Janney Montgomery Scott is rapidly expanding after years of weakened wirehouse recruiting.

The regional broker-dealer added 32 financial advisors this year alone and 57 in the last 12 months. Three quarters of their new recruits in the past 12 months have joined from wirehouses, the firm reports.

Jerry Lombard, president of the private client group at Janney, says advisors moving to regional BDs are looking for high-performance platforms with a small-firm culture.

“Our platform has become competitive with, or even more competitive than the larger firms,” Lombard says. “And yet we maintain the boutique feel.”

Industrywide, the big four firms have picked up $14 billion in client assets this year, while regional and boutique firms netted over $27 billion in client assets, according to hiring announcements.

Lombard says Janney is aiming for a 7.5% increase in commission revenue for 2018.

“It’s more about quality than quantity,” Lombard says, adding the firm is looking for “slow and steady growth.”

The Philadelphia-headquartered firm has a footprint from Maine to Ohio to Florida advising on $76 billion in client assets.

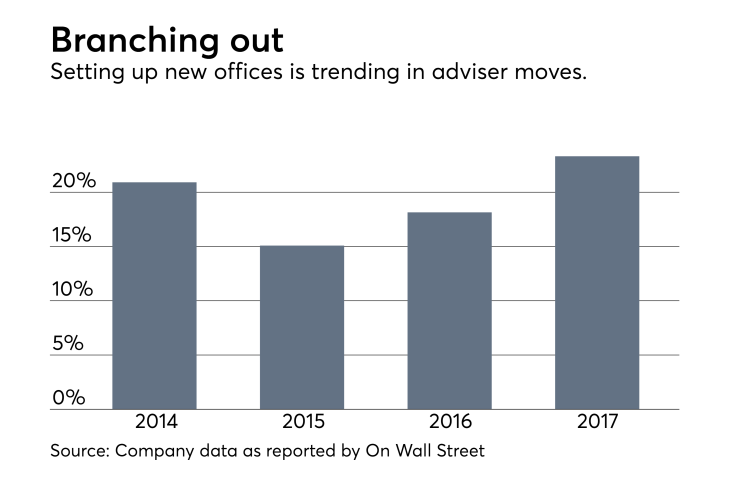

BRANCHING OUT

Janney opened up new offices in Tennessee this week — welcoming four

The new recruits bring Janney's reach to 116 total offices.

“Super-regional BDs are taking advantage of wirehouse slowdowns and moving into new markets,” says Rob Blevins, president of the Ohio-based recruiting firm Rowlette Executive Search.

With low interest rates and a bullish market, firms are borrowing cash to expand their offices and take on more market share, he says.

“There’s available money out there to expand,” Blevins says. “Regional BDs are capitalizing.”

Janney is looking to maintain its presence and continue its modest growth into the Southeast, according to Lombard.

“We’re primarily looking at our existing footprint,” Lombard says, “not to outrun our supply lines.”

He says Janney’s strength is that they are small enough to maintain their identity. “If we can hit 5 to 10% commission growth per annum,” Lombard says, “we’re not going to have to change the face of who we are.”

NO BANK? NO PROBLEM

Janney has one thing in common with some of the largest and most successful regional BDs — they’re not tied to a bank, says Blevins.

For example, Raymond James, Ameriprise and Stifel all offer advisory services as their core business — which becomes very attractive to prospects thinking about making the move to smaller firms.

“When you’re looking at a firm and the majority of revenue comes from the advisory business, that’s a good sign for advisors,” Blevins says.

This year has seen more moves, bigger moves and more expensive moves.

Janney’s recent success is also due in part to having strong ownership from Penn Mutual, Lombard says. The life insurance company has a top-notch AAA rating from Moody’s Investor Service.

“Strength and stability, in this day and age, is very appealing,” Lombard says. “Janney was once the best kept secret on Wall Street. Now, advisors want to kick the tires to see if what they hear is true.”

PLANNING WITHOUT THE PAPERWORK

Advisors making the jump to Janney and other regional BDs, are looking to ditch the bureaucracy, says Mickey Wasserman of the consulting firm Michael Wasserman & Associates.

“Regionals are just better equipped to get quick answers for clients,” Wasserman says. “Advisors have all the same tools they need, but when they call someone within their organization, a person actually picks up.”

Danny Sarch, president of recruiting firm Leitner Sarch Consultants, says advisors want a firm that recognizes the nuisances of their practices — not a one-size-fits-all platform.

“When you have 50,000 advisors,” Sarch says, “how many can you really get to understand?”

And, as wirehouses cut top leadership, he adds, more advisors are reporting to fewer people.

“Doesn’t leave a lot of room for nuisance,” Sarch says.

OFF THE WIRE

As for the wirehouses, Blevins thinks the costs of recruiting just became too steep for some firms. The fiduciary rule's introduction has cost the largest firms millions in compliance costs, making the prospect of bringing on expensive recruits less attractive.

“They’re just trying to figure out what direction to go,” Blevins says about the slowdown. “They’ve been beating each other up for the past 10 years and are just trying to figure out what makes the most sense.”

Blevins thinks this “window of opportunity” will last another two to five years.

Wasserman, on the other hand, is less optimistic, saying it’s possible the wirehouse recruiting slowdown continues indefinitely.