-

Virtually every major firm on Wall Street has joined the push into private markets, with many trying to get in early on the biggest "next big thing" to hit financial services since the exchange-traded fund.

7h ago -

A federal judge rejects arguments that U.S. Bank has a fiduciary duty toward uninvested cash sitting in clients' brokerage accounts.

February 5 -

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

Artificial intelligence tops the investment priority list for family offices globally, a survey from JPMorgan's private bank shows, though allocations lag and remain concentrated in public equities.

February 3 -

-

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

Red flags may abound, but so do arguments for an extended equities streak. Keeping clients on an even keel is crucial.

January 29 Wealth Teams Alliance

Wealth Teams Alliance -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

The Wall Street giant still is often associated with deposits, lending and checking and savings accounts. But it's among the throng of firms seeking to give clients easy access to both banking and investing services online.

January 26 -

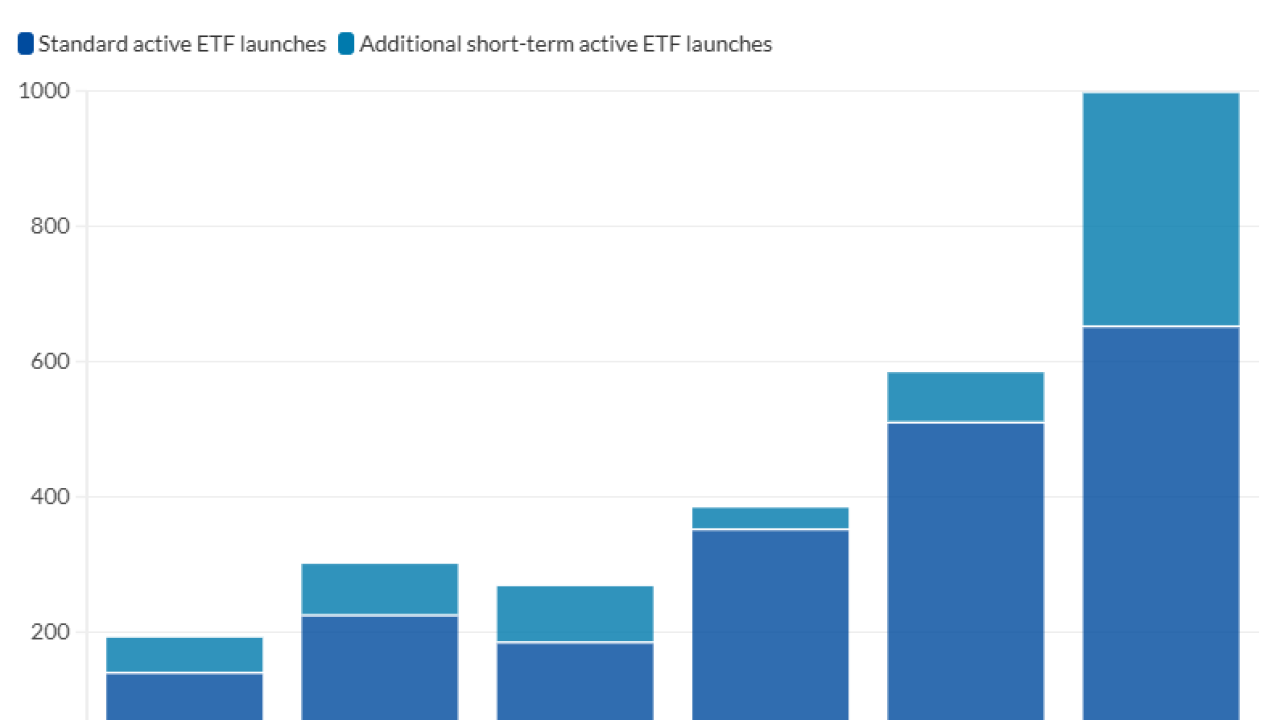

Fixed-income ETFs are rapidly gaining popularity among advisors, driven by growing familiarity, diverse offerings and strong asset flows, new Cerulli research shows.

January 22 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

Even as crypto prices slide, a growing share of financial advisors are adding digital assets to client portfolios, with firm policies slowly catching up.

January 21 -

As adoption of the dual-wrapper products accelerates, so will questions about timing, pricing and residual balances.

