Want unlimited access to top ideas and insights?

Although the aggregate divorce rate among Americans

This rise of so-called grey divorces has created a number of uncommon and complex issues for clients. Splitting an IRA, for instance, is pretty straightforward, but the matter becomes far more complicated for accounts that have ongoing 72(t) distributions.

Sometimes cash flow problems — or less commonly an early retirement — may have led one or both spouses to tap into IRA assets before reaching age 59 ½, via the use of specially scheduled annual payments commonly called 72(t) distributions. If accounts from such distributions being taken are split as part of divorce proceedings, they can exacerbate an already complicated situation.

Notably, there is no formal guidance from the IRS on the matter, and virtually all of the informal guidance available, via private letter rulings made publicly available, directly conflicts in some cases with the IRS’s limited formal guidance on 72(t) distributions.

All of which is to say, it is incumbent on advisors who work with clients nearing retirement and pursuing divorce to understand the implications of that legal separation on retirement funds — funds that can suffer a swift and sudden depletion if the planning isn’t done with care.

Congress created the IRA — along with the 401(k), 403(b) and other tax-favored retirement accounts — to address the specific need of saving enough money during one’s working years to be able to support oneself during retirement.

To encourage people to actually use these funds for their intended purpose, Congress attached a string to the money. More specifically, via

The first exception provided by IRC Section 72(t)(2)(A)(i) is more so the rule, as it allows an IRA owner to take distributions from their IRA after reaching age 59 ½ without a penalty. In the eyes of Congress, this was an appropriate age at which to consider someone retired or at least close enough — and thus, able to use their IRA savings for its intended purpose.

Congress also understood that from time to time, people may put money into retirement accounts and, for one reason or another, need to access some or all of those funds prior to reaching retirement age. They crafted a number of other narrow exceptions to the general rule — what Congress deemed permissible reasons to break the “I’m putting this money away for retirement” covenant.

Such narrow exceptions to the 10% penalty include, but are not limited to:

- Distributions to beneficiaries after an owner’s death;

- Distributions to IRA owners who are considered disabled, though they must be “unable to engage in any substantial gainful activity” due to a “medically determinable physical or mental impairment” expected to last indefinitely or result in death, as defined in

IRC Section 72(m)(7) ; - Distributions made on account of an IRS levy;

- Distributions for medical expenses in excess of 10% of the IRA owner’s adjusted gross income;

- Distributions used to pay qualified higher education expenses of the IRA owner or other qualified individuals; and

- Distributions up to $10,000, which are used toward the first-time purchase of a home.

Congress also included a broader exception to the 10% penalty rule that allows individuals to use a limited amount of retirement dollars for an early retirement — or at least taking ongoing early withdrawals as though the individual were in early retirement.

This exception relates to distributions that are “part of a series of substantially equal periodic payments (not less frequently than annually) made for the life (or life expectancy) of the employee or the joint lives (or joint life expectancies) of such employee and his designated beneficiary.” These are called 72(t) distributions, and are exempted from the 10% early withdrawal penalty by

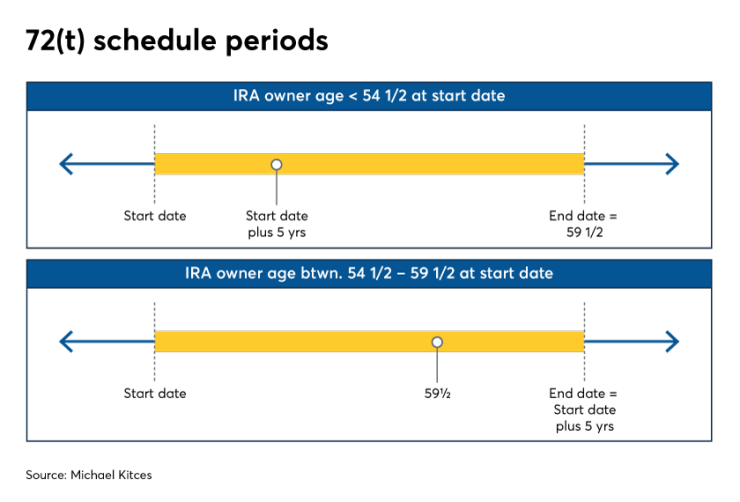

IRC Section 72(t)(4) further provides that in order to maintain the penalty-free nature of 72(t) distributions once they begin, they must continue without modification for the longer of five years or until the IRA owner turns 59 ½.

