ETFs may make up a minority of most client portfolios, but clients want to buy more of them.

Over the next five years, investors plan to raise their exposure to ETFs, to a mean of 38% of their portfolios, up from 29% today, according to Charles Schwab’s new ETF Investor Study, which surveyed more than 2,500 investors.

The research, which surveyed both clients who do and don’t use exchange traded funds, underscores the ongoing industry shift into tax efficient investment vehicles, particularly as more asset managers embrace the structure.

In the last year,

Meanwhile, both advisors and their clients are stowing more assets in these funds. In February 2021 alone, ETFs drew $91 billion in net flows, while open-end mutual funds attracted about $53 billion, according to

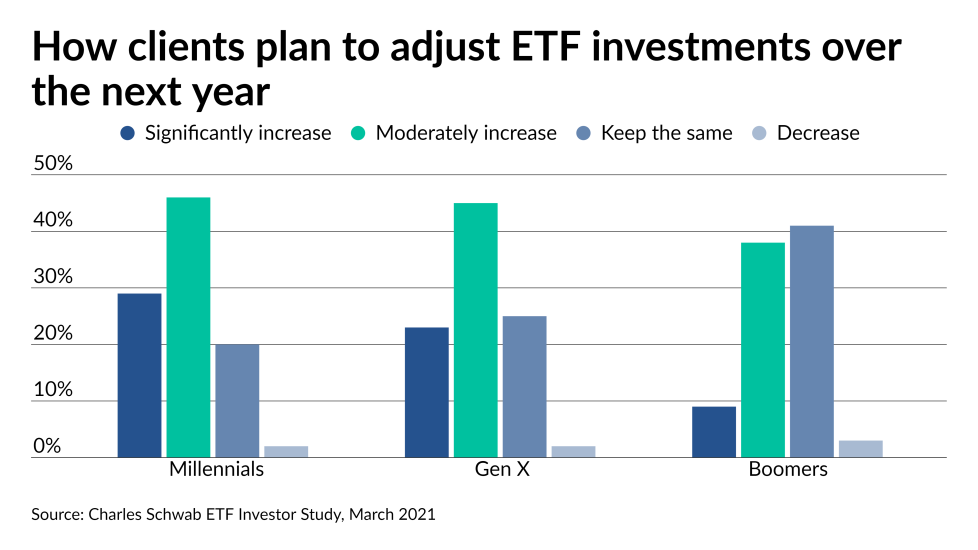

Clients anticipate they’ll put more money into ETFs in 2021. Here’s why clients want them, and what may be holding other clients back: