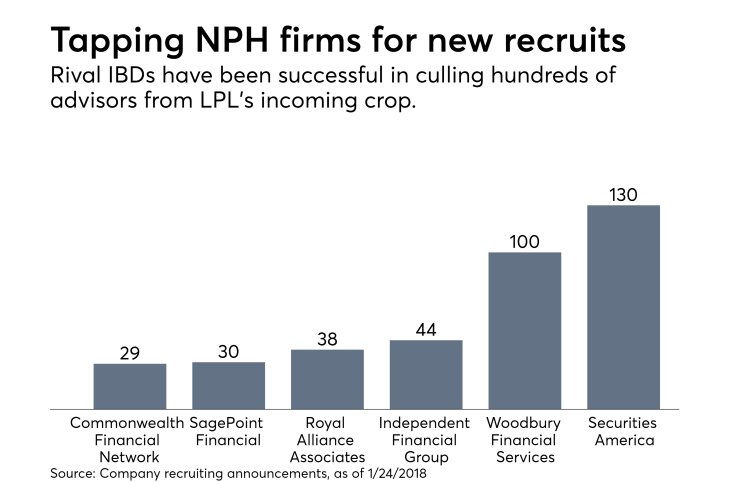

Two of LPL Financial’s biggest rivals have grabbed a combined 300 advisors with more than $9.4 billion in client assets from National Planning Holdings since LPL acquired its assets.

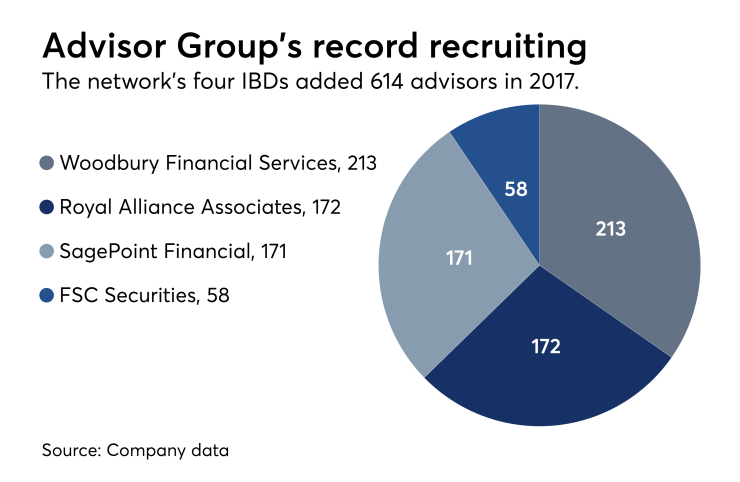

Securities America this week unveiled a group of 13 practices with 50 advisors and $2 billion in client assets that joined the firm in the fourth quarter from two of NPH’s independent broker-dealers. Advisor Group announced that it added 614 advisors in 2017, a company record and a 53% jump from 2016.

Competitors large and small have

Phoenix-based Advisor Group’s haul across its four IBDs amounts to

“More financial advisors are taking notice of what we have to offer,” Gregg Johnson, Securities America’s executive vice president for branch office development and acquisitions, said in a statement. He attributes the company’s success to its BD services, culture and technology, among other factors.

-

The No. 20 IBD unveiled a total of 15 practices joining its ranks in the fourth quarter.

December 21 -

At least 274 advisors with $11.5 billion in client assets have left the fold since the acquisition.

November 16 -

Exclusive: The No. 4 IBD unveiled a new bank-based team even as its competitor began revealing its retained firms under the acquisition.

December 15

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

A spokeswoman for NPH and a spokesman for LPL declined to comment.

Many NPH advisors

“We are excited to become part of the LPL family,” Advisors Southeastern founder Darin Stevens said in a statement, praising LPL’s technology and product offerings. “After doing our due diligence for more than eight weeks, we committed early to LPL. Every way we looked at it, the decision made sense.”

Other advisors have opted to make different decisions, though. Some 400 advisors with $18.2 billion in client assets have bolted from NPH firms since the LPL deal. It remains unclear, though, how many advisors LPL’s rivals have lost since the deal, since many of them do not readily report such data.

Johnson declined to discuss Securities America's net totals, noting the firm is a subsidiary of a publicly-traded firm, Ladenburg Thalmann. The firm doesn't discuss recruiting data beyond what is disclosed in Ladenburg's quarterly earnings reports and other SEC filings, he says.

A spokeswoman for Advisor Group did not immediately respond to a request for the firms’ amount of net new advisors for the year, along with other statistics related to their recruiting.

Advisor Group did, however, release some other figures about its record recruiting, which the firm said had been fueled in part by its many changes related to the fiduciary rule. The IBD network has

Net new assets for Advisor Group jumped 300% in 2017 due to the many recruited advisors in its fold, and existing advisors boosted their revenue by double digits. Its 614 new advisors brought about $13 billion in client assets under administration.

CEO Jamie Price led the firm’s 32-city roadshow over the course of the year, he noted in a statement.

“We believe actions speak louder than words,” Price said. “For us, that means equipping our affiliated advisors to succeed by delivering solutions that help them best serve their clients. This, in turn, fuels their growth in this rapidly-changing landscape.”

With at least 100 ex-NPH advisors, Advisor Group's Woodbury Financial Services appears to have reeled in

The No. 9 IBD, which has 2,200 advisors, previously unveiled

The new recruits include the Whitehouse Station, New Jersey-based U.S. Advisory, which has $192 million in client assets, the West Linn, Oregon-based Oregon Wealth Management, which has $189 million, as well as the Portland, Oregon-based Tom Brattain group, which also has $189 million.

One other practice out of a total of 14 that came to the firm in the fourth quarter left from Cetera Financial Group's Summit Brokerage Services. The recently-completed year ranks highly in Securities America's 34-year history, Johnson said in an email.

The year "was without question one of the most successful years that Securities America has experienced since its founding with respect to recruiting from all channels to our firm," he says.

Other IBDs have taken a piece of the NPH action as well. Independent Financial Group, the No. 41 IBD,