January 21 Nottingham

Nottingham -

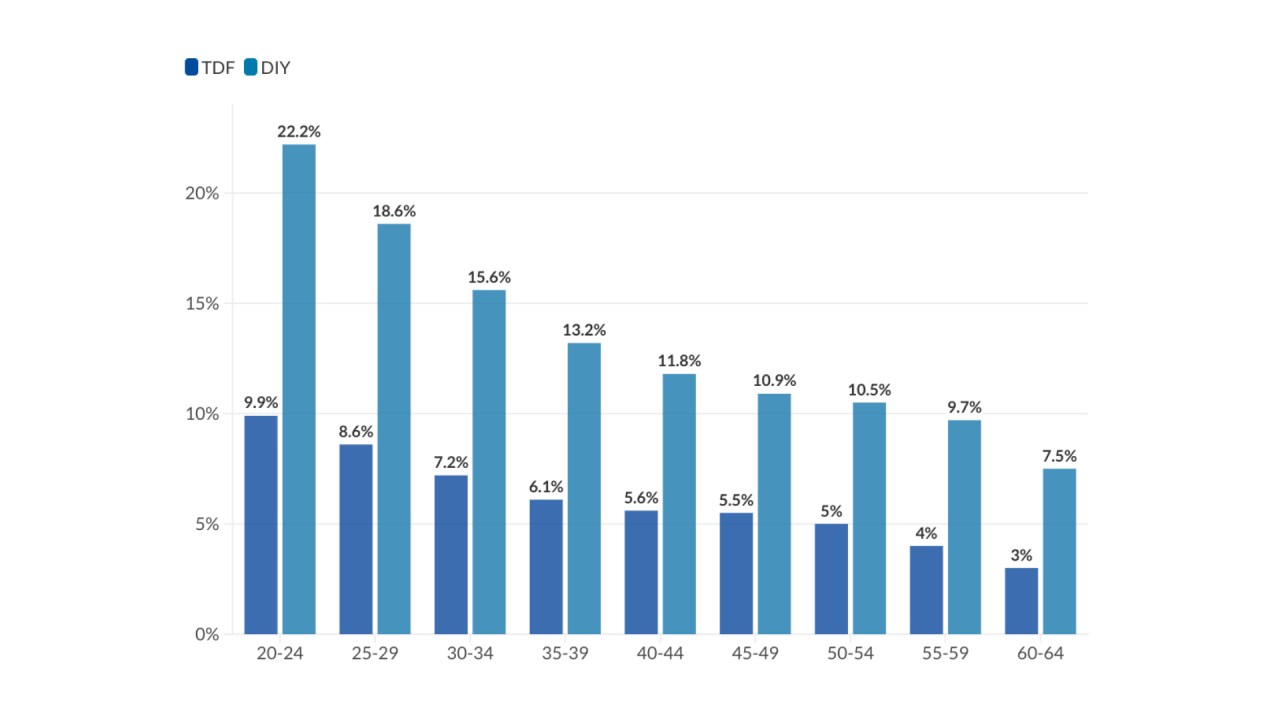

A new Morningstar study suggests managed accounts can significantly boost retirement wealth, particularly for younger workers and those currently managing their own portfolios.