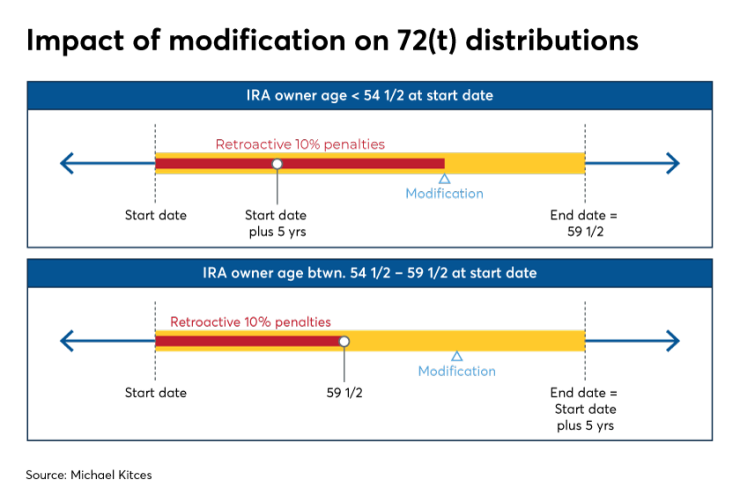

If a modification does occur before 72(t) distributions are allowed to terminate, the 10% early withdrawal penalty is retroactively assessed on all previously penalty-free 72(t) distributions taken prior to the IRA owner’s attainment of age 59 ½ — plus a late interest penalty on the penalties themselves for not having paid them in the original year.

MODIFICATIONS?

Despite the obvious importance of avoiding a modification for those using 72(t) distributions to tap into retirement funds early, there is virtually nothing in the Internal Revenue Code, nor the Treasury Regulations, that adequately describes what, exactly, constitutes a modification. Instead, most information we have about modifications, and indeed the 72(t) rules in general, comes from

Sections 2(.01)(a), 2(.01)(b), and 2(.01)(c) of this ruling provide that 72(t) payments generally must be calculated using one of three methods approved by the IRS. The agency also has authorized other distribution methods by specific taxpayers via Private Letter Rulings, or PLRs, such as

The three methods outlined by the revenue ruling are the fixed amortization method, the fixed annuitization method and required minimum distribution, or RMD, method.

Revenue Ruling 2002-62 further explains that once an initial 72(t) payment is calculated using either the fixed amortization or fixed annuitization method, “the annual payment is the same amount in each succeeding year.” Thus, any change in the distribution amount from one year to the next would be considered a modification, and would trigger the retroactive assessment of the 10% penalty to all previous 72(t) distributions made before the account owner reached age 59 ½.

When using the RMD method, 72(t) payments are calculated using a formula similar to the manner in which RMDs are calculated for IRA owners at age 70 ½, by dividing the current account balance by the IRA owner’s life expectancy in that year. As such, annual payments determined using this method can, and generally will, vary, given they are recalculated each year.

Payments determined by the RMD method, however, must still be calculated in accordance with the prescribed rules. For instance, if there was an incorrect life expectancy factor or an unreasonable balance used in the calculation — Section (.02)(d) of Revenue Ruling 2002-62 provides significant flexibility when selecting a reasonable balance — a modification could occur, once again triggering retroactive 10% penalties on pre-59 ½ 72(t) distributions.

Because the RMD method almost always produces the lowest cumulative 72(t) payments, it should rarely if ever be used as the initial method of calculating distributions, as the primary goal is generally to create the largest possible 72(t) payment from the smallest possible account balance. Revenue Ruling 2002-62 does, however, allow a one-time switch from either the annuitization or amortization method to the RMD method. This can be useful when 72(t) payments are no longer needed, but must continue to be taken to avoid modification.

Section 2(.02)(e) of Revenue Ruling 2002-62 provides further guidance on modifications, stating:

“Thus, a modification to the series of payments will occur if, after such date, there is (i) any addition to the account balance other than gains or losses, (ii) any nontaxable transfer of a portion of the account balance to another retirement plan, or (iii) a rollover by the taxpayer of the amount received resulting in such amount not being taxable.”

