No one wants to be a broker anymore.

The unsavory image of stockpickers peddling shares for hefty commissions still hovers over the $39 billion independent brokerage industry. It's partly why wealth managers that own both brokerages and registered investment advisors — the counterpoint to brokers, because they operate under the highest industry standard of client care — boast that they

But brokers aren't going away.

The RIA side of wealth management has grown to dominate the industry, where the conventional wisdom is that brokerages are going the way of the VCR and the tape cassette. A burgeoning number of firms ranging from startups to some of the largest wealth managers in the business are proving otherwise. Their brokerages clear certain transactions and retain relationships that could be going somewhere else without them and — the new breed of brokers argues — might be served at a lower standard of care, if not for their existence.

"There's room for all types of businesses out there," said Carolyn Armitage, the head of Thrivent Advisor Network, a Minneapolis-based RIA that uses a third-party brokerage for client investments. "The most important element is to own up to what you really are."

As Armitage's firm and other independent wealth managers increasingly work at the intersection of brokerages and RIAs, brokers have morphed into leaner, more flexible versions of themselves. Advisory services in which clients' interests come before that of the firm have

However, in the 37th year of Financial Planning's

A "blanket statement" positing that any commission business is bad is "going too far on the other end of the spectrum," said Penny Phillips, the president of Summit, New Jersey-based Journey Strategic Wealth, an RIA that uses an outside brokerage.

"This is another example of the industry dictating what's right for the advisor," she said. "That advisor's firm should have the ability to offer any and all products and services that exist in the industry for the end client."

IBD Elite 2022: For a printable PDF listing of the largest independent brokerages in wealth management,

By the numbers

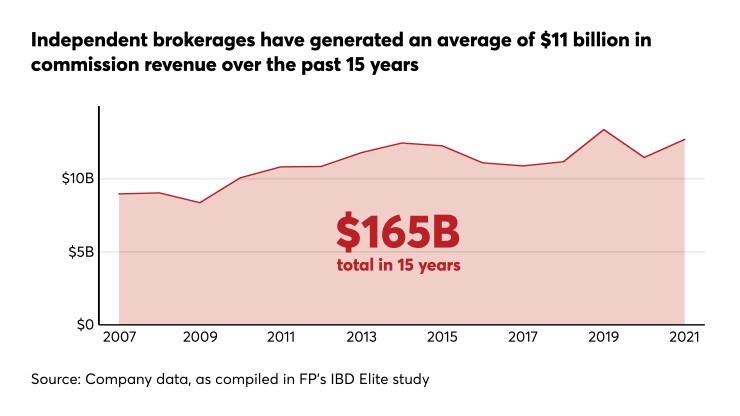

Industry statistics from the IBD Elite highlight how rumors of the death of brokerages are greatly exaggerated. They also show how brokerages are playing a bigger role than one may think after tens of billions of dollars in annual business have shifted to the RIA component of independent wealth managers.

Last year, independent brokerages raked in $12.7 billion in commissions — that's one-third of their $38.9 billion in total revenue and a sum

To be sure, brokerages have aged well past their heydays. Fifteen years ago, independent brokerages made 68% of their revenue from commissions. Those sales have risen by 42% during that span. In contrast, advisory fees have grown by 559% and now represent 51% of their revenue. Over the past decade, the number of RIA-only advisors has more than doubled to 77,468. The numbers of RIAs and the assets they manage

Those dynamics explain why, if you ask an advisor or wealth executive whether they're a broker, the answer is often "it's complicated."

Waltham, Massachusetts-based Commonwealth Financial Network, a brokerage and RIA, gets more than three-quarters of its $2 billion in annual revenue from advisory fees based on assets and not from commissions.

Referring to Commonwealth by its brokerage alone "just doesn't fit anymore," CEO Wayne Bloom said in an interview. Still, he added, "You don't forget where you came from."

That's why the company makes sure it pops up on Google in searches for "broker-dealer," according to Bloom. At the same time, nearly 300 of Commonwealth's 2,000 advisors have dropped their FINRA registrations as brokers entirely. Even though the company considers itself as "more like a national RIA than we are a BD," the advisors' legacy annuities, 529 college savings plans and alternative products necessitate a brokerage, he said.

Some of those older annuities have "terrific features and riders," Bloom said. "It would be completely inappropriate to change that business. You provide soft landings for advisors who are joining us."

