” Greengold warns. “While they all broadly invest in technology, some have industry specializations (the First Trust Dow Jones Internet ETF targets internet companies, while Fidelity Select Semiconductors focuses on semiconductors, etc.). That means that their performance could be driven primarily by the relative performance of their underlying industries rather than stock-picking skill of their managers.”

So far this year, those same funds posted an average gain of 33.80%. For comparison, the Dow had an 18.20% gain, while the S&P 500 returned 23.02% over the same period, data show.

Fees associated with these funds are higher than the rest of the fund universe. With an average net expense ratio of 0.56%, investors paid nearly 10 basis points more than the 0.48% they were charged on average for fund investing last year, according to Morningstar’s most recent annual fee survey, which reviewed the asset-weighted average expense ratios of all U.S. open-end mutual funds and ETFs. With more than $827 billion in AUM, the industry’s largest fund, the Vanguard Total Stock Market Fund (VTSAX), carries a 0.04% expense ratio and returned 14.52% over the last three years.

Greg McBride, chief financial analyst at Bankrate, warns advisors seeking similar gains for their clients from these products over the next three years must tread with caution.

“Technology stocks have powered the market over the past few years and the returns on the top technology funds reflect that,” McBride says. “Investors need to temper their expectations for risk of projecting recent returns into the future,” adding that “past performance is no guarantee of future results.”

