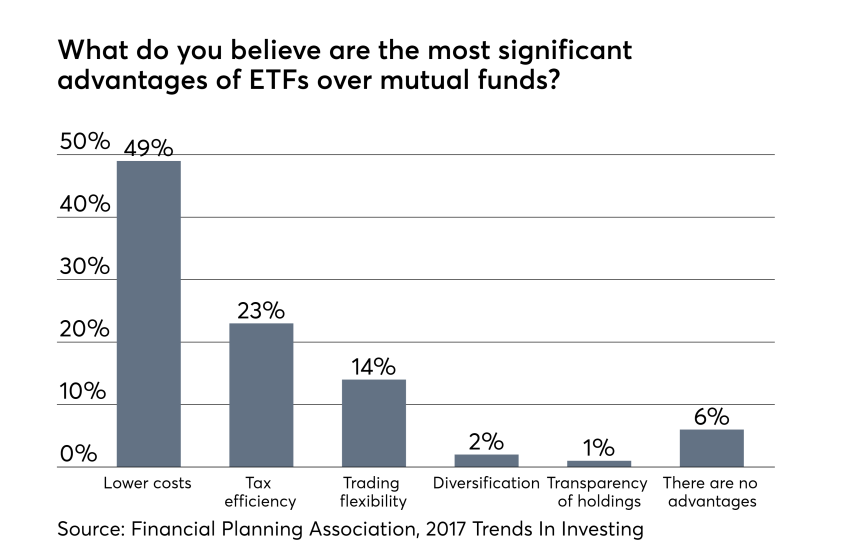

ETFs continue to dominate as the investment of choice for most advisers, according to the Financial Planning Association's 2017 Trends in Investing survey. Indeed, 88% of respondents said they currently use the passive products (the most popular among 17 options), and 50% said they plan to increase their use or recommendation over the next 12 months (again, the most common response.)

-

You pick a fund for your client and it returns 20%. You're a genius – until you realize the benchmark returned 23%. Here are the top overachievers.

June 28 -

Active management gets a black eye when funds can’t keep pace with indexes, especially when the shortfalls aren’t short-term.

July 6 -

For clients who crave consistency and aren’t trying to blow the doors off, these funds are worth a look.

June 21 -

Clients may become mesmerized by dazzling short-term returns, so consider pushing solid growth on the cheap.

May 3 -

Clients focus on returns, but advisers need to add “risk-adjusted” to their thinking.

