Annuity sales keep rising higher — and everyone from issuers to, potentially, the U.S. Congress is making it easier for financial advisors and their clients to buy them.

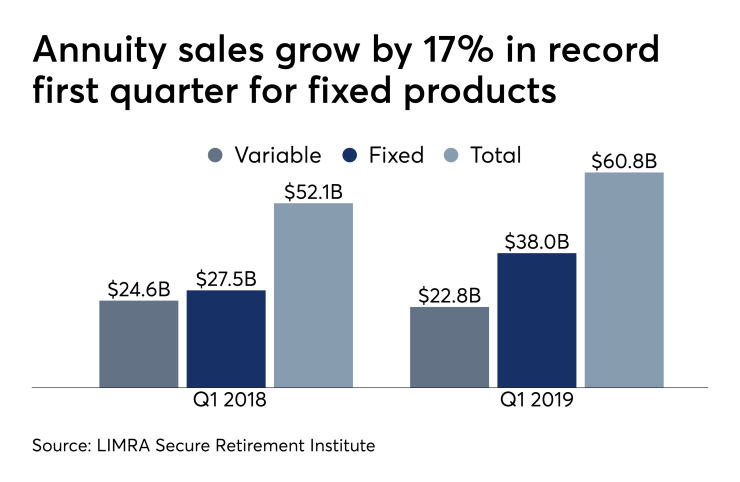

Fixed annuity sales jumped 38% year-over-year to $38 billion,

Notching the best first quarter in a decade, sales of all types of annuities also grew by 17% from the year-ago period to $60.8 billion. After a court decision vacated the Department of Labor's fiduciary rule in March 2018,

The record swell doesn’t appear to be letting up anytime soon: LIMRA’s midpoint forecast

Carriers,

Over the long term, the aging population and advances in technology point to sales optimism for LIMRA, which does caution that political or regulatory changes could undercut the rosy forecast. The current regulatory climate, equity volatility and interest rates are fueling short-term gains.

-

There's a lot to navigate when it comes to assuring clients that the benefits outweigh the headaches.

June 14 -

Fixed and variable contracts ended 2018 at nearly reverse levels of revenue from their totals three years earlier.

February 25 -

An educational campaign aims to place the products front and center amid increasing longevity — but sales figures show they’re already in the limelight.

April 8

Times are good for RIAs, but a new study suggests firms should be monitoring fees more closely.

FIA sales of $17.7 billion — a 25% jump — constitute the “strongest first quarter ever” for the products, Sheryl Moore, CEO of the research and consulting firm Wink,

Wink and LIMRA each reported that structured annuity sales soared by 60% year-over-year to $3.5 billion in the first quarter. LIMRA refers to the products as registered indexed-linked annuities, noting variable sales slipped by 14% when excluding the structured products.

Sales of multi-year guaranteed annuities expanded by more than any other product line in the past year, Moore notes. The products jumped by 80% year-over-year to $14.6 billion, according to Wink.

In terms of carriers, AIG took the largest market share at more than 7% of sales, followed by Jackson National Life Insurance, Lincoln Financial Group, New York Life and Allianz. Jackson’s Perspective II variable product sold at the highest level of any product tracked by Wink.

Annuity firms like Jackson

Another custodian — BNY Mellon’s Pershing — also

Annuities could reach more advisors and clients under provisions of a bill now in the Senate after passing the House in a 417 to 3 vote. With bipartisan support and a similar existing

The SECURE Act would give 401(k) sponsors a safe harbor from legal liability in the event of an insurer’s inability to satisfy the terms of a contract. Among other provisions, the bill would

“The gaps in America’s retirement savings system undermine our nation’s financial security, increase the risk of poverty among our retirees, and strain our social safety net,” TIAA CEO Roger Ferguson and AARP CEO Jo Ann Jenkins