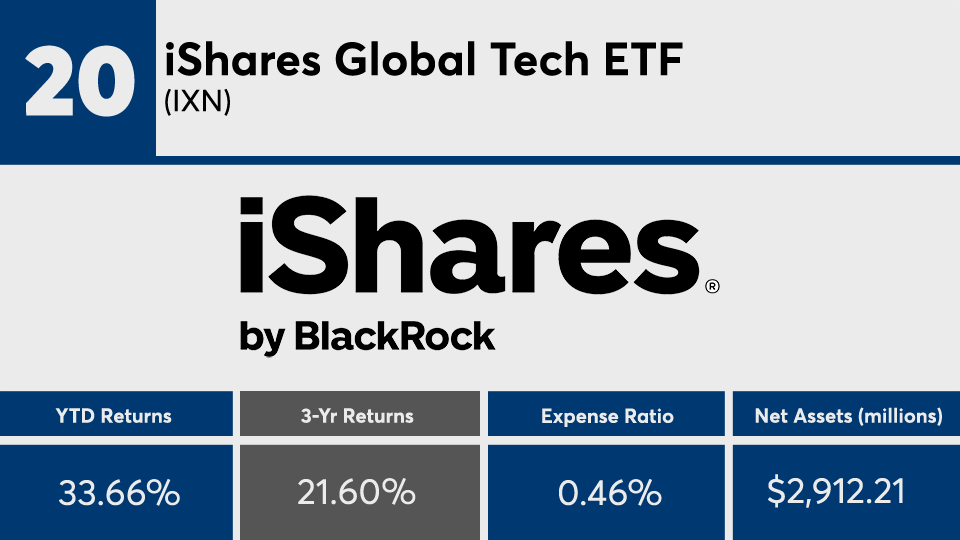

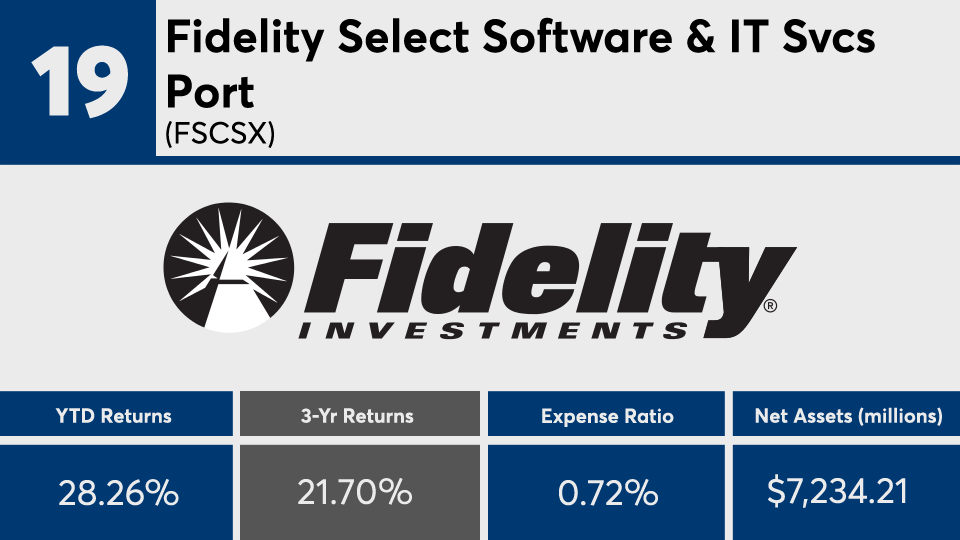

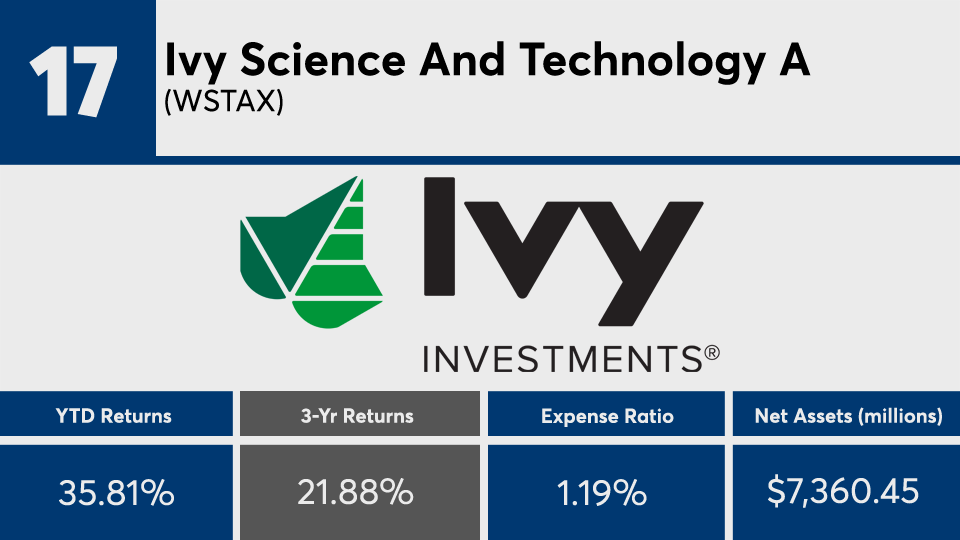

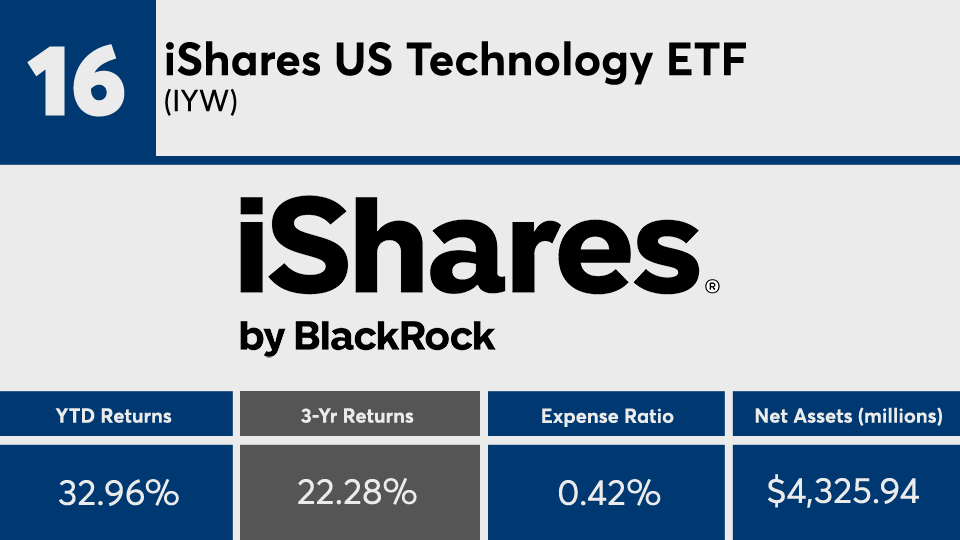

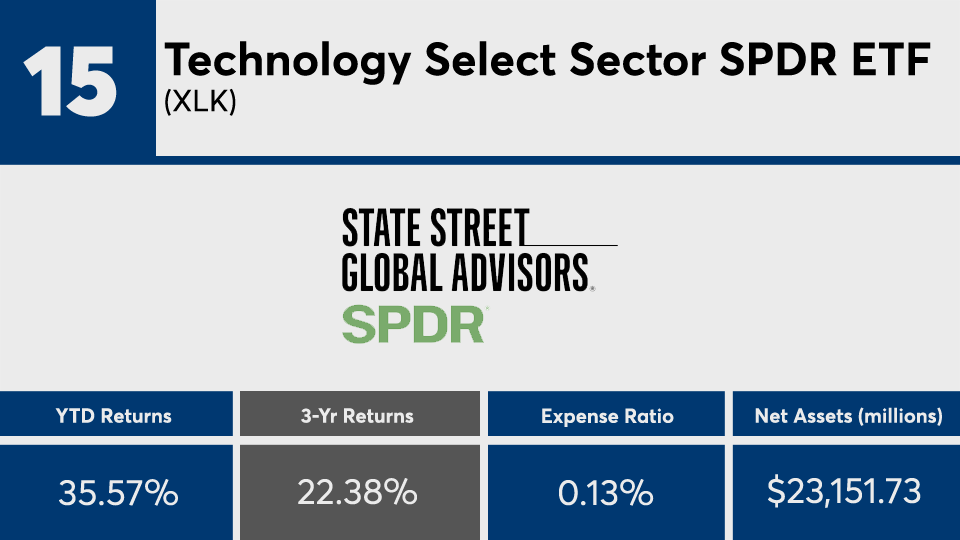

