For years, advisors have used active fund managers to target factors, including value, low volatility, capitalization size, momentum, dividend yield and quality to obtain higher returns for clients.

These days, however, with more than 370 U.S equity smart beta ETFs that feature one or more factors available, advisors have the tools to supercharge their own asset allocation strategies.

The extent to which they do so depends on the advisor — whose attitude toward factor investing can run the gamut from gung-ho to proceed with caution.

“When they first came out, I was probably a little skeptical about factors as just a marketing play,” says Eric Uchida Henderson, CIO of East Horizon Investments, a planning firm in Cambridge, Massachusetts.

Today, Henderson uses factor-based investments in one-quarter to a one-third of his clients’ domestic equity portfolios. He favors single-factor products targeting “dividends, low volatility and quality.”

Phil Huber, CIO of Chicago-based Huber Financial Advisors, uses both single-factor and multifactor products “depending on the situation.” Huber notes that a pure momentum and a pure value factor product could cancel each other out. But a well-run multifactor fund might choose stocks that rank B or B+ in both categories that would fit together better.

“We tend to gravitate more to multifactor funds,” says Aldo Vultaggio, director of investments at Capstone Financial Advisors in Downers Grove, Illinois. The firm uses them to hedge the risk that any one factor might underperform for an extended period of time. The use of multifactor funds also avoids overloading the portfolio with a multitude of single-factor products, Vultaggio says.

Even though value stocks have long been in the doghouse, “you have to believe that buying cheap works,” says Steven Sivak, managing partner at Pittsburgh-based Innovate Wealth. Sivak focuses client portfolios on value and momentum factors. “You want something that’s very pure. I try to go for that,” he adds.

John Diak, principal at Oatley & Diak in Parker, Colorado, is restrained when it comes to the use of factors. “We’re pretty vanilla when it comes to asset allocation,” he says. Diak mainly uses low-volatility factor ETFs for up to 25% of the large-cap domestic equity allocation of conservative clients “to try to mitigate some risk.”

-

The products seek risk and return objectives through factor exposures such as minimum volatility, value, momentum, liquidity and quality.

February 20 -

Studies show smart beta beating their benchmarks more than active managers.

May 17 -

Each of these funds has its own way of adding high-octane assets into clients' portfolios.

June 12

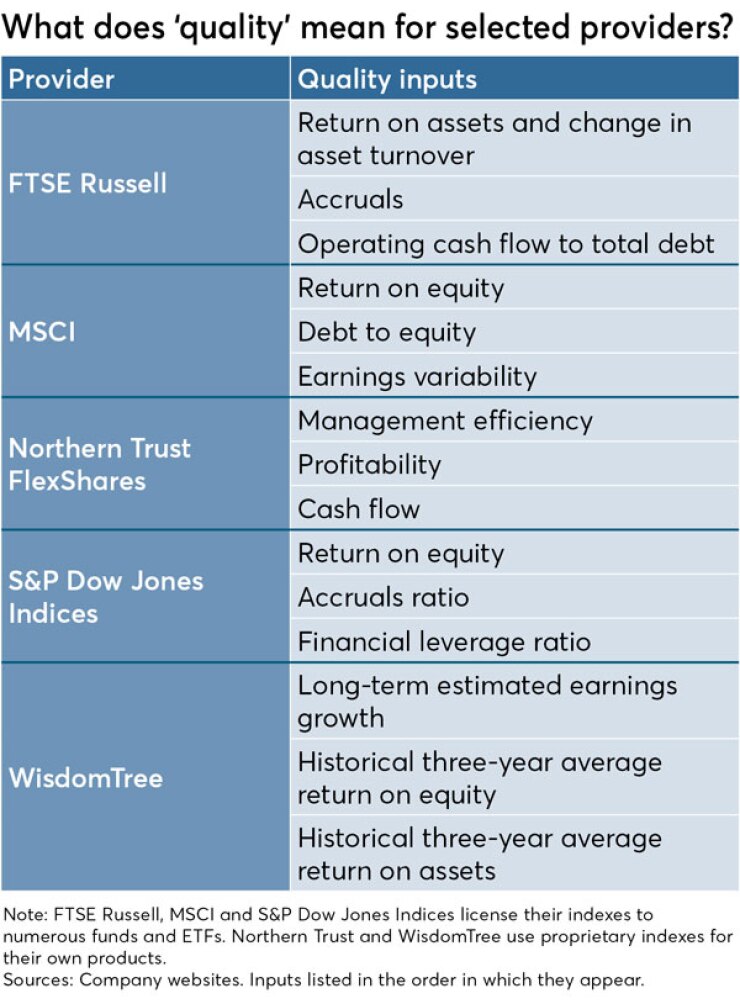

Paul Winter has been “interested in factor investing since the ‘90s.” Although the president of Five Seasons Financial Planning in Salt Lake City initially looked at value, size and momentum, he now mainly employs value and quality factors in client portfolios. While Winter says that “quality” has many definitions, he defers to providers who have done the research. “I don’t really impose my own views with respect to what is valid in terms of how to define quality,” he adds.

Most of the activity in factors has been on the equity side, but some planners have begun to use factors in allocating fixed-income assets.

Robert Anderson, principal at Voyager Capital Management in Lake Geneva, Wisconsin, modified his approach to debt assets after the 2008 financial crisis. As duration of the aggregate bond index began to increase, Anderson moved client assets to a combination of a short-term bond fund, a low-duration, high-yield product and an international bond fund.

“We recently did a background analysis on credit. That led us to add a new position to our portfolio recently,” he says — a fund that uses credit quality as a factor.