When Gordon Dalrymple was 60 years old, his financial advisor convinced him to roll over the savings in his 401(k) into investments including variable annuities and non-traded REITs.

“I sat down and talked with him at my house, and of course he made it sound like this was the smartest thing I ever did,” Dalrymple says.

Dalrymple, 70, now holds a different opinion — he has spent the last year trying to withdraw his money from the high-commission products after seeing his balance fall, he says. Advisor Craig Accardo allegedly never warned Dalrymple of the risks or the lack of liquidity involved with the investments.

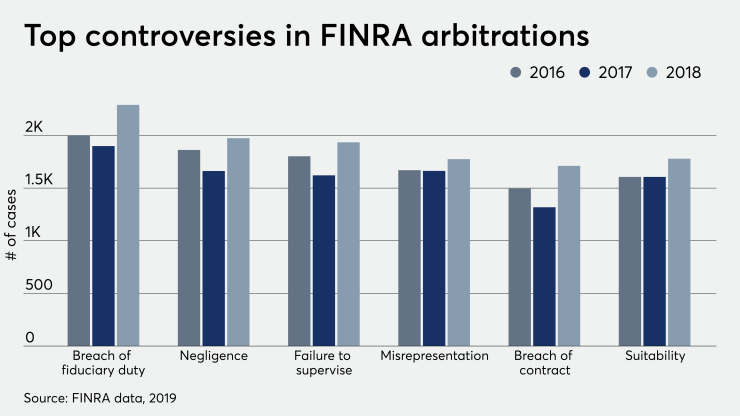

Dalrymple and 12 other clients with similar portfolios are seeking damages plus interest and fees against Advisor Group’s FSC Securities, arguing that Accardo and two other advisors who worked for the broker-dealer made unsuitable investment recommendations. The claims, which they filed in July through FINRA arbitration and which were originally reported by the New Orleans Times-Picayune, additionally accuse FSC Securities of negligence, breach of fiduciary duty, misrepresentation and omission of material facts as well as selling securities without adequate due diligence and a reasonable basis.

FSC Securities representatives Accardo, Frank Briseno III and his son, Frank Briseno IV, of the New Orleans-area NettWorth Financial Group made commissions of 5% to 10% from selling the clients variable annuities and alternative investments, according to the attorney representing the clients, Joe Peiffer.

A spokesman for Advisor Group — the parent of FSC and three other independent broker-dealers in its network — didn’t respond to requests for comment. The three reps deny the claimaints’ allegations against the firm, according to their attorney, Alan Wolper.

“They don't believe they did anything wrong relative to these investors,” he says. “If you're going to look at the bigger picture here, they feel like they've been the victim of this very aggressive media campaign that's being [initiated] by the lawyer that represents these people.”

The group of clients pressing the claims against FSC has expanded to approximately 40, according to Kevin Conway, who is also representing the clients. The advisors, who are not named as respondents in the statement of claim, allegedly concentrated too much of the portfolios in risky, unsuitable investments.

Some of the alternative investments have experienced severe losses in the past few years. For example, Dalrymple invested in American Finance Trust, a REIT which owns properties including Burger King and Bob Evans Restaurants.

American Finance lost $1 billion of the company’s equity value last year when it went public, according to

A spokesperson for American Finance did not respond to a request for comment.

The other products included expensive variable annuities and high-risk energy investments, according to the claim.

These portfolio recommendations were “clear commission grabs” for the reps, the statement of claim reads. The investments were “unsuitable for any investor let alone individuals preparing for and in retirement,” according to the claim.

The investments have cost these clients “tens of millions of dollars,” Peiffer says. The claimaints are still trying to quantify exactly how much money was lost due in part to some clients being unable to exit their investments, according to Conway.

Accardo, who recommended the products, had told Dalrymple that the principal in his investments would remain the same, Dalrymple says. But when he began collecting dividends after his retirement over four years ago, the balance started falling, he says.

“He would always have an excuse,” Dalrymple says. “Something's happening with the stock market, or this or that.”

After three years of losses in a well-performing market, Dalrymple says he dropped Accardo and attempted to liquidate his investments. But exiting proved easier said than done.

After roughly a year, Dalrymple has still been unable to withdraw money from two investments in his portfolio, he says.

In addition to the alternative investments, Peiffer says the variable annuities didn’t make sense for the clients. Tax-deferred growth is one of the main advantages of purchasing them, he notes.

VAs are an “extremely expensive product and that's directly due to the amount of commission that the broker makes on this,” Peiffer says. “If your money is already in an IRA or a 401(k), that already has that feature. So the way I always put it to people is, it's like wearing two pairs of shoes. It's expensive, it's stupid, and it ultimately hurts pretty bad.”

Wolper says he does not know the commission rate the brokers earned, but stated he believed the portfolios to be well-diversified and that the advisors had disclosed all potential risks.

“Not only are the risks disclosed in writing, it is my understanding that my clients did disclose orally to their investors and prospective investors the risks associated with the products they were interested in investing in,” he says.

He added that, in the case of a non-diversified portfolio, a client may choose to disregard an advisor’s recommendation.

Dalrymple has adjusted his lifestyle as the attorneys press the arbitration. He no longer eats out or takes vacation in his retirement, he says, “due to the fact that you just don't have the money to do that any longer."