A barred former Cetera Financial Group advisor fired after an earlier arrest on stalking charges received a five-year prison sentence after pleading guilty to fraud.

David A. Rockwell, 45, must forfeit more than $1 million in restitution after fraudulently obtaining a $700,000 line of credit under two clients’ names without their knowledge or permission and buying a home with $400,000 from a third’s low-income housing investment,

Cetera fired the Cape Coral resident in 2018 following his arrest on felony charges of aggravated stalking, harassment, cyberstalking and credible threat to person charges, FINRA BrokerCheck

In this latest case, a sentencing memo by the defense requested a reduction to four years from the 63- to 88-month sentencing guidelines based on Rockwell’s diagnosis of “severe” bipolar disorder. Rockwell's manic episodes “caused him to be reckless and impulsive,” according to a doctor whose observations were included in the defense sentencing memo. Rockwell has also received diagnoses of depression and anxiety, and he had a childhood marked by physically and mentally abusive parents as well as a history of substance abuse, the document states. Before his 2018 arrest, Rockwell had been arrested three times for driving under the influence, according to the memo.

Despite the petition, District Judge John Badalamenti handed down the five-year term on June 2. Rockwell pleaded guilty in January.

Rockwell’s attorney didn’t respond to a request for comment.

Rockwell has paid more than $450,000 to a receiver to compensate victims in the case and a relative of one of the clients, according to the defense’s sentencing memo.

“Mr. Rockwell knows what he did was wrong,” the memo says. “He knows that he has earned a prison sentence. Nevertheless, his sentence should take into consideration his unique circumstances as a person suffering with severe bipolar disorder. The timeline of events demonstrates how he deteriorated and mentally unwound. Since confessing, Mr. Rockwell has consistently shown remorse for his actions.”

Rockwell was affiliated with Cetera Advisor Networks from June 2015 to November 2018.

Representatives for Cetera didn’t respond to requests for comment. Another former Cetera advisor who pleaded guilty to fraud

Rockwell carried out the fraudulent transactions through his practice, Gralyn Financial Services, between October 2017 and December 2018, according to federal prosecutors. He diverted the unauthorized lines of credit to accounts he controlled for his own personal use and sold the other client on a housing investment he claimed would earn income of 5% to 7% annually, the criminal indictment states.

“In order to conceal the fact that he had fraudulently converted and misappropriated monies belonging to his clients and their beneficiaries, for his own purposes,” the document says, he made “materially false, fraudulent and misleading lulling representations to certain of those clients about, among other things, what he had done with money they entrusted to him and that the loans were interest-earning investment accounts that would gain money.”

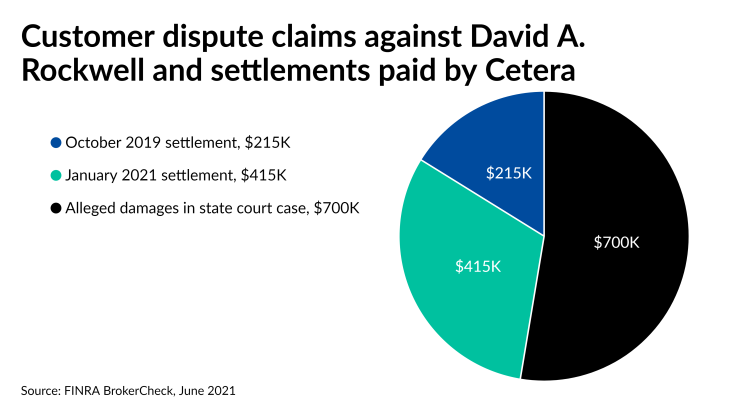

Cetera has paid two arbitration settlements to Rockwell’s former clients for a combined $630,000. A third client has filed suit in Macomb County, Michigan, alleging damages of $700,000, according to BrokerCheck.

Cetera terminated Rockwell after he notified the firm of the stalking arrest, BrokerCheck shows. Rockwell worked for three other firms in the course of a 17-year career in the financial services industry.

“For much of his life, Mr. Rockwell lived the American dream,” the defense memo states. “He grew up in an abusive home, but Mr. Rockwell overcame his surroundings. He was successful in school. He was successful in sports. He was successful at work. He used sports to get an education. He used his education to become a financial investment advisor. Mr. Rockwell was on his way in life.”