The CFP Board has disciplined eight planners for infractions ranging from fiduciary breaches to multiple bankruptcies.

Among the board's most significant sanctions, it permanently revoked the CFP certification of Ameriprise adviser William W. Gammon, effective July 2, 2016, after he failed to answer the board's complaint in a timely fashion. The board alleged that Gammon, based in Towson, Maryland, recommended and sold clients alternative investments — including non-traded REITs, debentures and equipment leasing funds — that were unsuitable given the clients’ ages, risk tolerances and investment objectives. The investments unsuitably concentrated the clients’ assets in alternative and real estate investments and the investments did not meet the clients’ liquidity restrictions, the board found.

According to his FINRA BrokerCheck record, Gammon has had 26 disclosure events since becoming an adviser in 1988. Of those client complaints, 18 have been settled, four were withdrawn, one was denied and one is still pending.

Neither Gammon nor Ameriprise immediately responded to attempts to reach them for comment.

And, following a

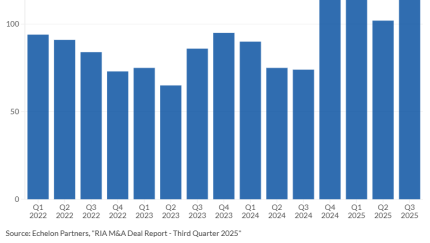

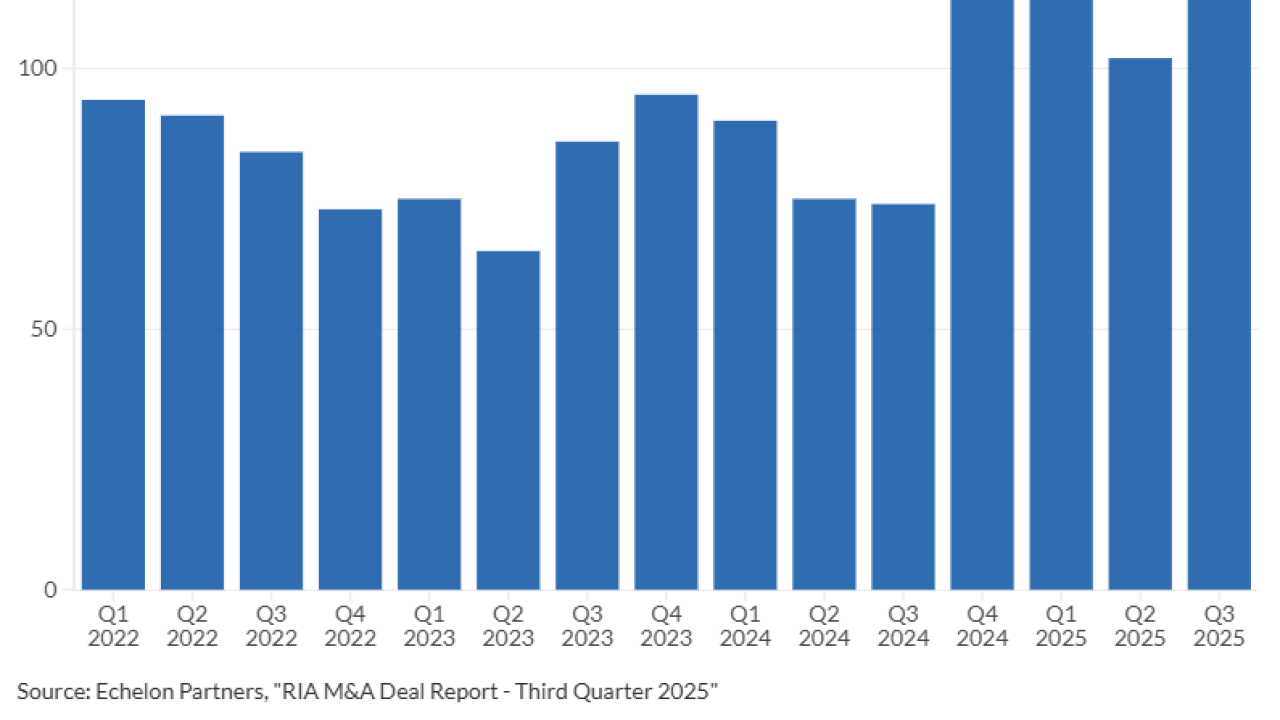

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

Also, Raymond James lands a $420M father-son team from Edward Jones, Cetera recruits a $350M LPL duo, and Cambridge acquires a $1B AUM dual registrant.

DOES THE PUNISHMENT FIT THE CRIME?

Among the other sanctioned advisers, one is taking issue with the CFP Board's approach.

"I don't think it was a valid decision the board made," says Frank Molinar, who received a public letter of admonition after self-reporting a bankruptcy last year. "I argued to get a private censure, but it was denied,"

The board sanctioned Molinar, an adviser affiliated with broker dealer Verus Capital Partners in Scottsdale, Arizona, given that last year's bankruptcy followed two others in 1990 and 1991.

From recommending wrong share classes to cherry-picking allocations, these are the pitfalls advisers should avoid.

The board said in a statement that bankruptcies reflect "adversely on Mr. Molinar’s integrity and fitness as a certificant, upon the CFP marks, and upon the profession."

Molinar says he self-reported all three to the board. "Those were 13 years prior to my CFP," Molinar says of the two from the early nineties, adding that he informed the board about those bankruptcies when he became certified in 2004.

The 2015 bankruptcy "was a result of the prolonged fallout from the recession and a divorce and a subsequent lawsuit from the ex, counter to a settlement agreement that I had with her," he said.

The board's rules state that it may take disciplinary action in cases of multiple bankruptcies "regardless of the dates of the filings."

The board gave another adviser Charles Zsarnay of Toledo, Ohio, a public letter of admonition, after it found that Zsarnay allegedly copied driver's licenses in violation of Ohio law. His actions resulted in a misdemeanor conviction, according to a note on his FINRA BrokerCheck record.

Zsarnay also allegedly provided false testimony to the Ohio Securities Division regarding his role in the driver's license matter, which led state authorities to deny his Ohio securities sales license and investment adviser representative license applications.

His misdemeanor conviction, since purged, "had nothing to do with pecuniary gain, identity theft or dishonesty," Zsarnay says. "Even though these licenses were mutilated to the point where they could no longer be used for identification I did not follow protocol in their disposal." He adds that the problem stemmed in part from "opportunistic bureaucrats" and that in his years as a planner he has never had a single client complaint.