No major leaguer has batted over .400 since Ted Williams did it 76 years ago, despite what experts agree is a clear increase in the average skill of baseball players since then. The reason for the dichotomy: the so-called paradox of skill. When the whole playing field is lifted higher, it’s harder than ever to stand out as a superstar.

Similarly, a growing base of data suggests that the amount of available investment alpha is shrinking — a combination of both the paradox of skill itself, and the mere fact that more and more investment research is revealing previously unknown factors that, once known, can no longer be exploited the way they were in the past.

Despite this trend, though, a number of widely known investment opportunities have continued to persist. For instance, it’s well-documented that small cap outperforms large cap, that value generates a long-term premium over growth, and that stocks exhibit momentum effects. Yet however common that knowledge is, investors still fail to fully take advantage and arbitrage them away.

And why not? The answer lies in the growing field of

Behavioral finance has revealed all the ways we fail to invest rationally, despite having all the available information.

THE PARADOX OF SKILL

One of the fundamental challenges of today’s investing landscape is that there are lots of smart people involved, with increasingly sophisticated tools.

While one might think that smarter people with better tools would lead to more superstars, the reality — as first articulated by Michael Mauboussin in his book “The Success Equation” — is that a

Consequently, even as our capabilities to identify good investment opportunities gets better, the pool of available alpha appears to be shrinking — as articulated most eloquently by Larry Swedroe and Andrew Berkin in their 2015 book, “

The greater the shift of investing away from individuals and over to institutions — in the 1940s households held 90% of U.S. corporate equity, whereas now it’s down to 20% — the fewer investing mistakes leading to market mispricings (i.e., alpha opportunities) there are. Meanwhile, more institutions are trying to carve up the same fixed alpha pie, resulting in each getting an ever-smaller share.

The better the average talent pool, the harder it is for standouts to emerge.

In the logical extreme, some have suggested that eventually, available alpha will go all the way down to zero — or at least to an imperceptibly low level, such that virtually no investor will be able to effectively capitalize on the small and very short-term pricing discrepancies that emerge. Simply put, with so many investors competing at the same time with so much capital, it may become almost impossible to see an investment opportunity by having a better grasp of the information than everyone else.

BEHAVIORAL BIASES

Notwithstanding the steady trend of shrinking alpha, as the capabilities and average skill level of investors rises, it’s not entirely clear that alpha can go all the way to zero. Such a path presumes that all alpha is derived by simply better using available information than everyone else, while ignoring the fact that a material number of investors aren’t making their investment decisions based solely on information alone.

After all, one of the hottest disciplines in recent years has been behavioral finance research — a study of all the various ways that we do not invest rationally. As just a brief list of our problematic tendencies, we tend to:

· Exhibit a

· Show an

· Perceive

· Pursue gambles that have significant upside potential, despite their improbable outcome — explaining why we continue

· Exhibit a significant

·

All of these behavioral biases, along with

SUSTAINABLE ALPHA

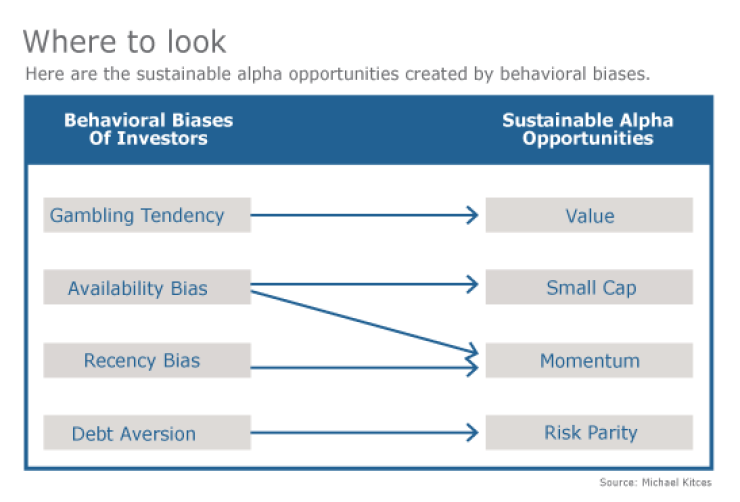

The significance of behavioral biases leading to irrational investing — trading in ways that are not consistent with available information and investment fundamentals alone — is that it not only creates the potential for the mispricing of assets, but that it can result in persistent investment opportunities as long as the behavior itself persists. And in this context, persistence appears quite likely, given that these are hard-wired investing mistakes.

The idea that available alpha is shrinking as investors become more skilled and get better tools presumes that those investors are carving up an ever-shrinking pie of available alpha as markets more efficiently price in the available information. But in a world where mispricings are created at least in part due to behavioral biases that are simply part of our human nature, then no amount of information and expertise can make them entirely disappear.

In fact, the persistence of behavioral biases helps explain why many

Behavioral biases mean that when we make investment decisions, we may do so in a manner that contradicts the available information.

For instance, the small cap premium — that small cap stocks

For instance, if an investor wants to buy a tech stock, they’re more likely to think of Apple, Google or Amazon than a small cap company they’ve never heard of, which means the small cap stocks get less buying demand than they might merit based on fundamentals alone. Even for an investment manager, there is a similar dynamic; as professional, you’re not as likely to get fired if you bought Apple or Google and it went down, compared to losing money in a small cap tech company that was perhaps more promising but not widely known.

Similarly, the value premium — that value stocks

Continuing this theme, it’s also easy to see why a

And the impact of behavioral biases on investment opportunities isn’t exclusive to the Fama & French

-

When advisers blend behavioral finance approaches with data insights, it makes them even more valuable.

September 22 -

Like many planners, Shane Larson never received any training in psychology. Now he finds using basic counseling skills can help make relationships with his clients stronger.

August 26 -

Positive psychology might be the key to determining just what a client needs.

September 15 -

Experts say planners ignore offering counsel beyond numbers and investments at their own peril.

September 23

All of this suggests that even as some forms of available alpha are shrinking — and active managers continue to struggle — the end game is not a world in which the opportunity for alpha goes to zero. Instead, the existence of behavioral biases means that at least some forms of alpha can persist — even after they’re known and exploitable — but that alpha opportunity will only be sustainable if it is in fact predicated on a behavioral bias. If the alpha is based on expert information alone, the investor will inevitably be out-forecasted by increasingly sophisticated competition.

Of course, the caveat to recognizing that the most sustainable alpha opportunities are the behaviorally derived ones is that they will also be the hardest ones for other human beings to take advantage of for the very same reason.

Whether it’s succumbing to the very biases that create the opportunities, or simply trying to move against the herd — and as an advisor, risk being fired by most of your clients, even if you’re right in the long run — behaviorally driven alpha is arguably one of the riskiest forms of alpha to try capturing. This perhaps explains exactly why it provides a persistent risk premium in the first place, even when it’s known to all.

So what do you think? Do behavioral biases create sustainable alpha? Can that alpha be captured in a profitable manner? Does trying to capture behaviorally-driven alpha put advisors at risk of being fired by clients? Please share your thoughts in the comments below.