January 20 -

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

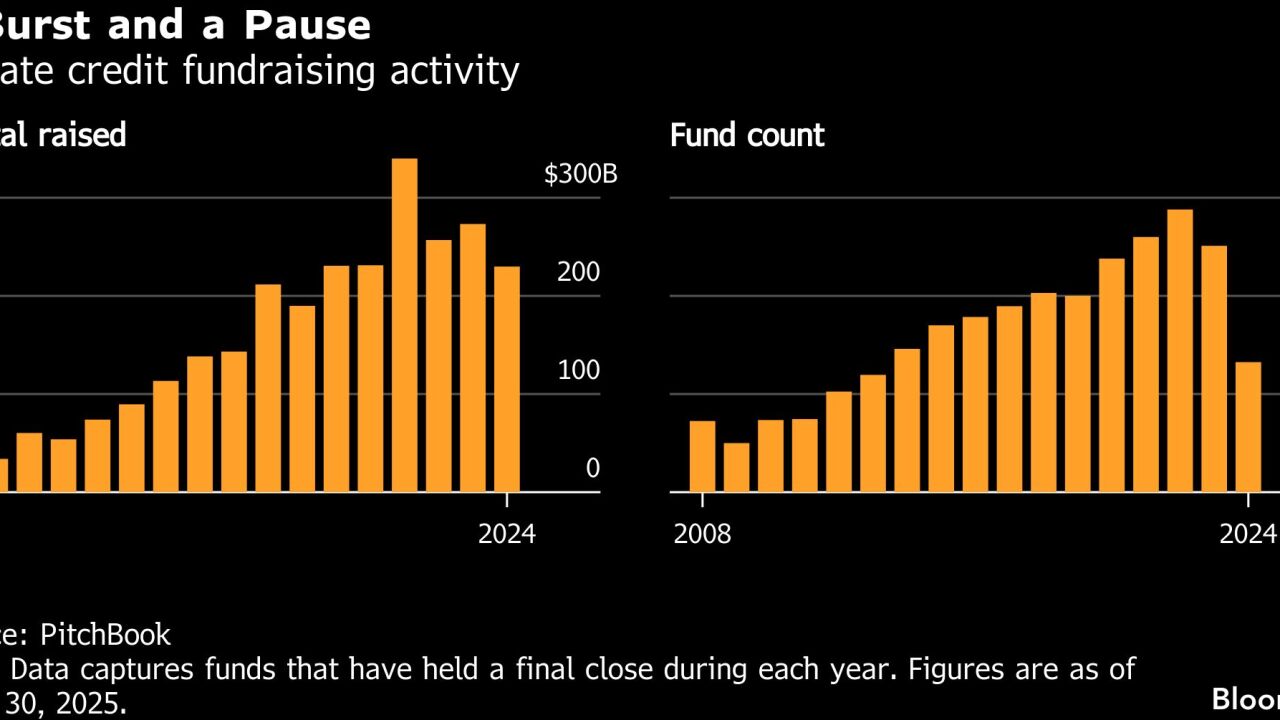

Once rare, the same kind of permissive terms that are widespread on leveraged loans are becoming increasingly common in the $1.7 trillion private credit market.

January 15 -

Spot bitcoin ETFs simplify custody, but they cost clients a major tax advantage. Here is why direct ownership still wins for HNW and UHNW clients.

January 7 -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

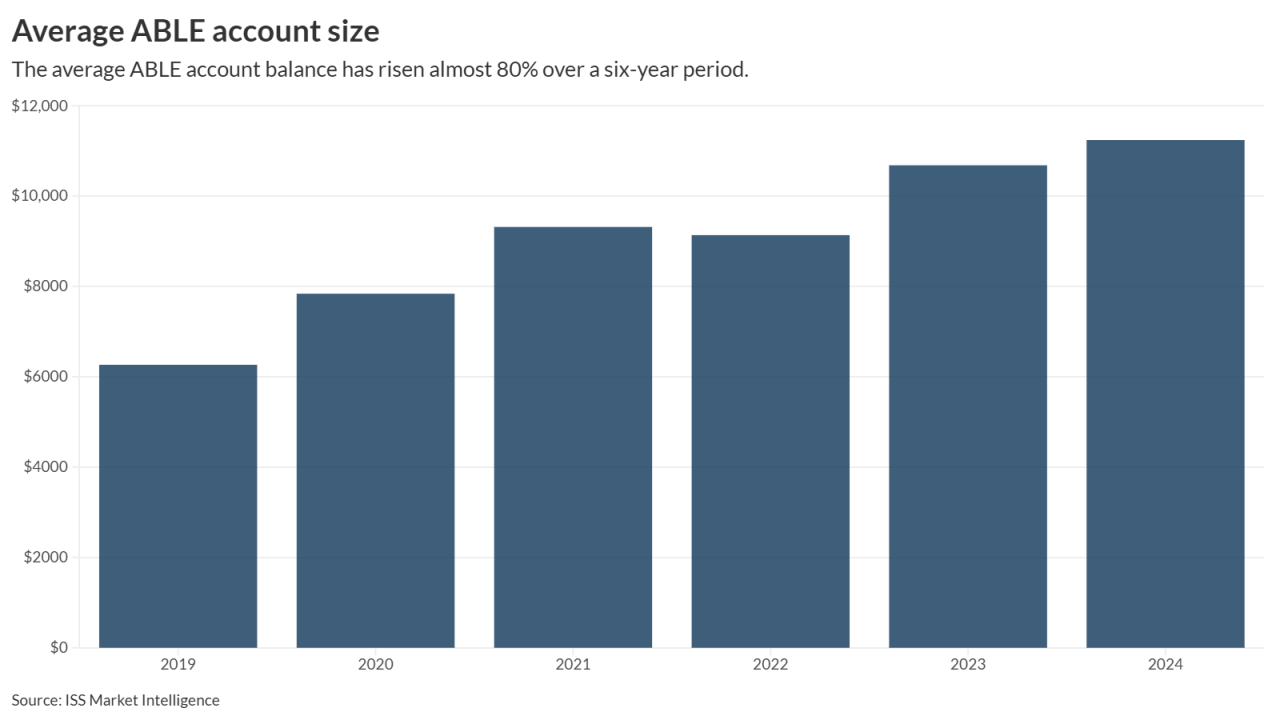

Starting in 2026, the starting age limit for those with significant disabilities to take advantage of these tax-advantaged savings accounts has been raised by 20 years.

January 2 -

It's no surprise that AI saw big gains, but some longstanding winners saw their fortune flag.

December 31