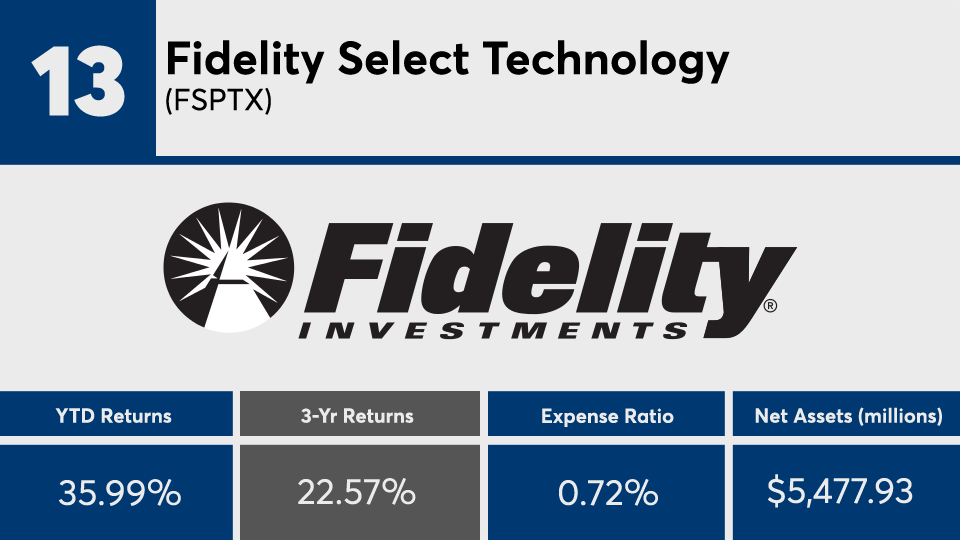

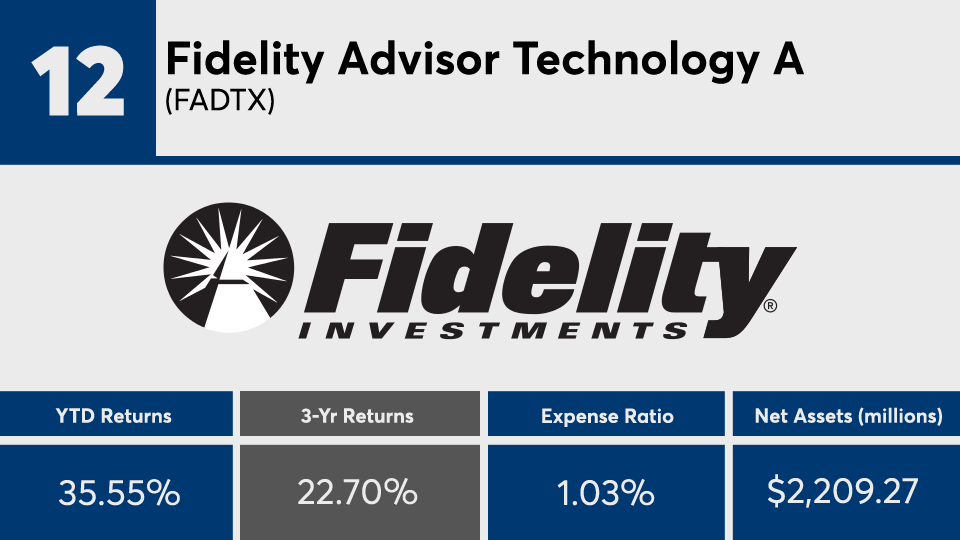

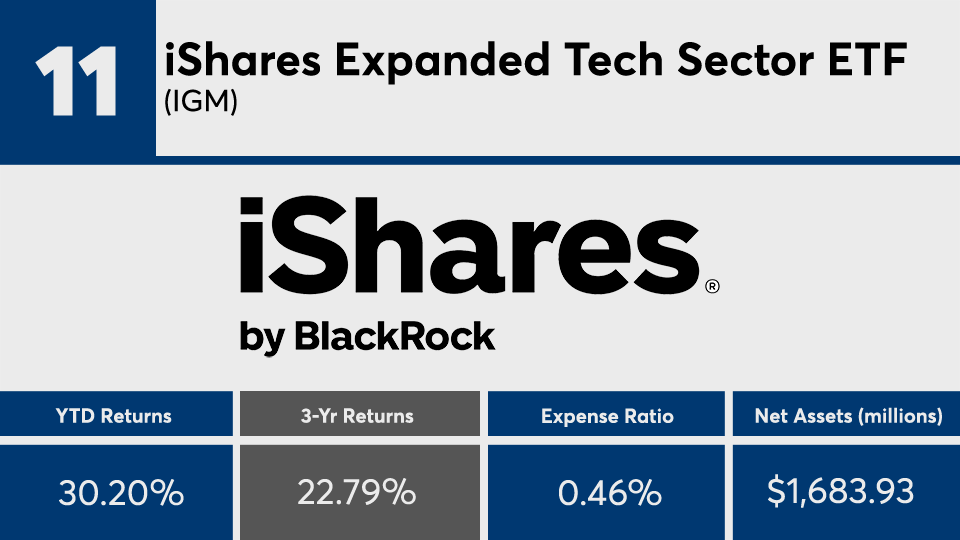

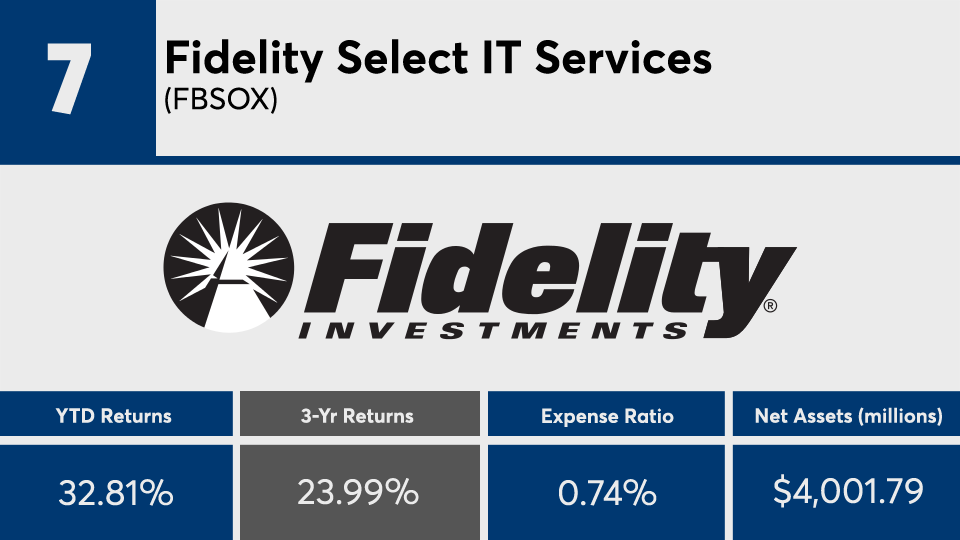

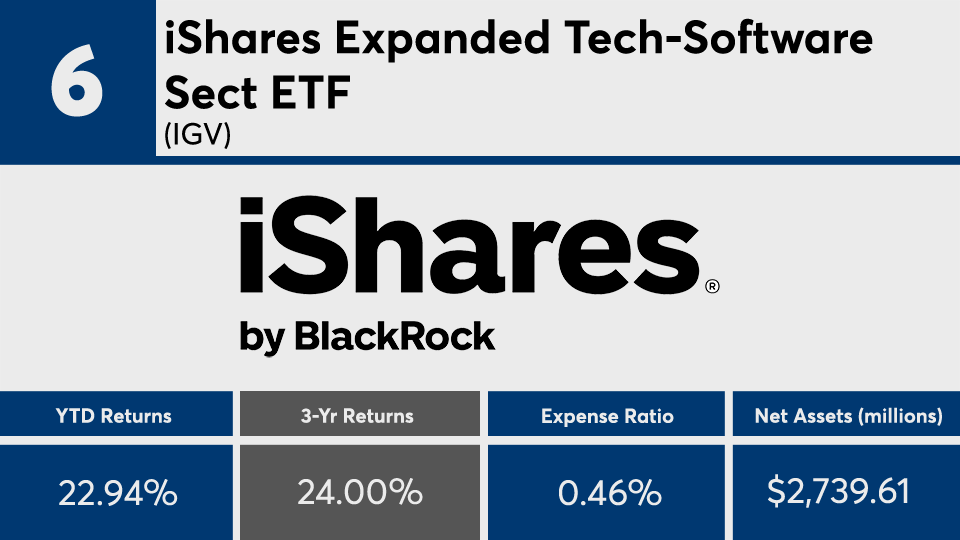