A long term buy-and-hold investment without active management, like a passive index fund, represents another example of how brokerages can be the better option for clients than RIAs, according to Wendy Lanton, a founding principal of Melville, New York-based Herold & Lantern Investments. The one-time sales charges for a passive fund run far below an RIA's traditional ongoing 1% fee. Certain transactions and services require a brokerage, such as a 1031 exchange, she noted. That's a tax break on capital gains that's eligible in a trade of one real estate asset for another.

Lanton's firm has about 65 advisors, with roughly 20% of them operating as independent contractors and the rest as W-2 employees. Its RIA has $166 million in AUM.

"From my perspective, it's very simple. It's being able to have a dialogue with the investor about what their needs are," Lanton said. "It would be limiting for a person who is solely an investment advisor representative to not be able to offer their client a full product suite because it should be about what's right for the client, not 'this is what I offer, so this is what you're getting.'"

RIA brokers

Even firms closely

Much of the confusion in the industry about who is and isn't a broker stems from the so-called independent firms that take control of practice's equity, force advisors to use a corporate RIA or distribute affiliated products issued by the same parent firm, Swenson said.

"It's core to their model to keep it a little bit opaque so that they can recruit more teams," he said, noting the perpetual growth of RIAs in recent years. "They're all trying to pivot in that direction, but there's a lot of baggage on that tanker."

The passengers on the giant vessel that is the

In addition to companies like Commonwealth that are known as the largest independent brokerages, the group includes insurer- and fund company-owned firms such as Northwestern Mutual and Principal Securities, big LPL Financial hybrid RIAs in Private Advisor Group and Wealth Enhancement Group, and a firm more often identified as an RIA consolidator, Hightower. The group's two-part criteria calls for members to be brokerages or RIAs in good standing with regulators and a retail-facing firm that sells the products of more than one outside company.

"Both independent broker-dealers and RIAs will continue to play a vital role in financial planning in the years to come, and dually registered firms further enhance the flexibility that has been a hallmark of the independent financial services industry," FSI CEO Dale Brown said in a statement. "While independent broker-dealers and RIAs often have unique aspects and features, that's a good thing, as it provides advisors the opportunity to identify the best partner for how they want to operate their business."

In theory, consumer advocates like Knut Rostad, the president of the nonprofit Institute for the Fiduciary Standard, see evidence for the argument that brokers put their clients first when they're being clear with them about any conflicts of interest. In practice, though, many firms bury those disclosures in lengthy documents with disturbing, if little read, information, Rostad said. If brokerages truly explained their fees to clients, that would be different, he said.

"In that world, then it becomes more of a transaction fee that is upfront and then there's no hiding it," Rostad said. "I believe there are a lot of brokers are trying to do the right thing in their work, but they are literally prevented because they're not able to be transparent the way an independent, fee-only advisor can be in this very fundamental way."

Nothing wrong with it

And the way wealth managers run their businesses keeps growing more complex to the average person or even to some industry professionals. Take Thrivent Advisor Network and its 200 advisors with $6.5 billion in AUM as an example. The hybrid RIA's parent is a fraternal benefit society that's an insurer and a fund company. It uses PKS as its brokerage. And it's now working on its first acquisition under a new partner model similar to those of RIA consolidators.

A majority of Thrivent's advisors have securities licenses, according to Armitage, who

"The term 'broker' doesn't have a great connotation for our jargon in the industry today because they think of the stock broker," Armitage said, observing that clients use the words "broker" and "financial advisor" interchangeably. "It doesn't matter to them. It's somebody that deals with their finances. We've always tried to establish those boundaries of 'fiduciary' or 'commission-based.' I still don't think clients understand that distinction."

Since

The word "broker" evokes traditional industry practices such as minimum gross dealer concession mandates, rankings based on sales, affiliated products and other conflicts of interest, she notes. For RIAs using a limited-purpose brokerage, the capability to offer or manage certain insurance or investment products falls outside of that realm.

Advisors "have so many old belief systems that have been formed, and some of those belief systems need to be shed," Phillips said.

"There's nothing wrong with having a broker-dealer affiliation, as long as you're transparent," she said. "I'd rather the advisor make the choice to say no to the brokerage products every single time, rather than not to have the ability to place the clients in them at all."