Edward Jones launched its first ever advertising campaign targeting experienced advisers in a shift from the broker-dealer’s traditional recruiting focus on training.

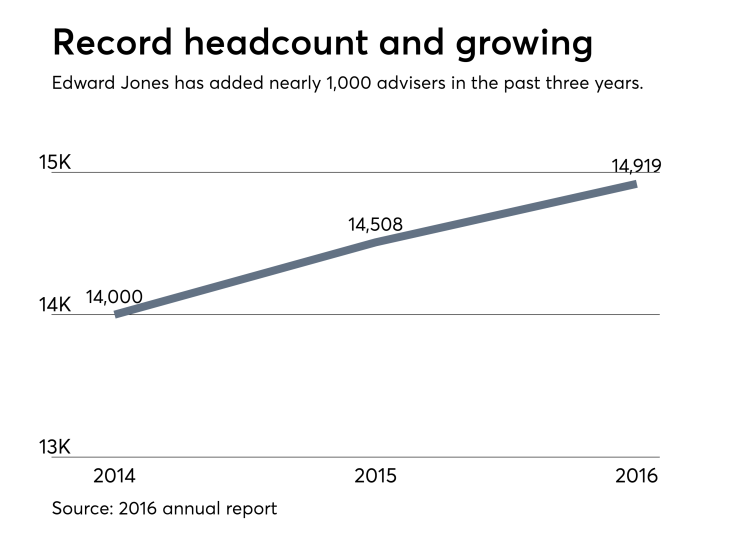

The company’s headcount grew by 919 advisers to 14,919 over the past three years, according to its latest annual report. Edward Jones executives have previously said

The St. Louis-based company last week unveiled a series of ads in national business and industry publications as well as a new website touting its “enduring growth” and “deep resources.” The $6 million ad campaign marks a new path for Edward Jones, which is known for having one of the industry’s largest training programs.

“We haven’t been in this space. We haven’t been recruiting experienced advisers in a significant way. One of the opportunities we have is just to make sure more advisers are thinking of us,” says Katherine Mauzy, the firm’s principal of adviser talent acquisition.

Edward Jones faces stiff competition: Merrill head Andy Sieg

“They were experts at that, so why not stick with something you’re successful at?” says Mickey Wasserman, president of recruiting firm Michael Wasserman & Associates. Wasserman says he’s skeptical of the strategy, though he notes he hasn’t seen the firm’s offers or transition programs.

JONES BY THE NUMBERS

This year alone, Edward Jones hopes to add almost 200 advisers who have just secured a license, 150 advisers with three to five years' experience and 60 or 70 advisers with at least $250,000 in production and $30 million in assets under management, according to Mauzy.

The ad campaign follows the creation two years ago of a transition and integration team aimed at recruiting seasoned advisers, she says. The team helped bring 38 advisers into the fold last year, according to Mauzy.

“We’ve recognized that a lot of advisers are not happy where they are and seen them move to Edward Jones successfully,” she says.

The company placed the ads in The Wall Street Journal, Fortune, Barron’s and (full disclosure) On Wall Street.

The firm, whose headcount includes 660 brokers in Canada, set new records in 2016 for both its number of advisers and client assets under care, at $963 billion, according to the annual report of its parent firm, The Jones Financial Companies.

Profits before allocations to partners fell 11% last year to $746 million, mostly due to a drop in trade revenue and an increase in adviser pay. The extra expense reflects the growing headcount and “certain enhancements” to pay which the firm rolled out in September 2016, the report shows.

Asked to clarify, Mauzy says the firm has abandoned forgivable upfront loans for new advisers and introduced 12-month income guarantees and new asset bonuses.

“It’s very clear. It’s competitive,” she says of the compensation for new advisers. “I think they feel much better explaining this to a spouse or their family: 'This is how I’m going to be paid.'”

-

The wirehouse aims to grow its adviser ranks in a potential bid to surpass its larger rival Morgan Stanley, according to Andy Sieg, head of Merrill Lynch.

April 10 -

"If we don't grow, then we abdicate that opportunity to our competition," says James Weddle, managing partner of Edward Jones, which hopes to surpass Morgan Stanley as the industry's largest brokerage by headcount.

June 30 -

Which firms showed “meaningful progress” in improving client experience? And which one slipped?

April 11

NEW TRAINING RIVAL

At roughly 3,100 a year, Edward Jones has traditionally hired about double the number of trainees as Merrill Lynch. Approximately 70% of the group completes the training and 40% of it remains with the firm after three years, Mauzy says. The company has planned for a training class of the same size this year.

Yet Merrill’s Sieg placed emphasis on training in a closely watched speech last week at SIFMA’s Private Client Conference in Phoenix. The wirehouse currently has 3,500 trainees in its program, with plans to increase this year's crop beyond Merrill's normal annual trainee headcount of 1,500 to 1,700 people, according to a spokeswoman.

"Make no mistake,” Sieg said at the conference, “when you look out over the next 10 years the thundering herd will be growing.”

MAKING THE PITCH

Edward Jones hopes to attract “experienced financial advisers and business professionals, including CPAs and attorneys,” according to a company announcement about the ad campaign.

The new recruiting effort will seek out prospective advisers with the message, “The more you know, the more we make sense,” according to Edward Jones. The website features portraits of brokers and specific listings for current advisers, new ones, support staff and students.

“What we’re noticing is that, as more advisers take the time to sit and talk to us, they’re excited to see our platform and how we’ve expanded over the last five years,” says Mauzy, noting she added 17 more staff members to the firm’s transition and integration team.

Coaching and other such “infrastructure with ongoing support” figure into advisers’ decisions about switching firms, according to Wasserman, the recruiter.

The lack of such services in the past and the firm’s non-membership in the Protocol for Broker Recruiting raise questions about the new recruiting effort, Wasserman says. Edward Jones’ status outside the agreement may open advisers to litigation if they leave the firm and try to take clients with them.

The possible problems make it “too early to tell” if the firm will have success, Wasserman says.