Clients with holdings in any of the industry’s AMT-free funds saw positive returns over the past five years. Now, however, changes under the new tax law are expected to put a damper on those figures.

With the enactment of the Tax Cuts and Jobs Act, the income threshold for AMT eligibility is expected to reach a smaller pool of clients, ultimately driving down the products’ demand over the long-run, according to Morningstar manager research analyst Alaina Bompiedi. The IRS estimates AMT filings will decrease to one million households from 10 million in 2015 as a result of the law; with even fewer clients owing AMT liability, according to Tax Foundation analysis of IRS data.

“While AMT bonds are relatively less attractive now, their spreads have actually narrowed since the passage of the TCJA because they no longer have to offer higher yields to entice buyers,” Bompiedi explains. “Buyers of AMT bonds assume the risk that they will have to pay taxes on those bonds, and so they often demanded a higher yield for AMT bonds versus AMT-free bonds.”

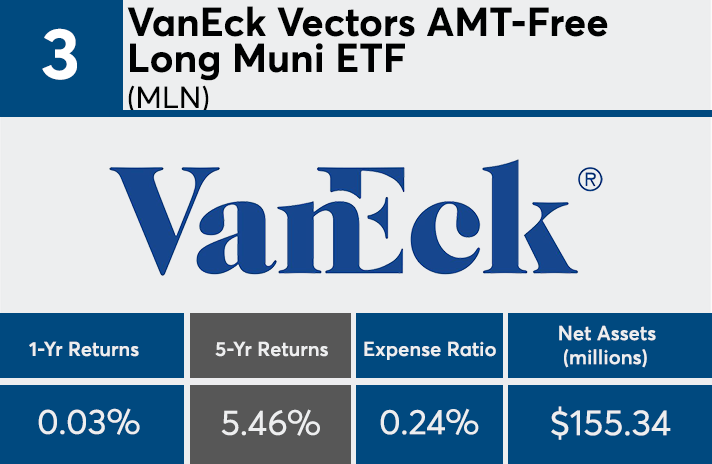

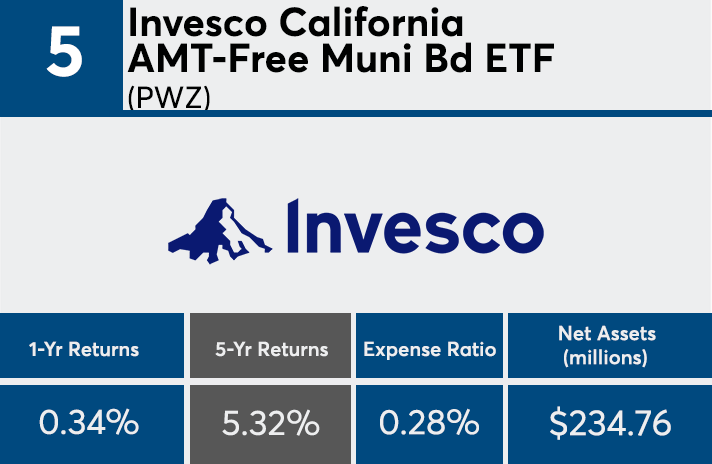

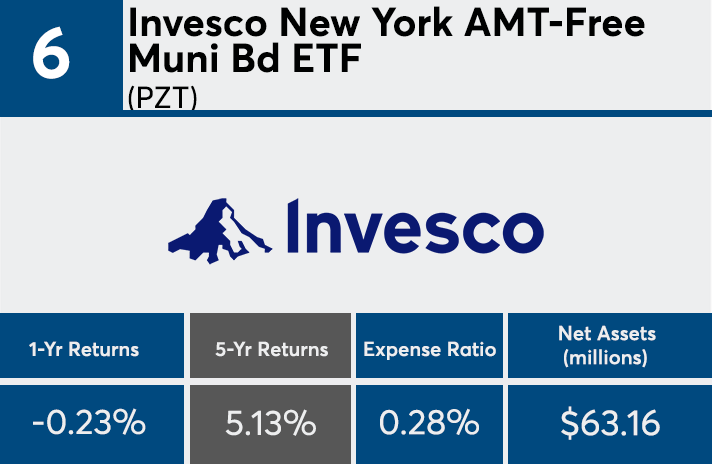

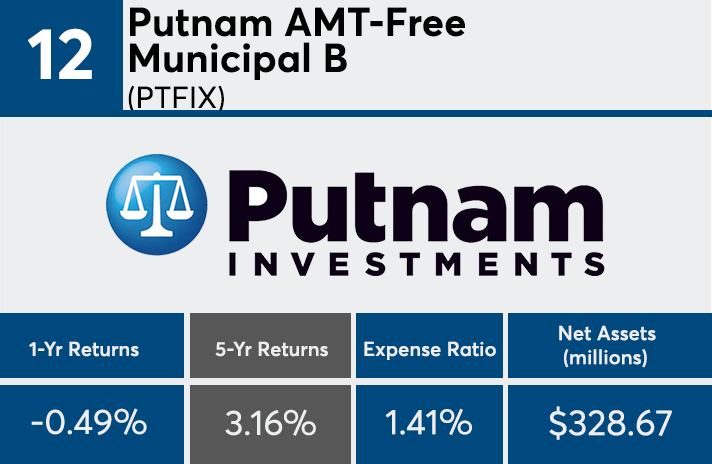

AMT-free funds have posted significantly poorer performance numbers in the last year, Morningstar data show. These funds, which hold a combined $12.9 billion in client assets, brought in an average 5-year return of 4.40% and just 0.30% year-over-year. Bompiedi says this is no surprise.

“Funds that have held AMT should have theoretically outperformed their AMT-free rivals since the beginning of the year, because of this change from the TCJA,” Bompiedi says.

It should be noted that many of the funds are state-specific and only provide maximum advantage for the residents of those states.

“These only make sense for individuals who live in the fund’s dedicated state,” Bompiedi says. “The California investor who owns the California fund is investing in the said fund because it owns only California debt, and possibly some territories. Because that investor lives in the state of California, they can own California bonds exempt from their California state income tax.”

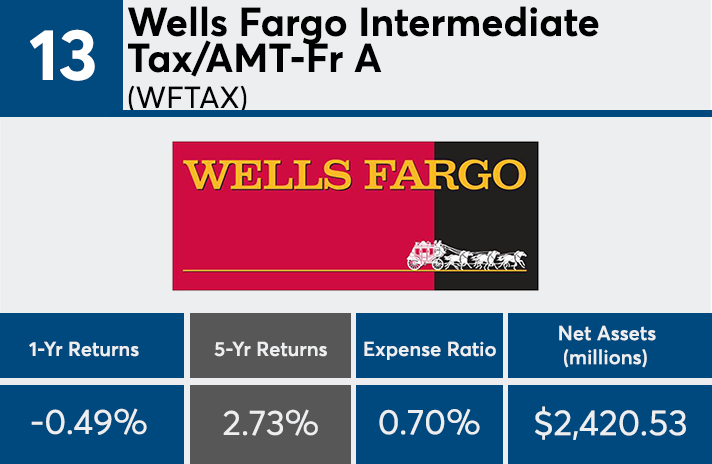

Scroll through to see the 20 best performing AMT-free touted funds over the past five years. Daily return figures are as of Sept. 17. Funds with investment minimums over $100,000 were excluded, as were leveraged and institutional funds. We also show one-year returns, assets and expense ratios for each. All data from Morningstar Direct.