In simpler terms, once a 72(t) payment plan has begun, an IRA owner must follow both of these requirements to avoid modification:

- Continue taking the same annual payments — or in the case of the RMD method, be calculated and distributed correctly — until the completion of the 72(t) schedule; and

- Avoid any changes to the account balance(s) on which the 72(t) payments were calculated, other than changes via gains or losses within the account and, of course, by the 72(t) distributions themselves.

And again, if an individual fails to meet one of these requirements, the 10% penalty will be assessed on all 72(t) payments that were taken before the individual reaches age 59 ½, which can result in some very steep penalties.

Example No. 1: Chris, who turned 57 years old on July 10, 2019, began taking $10,000 annual 72(t) distributions from his only IRA in 2015, at age 53. On August 1, 2019, Chris’s home was damaged by a flood.

Chris, who did not have flood insurance or an adequate non-retirement account emergency reserve, was forced to take an additional $15,000 from his IRA to pay for flood repairs. Because this additional distribution occurred prior to Chris attaining age 59 ½, it created a modification of the 72(t) schedule.

As a result, the 10% early distribution penalty will be retroactively assessed on all of Chris’s pre-59 ½ 72(t) payments. Thus, Chris will be assessed retroactively a $10,000 x 10% = $1,000 penalty plus interest, for each of the 72(t) payments taken in 2015, 2016, 2017, 2018 and 2019, in addition to the $15,000 x 10% = $1,500 penalty for the distribution taken in 2019 after the flood, for a total penalty of $6,500 plus interest.

In Example No. 1 above, by taking an extra distribution outside of the 72(t) schedule, Chris failed to follow the rule requiring him to continue taking the same annual payment, triggering the 10% penalty on all payments taken since he had not yet reached age 59 ½ — even though he continued taking the payments themselves. That’s because any additional distribution from an IRA making 72(t) distributions is treated as a modification of the entire distribution schedule.

Example No. 2: Janet, who turned 61 on September 2, 2019, began taking $12,000 annual 72(t) distributions from her only IRA in January 2016 after losing her job at age 58. In 2017 Janet found new employment but has continued to correctly take her $12,000 72(t) distribution each year.

Janet retired in June 2019, at which time she had accrued $17,000 in her new employer’s 401(k) plan. Wanting to simplify her life as she started retirement, Janet rolled the 401(k) balance into her IRA, creating a modification — that is, a change in the account value other than via gains, losses or 72(t) payments — of the 72(t) schedule prior to the passing of five years. Consequently, the 10% early distribution penalty will be assessed on all of Janet’s pre-59 ½ 72(t) payments.

Janet will be retroactively assessed a $12,000 x 10% = $1,200 penalty, plus interest, for her January 2016, 2017 and 2018 distributions, for a total penalty of $3,600 plus interest. Note that no 10% penalty would be retroactively assessed for Janet’s 2019 distribution, as she was already over 59 ½ at the time.

In this example Janet failed to follow the rule requiring her to avoid account balance changes when she rolled over her 401(k) balance to the IRA account from which she was taking 72(t) payments. This resulted in three of her four 72(t) payments — i.e., those taken before she turned 59 ½ — to be subject to the 10% penalty.

Had Janet waited until February 2021 to transfer her 401(k) balance to her IRA, or simply rolled over the balance into a separate IRA account not encumbered by a 72(t) payment schedule, she would have avoided creating a modification and the associated retroactive penalties.

SPLITTING AN IRA

An interesting question begins to emerge when we consider the 72(t) rules in the context of divorce: How do you split an account from which 72(t) payments are being made without triggering a modification?

To fully appreciate the complexities and practical challenges presented by such a situation, it is necessary to understand the basic rules for splitting an IRA in divorce in the first place.

Unlike qualified retirement plans such as 401(k) and defined benefit pension plans that must be split via a

From there, the IRA custodian will transfer the divorce decree/MSA-approved portion of the IRA balance from the current IRA owner as a non-taxable transfer to an IRA account in the name of the ex-spouse.

The ex-spouse receiving the funds must generally complete new account paperwork with the custodian splitting the IRA account, if such an account does not already exist. Afterward, if the receiving ex-spouse wants to change custodians, they can execute a transfer or rollover of the funds within their own IRA.

