An executive at Robert W. Baird has been fired from the firm for “conduct that does not align” with its values, according to an internal memo sent to Baird employees from Chairman Paul Purcell and CEO Steve Booth.

“Following an internal review, Bill Mahler … is no longer with the firm, effective immediately, as a result of conduct that does not align with our expectations of Baird associates,” according to the memo, which was obtained by Financial Planning.

Mahler served as chairman of equity capital markets and equity asset management and was a member of Baird’s board and executive committee, according to the memo. He also serves as director of the Baltimore-based hedge fund Greenhouse Funds, which is

Mahler did not respond to three immediate requests for comment via phone and email. The memo did not specify what conduct led to the termination.

“Bill Mahler is no longer with the firm as a result of conduct that does not align with our expectations of Baird associates,” Baird spokesman John Rumpf said in an emailed statement, declining to comment further.

“We have already begun working with the ECM, equity asset management, and marketing & communications teams to address any needs resulting from Bill’s departure,” the executives wrote in the memo. “In terms of the board and executive committee, we have every confidence in the exceptional leadership we have in place and our ability to succeed by putting our clients’ needs first has never been better.”

The memo instructed employees to bring any client inquiries about Mahler’s departure to the attention of senior leaders or their business heads.

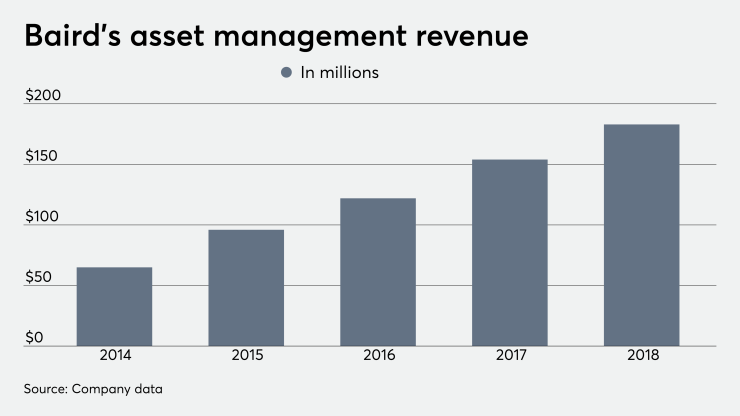

The assets in Baird’s equity asset management division have grown by 24.5% annually since 2014, according to the company. Last year, Baird launched a new SMID Growth mutual fund and reduced mutual fund fees.

Baird’s annual net revenue was about $1.8 billion in 2018, up from $1.5 billion the year prior. There are more than 3,600 associates at the firm.

At the end of November 2018, Baird said it would acquire Hilliard Lyons, a regional BD with approximately 380 advisors, a deal that