One of the largest wealth managers must pay restitution and a fine after selling $18 million worth of investments in a risky alternative mutual fund that went bust.

A registered representative of Cambridge Investment Research sold more than 80% of the shares in the LJM Preservation & Growth Fund — a product tapping the difference between implied and actual volatility,

Ironically — and unfortunately — for clients, February 2018’s “volmageddon” brought a

Fairfield, Iowa-based Cambridge failed to supervise the recommendations of the fund by its 4,400 reps in 2,500 offices, according to FINRA investigators, who noted that the firm sold shares to 550 clients. Furthermore, Cambridge didn’t adequately train the reps in alternative mutual funds or design due diligence and suitability reviews, investigators say. Clients holding shares on Feb. 6, 2018, lost 80% of their investments.

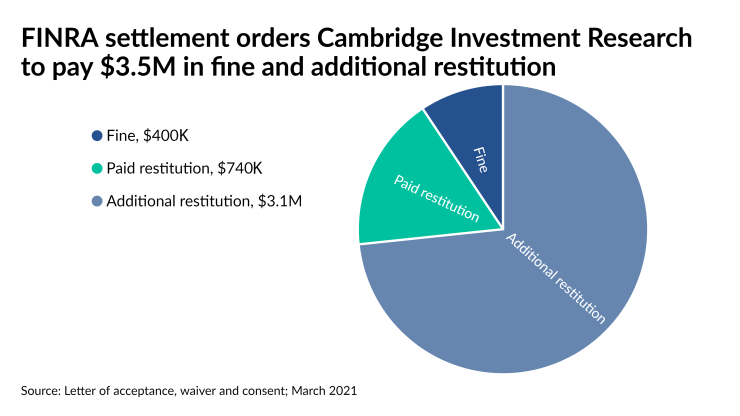

“Cambridge permitted the sale of LJM on its platform without conducting reasonable due diligence and without a sufficient understanding of its risks and features, including the fact that the fund pursued a risky strategy that relied, in part, on purchasing uncovered options,” according to FINRA’s letter of acceptance, waiver and consent. The settlement requires Cambridge to pay a fine of $400,000 and restitution of $3.13 million while altering its procedures.

The unidentified rep is no longer with the firm, spokeswoman Cindy Schaus said in an email, without stating whether there was a termination or other discipline. The firm has already paid $740,000 in restitution to affected clients after an investigation that stemmed from FINRA’s 2018 cycle exam of Cambridge and several client complaints, according to the settlement.

“Without admitting or denying FINRA findings, Cambridge entered into this letter of acceptance, waiver and consent in which FINRA notes Cambridge provided considerable assistance,” Schaus said.

Investors, which included several RIAs, filed lawsuits against issuing firm LJM Partners, which shut down after liquidating the fund that year, Citywire

The complex products relied on what its marketing materials called a “volatility premium” resulting from investments primarily in “purchased (long) and sold (short) call and put options on the S&P 500 futures index,” according to FINRA. The fund disclosed that “extreme volatility spikes” were one of three scenarios that would challenge its strategy, FINRA says.

Although Cambridge reached a selling agreement to offer the fund in 2013, most sales occurred after a wholesaler associated with the fund pitched it to certain reps in May 2016, according to investigators. The last sale allegedly occurred on Feb. 5, 2018 — the day Reuters