Individuals receiving IRA funds pursuant to a divorce should fully understand that there is no exception to the 10% penalty for distributions from an IRA because of divorce. Thus, while the actual splitting of the IRA does not result in the imposition of a tax or a penalty, distributions by the receiving spouse from their own IRA after the transfer occurs are subject to the 10% early withdrawal penalty if the the receiving spouse is not yet 59 ½ — or unless a specific exception to the 10% early withdrawal penalty applies.

Oftentimes this comes as a surprise to individuals, especially those who may also be receiving qualified plan funds pursuant to a QDRO, since such funds that are later distributed from that same plan — i.e., not rolled over to another plan or IRA — are exempt from the 10% penalty.

But since as noted above that IRAs are not split via a QDRO, the QDRO exception never applies to distributions from IRAs.

Thus, in the event a receiving ex-spouse would like to take a distribution of some or all of their newly acquired IRA funds from their MSA or divorce decree without incurring the 10% penalty, they must either be 59 ½ or qualify for one of the exceptions to the 10% penalty that apply to IRAs — including the option to set up a 72(t) payment schedule.

IRAS AND 72(T) PAYMENTS

Recall that when IRAs are split pursuant to a divorce, the receiving ex-spouse gets their portion of the IRA balance via a non-taxable transfer from the original owner. And now consider that Section 2(.02)(e) of Revenue Ruling 2002-62, in no uncertain terms, states:

“… a modification to the series of payments will occur if, after such date, there is (i) any addition to the account balance other than gains or losses [or] (ii) any nontaxable transfer of a portion of the account balance to another retirement plan.”

Frankly, that’s about as cut and dry as it gets when it comes to tax rules. The revenue ruling quite literally says that any nontaxable transfer of a portion of the account is a modification. Clearly a nontaxable transfer of a portion of an account balance would run counter to that rule, and would therefore trigger a modification — right?

Not so fast.

Incredibly, it would appear that when the IRS drafted Revenue Ruling 2002-62, the authors simply did not contemplate that a person receiving 72(t) payments from an IRA account might get divorced and that, as part of that divorce, they might be required to transfer a portion of their IRA balance to their ex-spouse. After all, would they really want to trigger retroactive 10% penalty amounts, plus interest, on an individual simply because they were complying with a state-court–ordered division of assets? Unlikely.

But when a revenue ruling says any nontaxable transfer creates a modification and you have to make such a transfer, and there is no additional guidance that would lead you to believe that there are any exceptions to this rule, what’s a person to do?

PRIVATE LETTER RULINGS

In a number of taxpayers’ cases, the answer to figuring out how to deal with a nontaxable transfer of IRA assets to an ex-spouse due to a divorce ruling ended up being a private letter ruling, or PLR. These are sort of like a mini tax court case, in which a taxpayer argues their position in writing to the IRS, and then the IRS decides how to treat the situation.

Furthermore, in an effort to promote transparency, the IRS makes its response publicly available shortly after apprising the taxpayer of their decision, less the redaction of some potentially personal identifying information.

Technically a PLR cannot be relied on by anyone other than the taxpayer receiving it. But when IRS rulings are consistent on the same or similar matter over a period of time, they can be a good indication of how the IRS would likely treat another matter with a similar set of facts and circumstances.

In a perfect world all affected taxpayers would seek their own PLR prior to the divorce-triggered splitting of an IRA from which 72(t) payments are being made. But that won’t happen, as even though the receipt of such a ruling would give taxpayers a definitive answer as to how the IRS would view their situation, the PLR process is both time-consuming and expensive.

From start to finish, the whole process can last a year or longer, and the IRS fees for PLRs — which vary depending on the type of ruling requested —

Not surprisingly few taxpayers are willing to spend that type of time and money, particularly during a divorce, when time and money are often in short supply. The good news is that there have been enough rulings on the matter to provide a good gauge of the IRS’s position, to the extent that many tax professionals and custodians now consider a PLR unnecessary.

Furthermore, in response to PLR requests involving the treatment of the division of IRAs from which 72(t) payments are being made, the IRS has been rather accommodating toward both the transferor and transferee.

So while Revenue Ruling 2002-62 says in no uncertain terms that there cannot be any nontaxable transfers, PLRs dealing with transfers pursuant to divorce have consistently sent a different message.

