With income-hungry investors gorging themselves on high-yield bonds and the funds and ETFs holding them over the last decade, perhaps a backlash was inevitable.

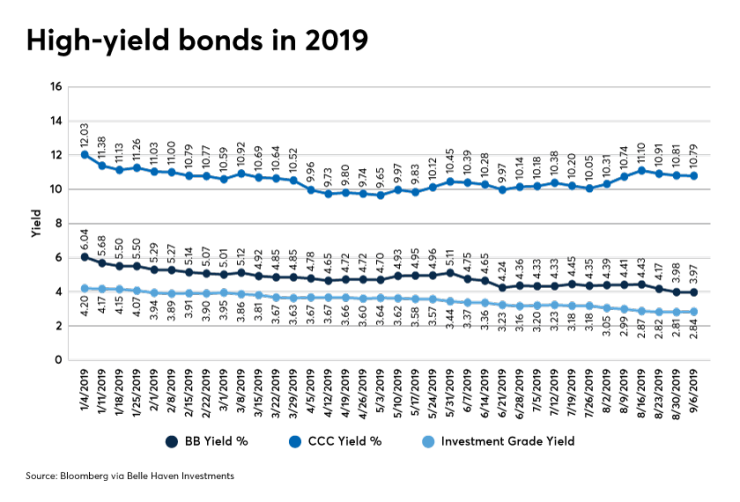

In early January, the yield on BB-rated bonds stood at 6.04%. Eight months later, it stood at 3.97%. The price rise and concurrent yield slide is enough to give some planners pause.

“I just don’t think that investors are being adequately rewarded for taking the risks,” says Howard Pressman, an advisor and partner at Egan, Berger & Weiner in Vienna, Virginia. “We’re probably closer to the end of this expansion cycle than to the beginning. Now may not be the time to be invested in these more risky securities.”

Kevin Brosious, a planner at Wealth Management in Allentown, Pennsylvania, shares Pressman’s unease. “Right now companies are doing very well, but that can turn on a dime,” Brosious says. He will use high yield only as a “diversifier for the bond holdings” of a client that has “a large portfolio.”

But even then, Brosious says, it would be a very small piece of the asset allocation. “They make me nervous,” he adds.

Brosious’ caution extends up the credit ladder. He now avoids many former favorites among bond funds and ETFs because of weakening credit quality. Instead the advisor is parking some client assets in a federal money market fund that recently yielded about 2%.

“That’s a real option for me,” he says.

Jerry Verseput of Veripax Wealth Management in Folsom, California, took his clients out of high-yield bonds when their spreads narrowed and now seeks yield through business development companies. He says income from BDCs tends to be very stable.

“High-yield bonds tend to be illiquid when you get a credit crunch,” Verseput says. “If you’re holding those in a publicly traded fund and suddenly everybody wants to get out, it can sometimes be a time bomb waiting to go off.” Verseput grants that BDC “prices may retreat” when credit is less available. But as individual companies, he contends, “they’ll never be forced to sell their debt.”

But Michael Luong, a corporate credit analyst at the fixed-income asset management firm Belle Haven Investments in Rye Brook, New York, says he thinks many clients pressure themselves into taking on excessive risk with high-yield debt.

“The less money a person has, the more pressed they are to look for yield,” says Luong. “The asset class, in my opinion, is for those who can afford to lose a little money because you’re going to lose some money in that category.” For most clients and their advisors, he believes, the exercise isn’t worth it. Luong observes that picking up 200 basis points in yield for a year or two can be wiped out with a single default. “People want high yield until they own it and it goes from par down to 80 cents and then they don’t want high yield,” he says.

“If I had to initiate a position right now in high-yield bonds, I probably would not,” says Jeff de Valdivia, a planner at Fleurus Investment Advisory in Fairfield, Connecticut. The advisor explains his hesitation has everything to do with current conditions and nothing to do with the asset class, which in typical times adequately compensates investors for the risk they take. Nevertheless, de Valdivia says, “You can get hurt and buying them in certain situations where you pay up makes no sense.”

He recently reduced his clients’ exposure to the high-yield bond market and calls his approach to the asset class “marginally defensive.” Yet de Valdivia’s clients have anywhere from 5% to 15% in high yield, mainly through a conservatively managed fund that concentrates on BB debt.

“It has all to do with dosage,” he says.