April 25

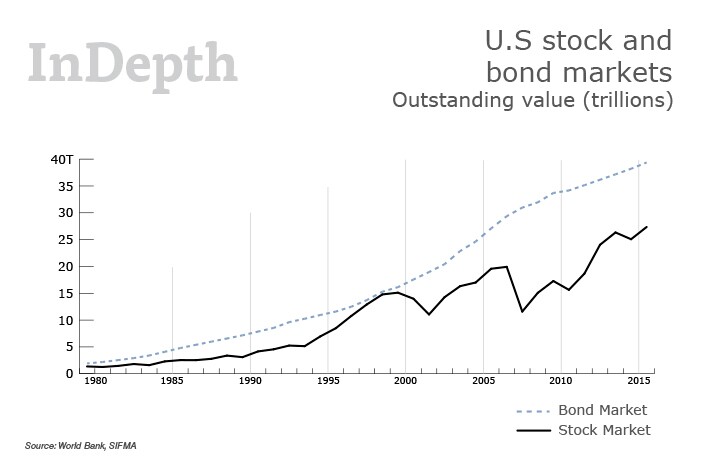

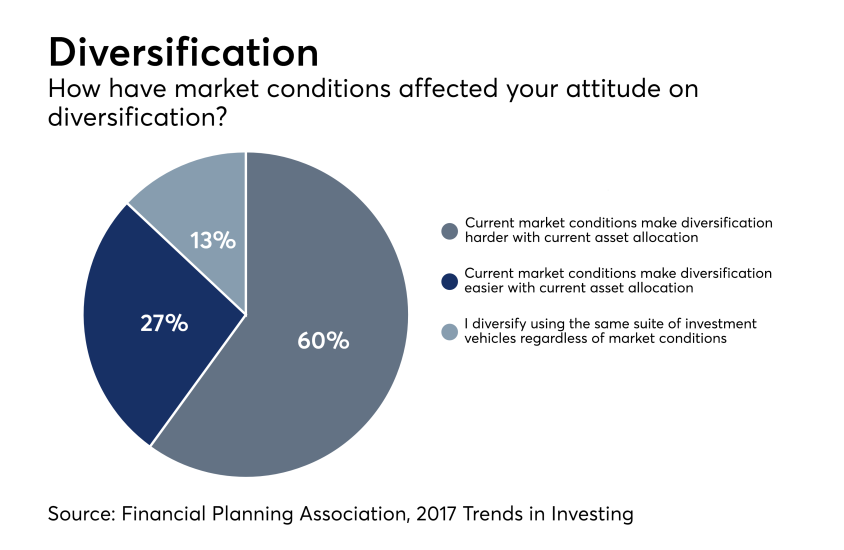

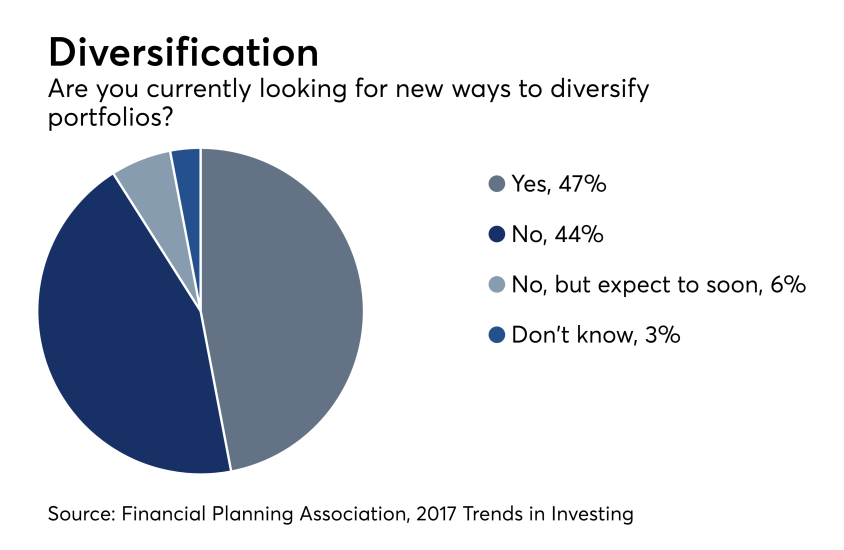

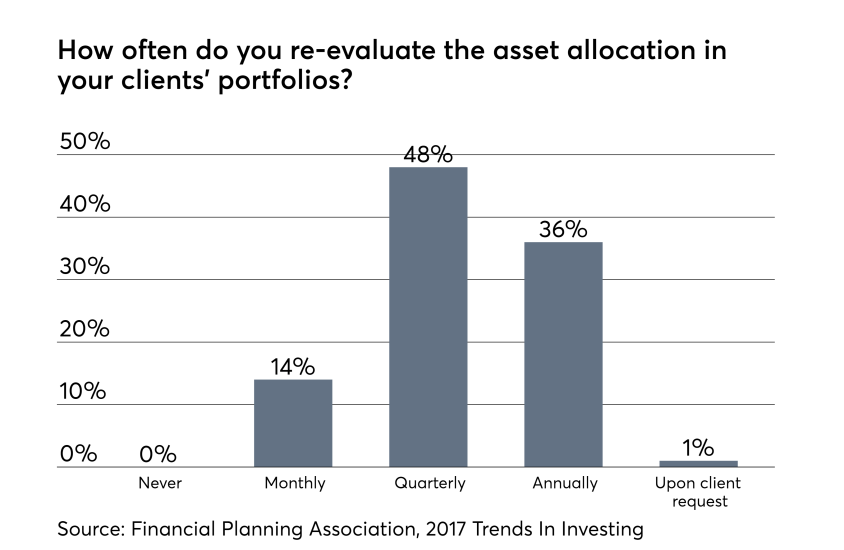

Scroll through to see some of the other trends among advisers. All data on the following slides is from the Financial Planning Association's 2017 Trends in Investing Survey. Data on the cover slide showing the overall U.S. stock and bond markets comes from the World Bank and SIFMA.