REDUCING PAYMENT AMOUNTS

But what should the transferring spouse do once the account is divided with their ex-spouse?

As noted above, the IRS has been flexible. For starters, continuing existing payments effectively maintains the status quo of the 72(t) schedule. Of course, if someone is giving away a good chunk of their IRA money, they may wish to reduce their 72(t) payments as well so as to not liquidate the IRA at an expedited — and potentially dangerous — rate. To that end many PLRs — such as

Example No. 3: Shira and Lance are in the final phases of a divorce. Shira, 57, began taking $14,000 annual 72(t) distributions from her IRA four years ago, and has 2.5 years left to continue the distributions without modification until she turns 59 ½.

As part of the divorce decree, Shira will transfer 50% of her current IRA balance to Lance. Therefore, based on guidance from available PLRs, it would be reasonable to believe that Shira could reduce her current $14,000 annual distributions to $7,000 per year until she reaches 59 ½, at which point her 72(t) schedule would be done and she could take as much or as little as she wants.

If a transferor ex-spouse wishes to reduce their ongoing 72(t) payments even further, they could also make a one-time switch to the RMD method, as authorized by Revenue Ruling 2002-62, assuming they were not already using the RMD method.

Finally, it should be noted that divorce is never a reason that would allow the transferor ex-spouse to stop taking 72(t) distributions altogether. Rather, the choice is simply whether to continue the original distributions or reduce them on a pro-rata basis. Either way distributions of some appropriate amount must continue for the longer of five years, or until the account owner reaches age 59 ½, for the 72(t) schedule to have been reached.

OPTING OUT

Over the years PLRs have also granted ex-spouses receiving the IRA assets flexibility when determining what amount, if any, they should take from their newly acquired IRA funds to satisfy 72(t) payments established by their ex-spouse.

For those individuals who wish to preserve as much of the account as possible, the simplest answer may also be the most obvious: Don’t take any distributions if you don’t want to.

After all, the ex-spouse receiving the newly divided IRA account didn’t set up the 72(t) schedule, the transferor ex-spouse did. Thus, the receiving ex-spouse is under no obligation to continue receiving payments, a fact confirmed by the IRS in numerous PLRs, including

That being said, if the receiving ex-spouse is under 59 ½ at the time of the transfer and they need income to meet their living expenses, they may wish to continue taking distributions in some manner from the new IRA. In PLRs such as PLR 9739044, the receiving taxpayer asked the IRS if they could continue taking their share of the original 72(t) payment amount, in proportion to the amount of the account they received. The IRS obliged.

Alternatively, another option for the receiving ex-spouse is to simply start a new schedule by starting their own standalone 72(t) distribution payments, using their current account balance and their current age. The benefit of doing so is that in certain situations — e.g., the receiving spouse being much older than the transferor spouse when they began their initial 72(t) payment schedule — it might allow for an increase in the annual payment amount.

The downside is that by doing so, the receiving spouse would be starting a new distribution schedule, which itself would then need to last at least five years — or until they turned 59 ½, if longer.

The key is to realize that over the years there has been a significant volume of non-formal guidance accumulated in the form of PLRs. And while none of these rulings is authoritative to anyone other than the taxpayer who initially sought it, the consistency of the IRS in its decisions has shed light on how it views the splitting of accounts during a divorce from which 72(t) payments are being made.

Contrary to its own, more formal guidance in Revenue Ruling 2002-62, the IRS has repeatedly authorized taxpayers to make nontaxable transfers of a portion of their account balances to ex-spouses, pursuant to a divorce decree or separation agreement. In addition, the IRS has given both the transferor and receiving ex-spouses flexibility in terms of adjusting payments, by giving the transferor the ability to ratably reduce payments. The receiving spouse then gets the option of stopping payments altogether, continuing with a share of the existing payments or starting a new 72(t) schedule of their own.

The best thing for the affected taxpayer is to seek their own PLR from the IRS. However, given the time and expense of such rulings, few taxpayers will do so. That leaves advisors, CPAs and attorneys left trying to decide to what extent they should rely on previous, non-authoritative IRS guidance to base their tactics and decisions. That may seem daunting, but luckily the de facto official party line exists, more often than not.

Jeff Levine, CPA/PFS, CFP, MSA, a Financial Planning contributing writer, is the Lead Financial Planning Nerd at