Revenue was down. WebEx meetings went through the roof.

Merrill Lynch suffered setbacks but also set new records in 2020, the latest indication of how the biggest wealth managers were buffeted by — and navigated through — coronavirus-related volatility and economic upheaval.

The firm faced headwinds but ended the year with some notable bright spots: record client balances, soaring use of digital tools and a surge in client acquisition in the fourth quarter, according to the Bank of America’s earnings report, issued Jan. 19.

Merrill Lynch’s quarterly revenue fell 5% year-over-year to land at $3.8 billion from $4 billion, according to the report. Annual revenue was down by a similar percentage, falling to about $15.3 billion for 2020 from $16.1 billion for 2019.

The drop was attributable in part to lower net interest income, which dropped to $5.5 billion for the year from $6.5 billion, a decline of about $1 billion or 15%.

Overall advisor headcount at Bank of America’s wealth unit dropped to 17,331 from 17,458, a figure that includes advisors outside the Merrill Lynch franchise. Yet despite the headcount dip, client balances hit a record $2.8 trillion, up from $2.6 trillion and boosted in part by higher markets.

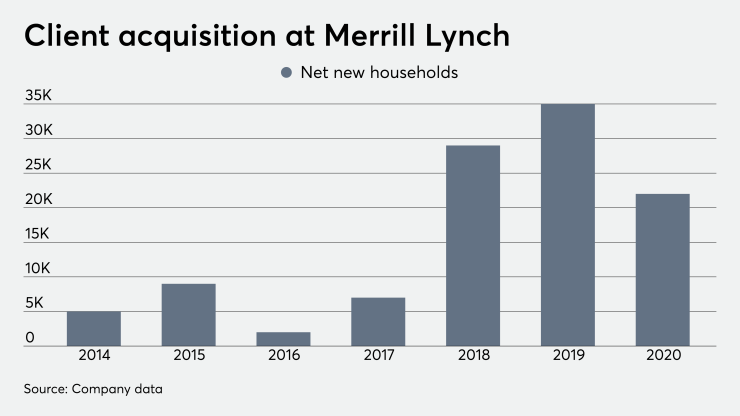

The firm reported that net new household acquisition fell to 22,000 for the year from 35,000 for 2019. That number also fell short of the 29,000 Merrill recorded for 2018.

Unsurprising, perhaps, given the difficulty of face-to-face meetings between advisors and prospective clients due to lockdowns as COVID-19 raged across the country. But the figure was still much higher than the 6,800 net new households Merrill Lynch recorded for 2017, demonstrating how the wirehouse’s advisors strove to find new ways to pick up new clients despite the coronavirus pandemic.

And those new clients were not small investors: the average asset size of a new relationship stands at nearly $1.4 million, according to a senior executive familiar with the matter and who requested anonymity. The wirehouse acquired more ultrahigh-net-worth clients than ever before, according to the executive.

Merrill Lynch also reported that two-thirds of its advisors had their best year ever in terms of production.

It’s “pretty extraordinary given the environment we have been operating in,” the executive said.

As with other wealth managers, Merrill Lynch is experiencing a surge in adoption of digital tools. Three-quarters of Merrill clients are using the company’s online and mobile platforms, according to the firm. Last year, advisors hosted more than 375,000 WebEx meetings with clients — five times the number they hosted in 2019.

Messaging between advisors and clients has also soared. In the fourth quarter, almost 420,000 client households used the firm’s secure messaging app — up 20% quarter-over-quarter, according to the company.

Rival Wells Fargo reported earnings last week. The wirehouse recorded similar declines in revenue, which tumbled 8% for the year falling to $14.5 billion from $15.7 billion. Total client assets for the wealth manager rose to $2 trillion from $1.89 trillion, a 6% increase.

Morgan Stanley reports earnings Jan. 20.