If the notion that emerging markets are volatile needs any data backup, consider two numbers. In 2017, the benchmark MSCI Emerging Markets Index rose 37.28%; this year, through Dec. 7, it’s down 10.83%.

But the decline could present advisors and their clients with an opportunity for future gains in any rebound. Despite notable problems in the asset class, including Turkey’s debt load and China’s growth slowdown, many EM countries are in better economic shape now than they were during the financial crisis.

Consider that the public debt of emerging market countries is less than half that of the major advanced economies, as represented by the G7 nations. And the emerging market designation hides some economies that have long emerged as majors: South Korea, for instance, is an emerging market in the MSCI benchmark yet is the 11th largest economy in the world with nominal GDP of $1.53 trillion.

South Korea is an emerging market in the MSCI benchmark yet is the 11th largest economy in the world with nominal GDP of $1.53 trillion, says contributor Joe Lisanti.

Another example is India (nominal GDP $2.61 trillion), which the World Bank expects to be the fastest-growing large economy on the planet for the rest of the decade. India is already the sixth-largest economy in the world, but is considered an emerging market.

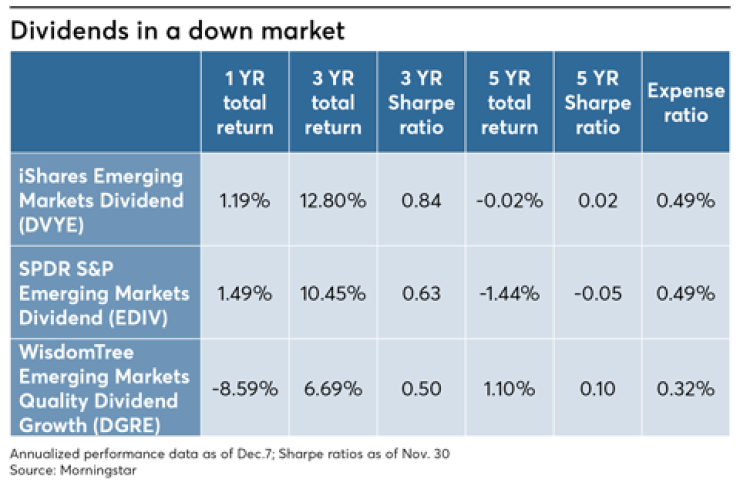

Here are three ETFs with at least a three-year history that own dividend payers in emerging markets. We’ve excluded funds labeled high-yield or small-cap.

iShares Emerging Markets Dividend ETF (DVYE, expense ratio: 0.49%) is based on the Dow Jones Emerging Markets Select Dividend Index, which is formed by taking the S&P Emerging Broad Market Index and excluding REITs. To be eligible for the DJ EM Select Dividend Index, a company must have paid a dividend in each of the past three years and must have non-negative trailing 12-month per-share earnings. Stocks with a minimum market cap of $250 million that pass the screens are ranked by indicated annual yield with the top 100 included, subject to country caps.

The decline could present advisors and their clients with an opportunity for future gains in any rebound.

No more than 30 stocks may be from any single country and no country may represent more than 25% of the index. DVYE’s largest industry concentrations are technology (15.31%), real estate (14.01%), and utilities (13.98%). Biggest country positions are Taiwan (28.09%), Russia (16.23%), and Brazil (9.69%). In 2017, DVYE returned 25.71%; this year, through Dec. 7, it’s down 3.35%. Morningstar projects the forward dividend yield at 10.11%.

SPDR S&P Emerging Markets Dividend ETF (EDIV, 0.49%) is based on the S&P Emerging Markets Dividend Opportunities Index. That index is derived from the S&P Emerging Broad Market Index by screening for a minimum market cap of $300 million and by requiring positive 12-month per-share earnings (excluding extraordinary items). In addition, stocks must have stable or increasing dividend growth over three years and per-share funds from operations must be greater than the dividend per share. Yield must be higher than median yield in the eligible universe of stocks meeting the other criteria. Stocks are ranked by risk-adjusted yield (yield/volatility of yield over 36 months).

The top 100 ranked stocks are included. In addition to the stocks in the index, EDIV has cash holdings of multiple currencies. The ETF’s current largest sector weightings are financials (24.29%), industrials (11.68%), and communications services (11.51%). Top country weightings are China (22.93%), South Africa (20.61%), and Thailand (16.23%). In 2017, EDIV had a total return of 27.97%. This year, it is off 5.74% through Dec. 7. Based on current holdings, Morningstar sees its forward yield at 4.95%.

WisdomTree Emerging Markets Quality Dividend Growth (DGRE, 0.32%) is an ETF that, despite its name, does not require holdings to have increasing dividends. The “growth” referred to in DGRE’s name is corporate profit growth. Until Oct. 19 of this year, DGRE operated using a passive strategy. Now it is actively managed. Managers have some leeway, but generally employ the same strategy that had been imposed by the WisdomTree “smart beta” index that used to steer the portfolio. That means DGRE concentrates on dividend-paying companies that have a high return on equity.

The share of fund’s total dividend pool represented by each holding weights the 269-stock portfolio. Biggest sector positions are technology (16.35%), consumer discretionary (13.38%), and financials (13.18%). DGRE’s largest country allocations are to China (25.39%), South Korea (12.27%), and India (12.12%). As a passive fund in 2017, DGRE had a total return of 29.91%. This year, through Dec. 7, the ETF is down 14.05%. Morningstar projects its forward yield at 3.48%.