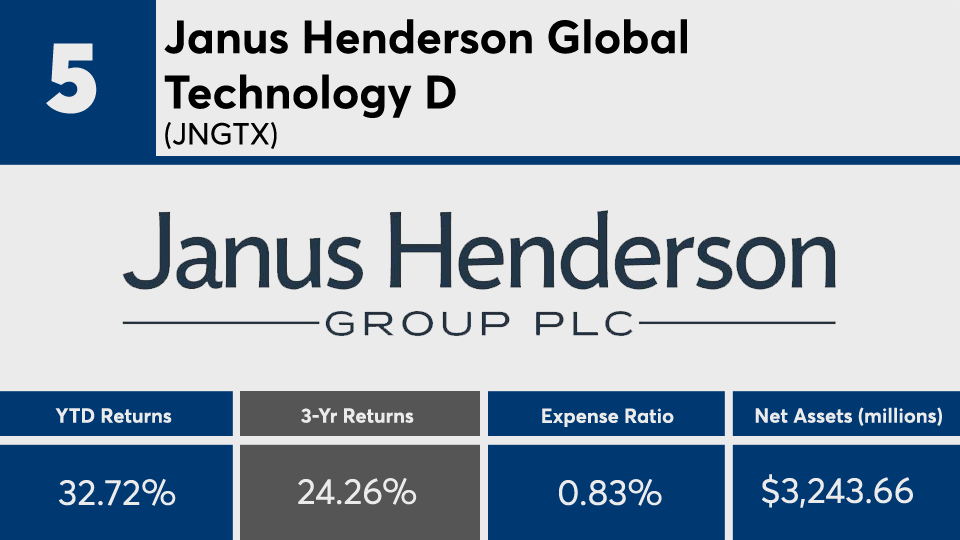

Scroll through to see the 20 top-performing technology category mutual funds and ETFs (with at least $500 million in assets under management) ranked by three-year annualized returns through Oct. 29. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. Assets and expense ratios for each, as well as year-to-date returns, are also listed. The data shows each fund's primary share class. All data from Morningstar Direct.