For most retirees, the tax-efficient liquidation of a retirement portfolio requires coordinating between both taxable brokerage accounts and pre-tax retirement accounts like an IRA or 401(k).

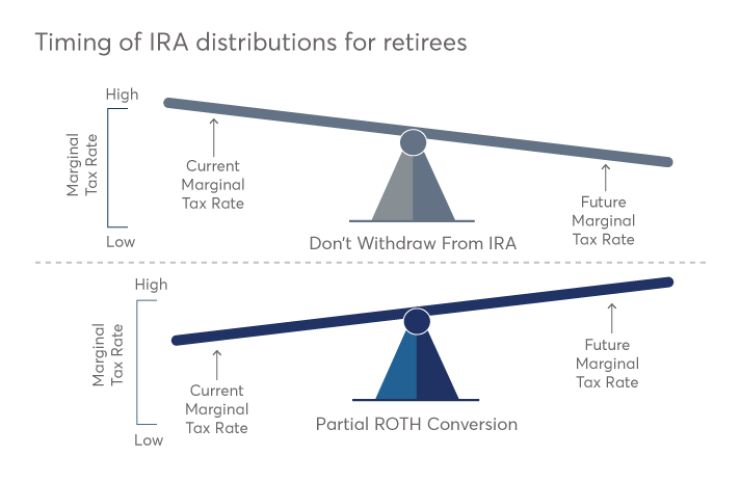

The conventional view is that taxable investment accounts should be liquidated first, while tax-deferred accounts are allowed to continue to compound. In practice, however, it’s possible to be too good at tax deferral, such that the IRA grows so large that future withdrawals — or even just RMD obligations — actually drive the retiree into higher tax brackets.

A more tax-efficient liquidation strategy is to tap IRA accounts earlier rather than later: Not so much that the tax bracket is driven up now, but enough to reduce exposure to higher tax brackets in the future.

The optimal approach, though, preserves the tax-preferred value of retirement accounts while filling the tax brackets early on. This is achieved through funding retirement spending from taxable investment accounts — while also doing systematic partial Roth conversions of the pre-tax IRA to fill tax brackets in the early years.

The result is that the retiree will tap investment accounts for retirement cash flows in the early years and a combination of taxable IRA and tax-free Roth accounts in the later years; a process that avoids ever being pushed into top tax brackets, now or ever.

LETTING THE IRA COMPOUND

A more tax-efficient liquidation strategy is to tap IRA accounts earlier rather than later: Not so much that the tax bracket is driven up now, but enough to reduce exposure to higher tax brackets in the future.

The classic approach to liquidating investment accounts in retirement is fairly straightforward: After-tax taxable brokerage accounts should be liquidated first, while retirement accounts like IRAs and 401(k) plans receive preferential (i.e., tax-deferred) treatment and should be liquidated last. This allows the retiree to spend down the least tax-efficient portions of the portfolio first — the brokerage account with annual taxable interest and dividends, and potential capital gains — while preserving tax deferral and the benefits of tax-deferred compounding growth as long as possible.

Imagine a retiree who has $750,000 in a brokerage account and $750,000 in an IRA, and plans to withdraw $80,000 per year from the portfolio — with spending adjusted annually for inflation — on top of other available income sources such as Social Security.

If the IRA is liquidated first, even at an 8% growth rate, the retiree quickly spends down the account. In fact, at an average tax rate of 20%, it actually takes close to $100,000 per year of withdrawals to support $80,000 per year of net spending. At that point, the retiree must rely on the brokerage account, which will never grow quite as quickly in the first place, as the annual drag of taxation on interest, dividends, and capital gains reduces the ability of the account to compound. The example below assumes a 7% net rate of return on the taxable account, assuming a combination of ordinary income interest and non-qualified dividends and short-term capital gains being taxed at 15%, and qualified dividends and long-term capital gains eligible for 0% rates.

By contrast, if the retiree reverses the order, the results are more favorable. By drawing on the brokerage account first, which is growing in a less tax-efficient manner anyway, and allowing the pre-tax IRA more time to compound, the strategy of spending the brokerage account first and the IRA second: allows the portfolio to sustain withdrawals for a longer period of time, retaining a significant remaining balance even after 30 years. In contrast, the prior spend-down strategy nearly depleted the portfolio by the end of the 30th year.

BIG IRA DISTRIBUTIONS INCREASE TAXES

While the example above shows how deferring withdrawals from a pre-tax IRA can allow more wealth to compound, there is a significant caveat: The IRA is being subjected to a 20% average tax rate because the withdrawals are happening all at once, and driving a portion of the distributions into the 25% tax bracket.

For instance, continuing the prior example, the couple would likely only be in the 15% ordinary income tax bracket. After all, if the couple is receiving $30,000 per year of Social Security benefits, of which 85% would be taxable, and the taxable portfolio generates about $20,000 per year of interest and dividends, and available exemptions/deductions are $25,000, their taxable income after all deductions would be barely over $20,000 per year.

A Department of Labor rule adopted under the Biden administration had many brokers worried about their ability to work as independent contractors. A new proposal would roll it back.

The financial advisory firm initially sought an industrial loan charter back in 2020. It's the third company to receive the necessary approvals this year, joining General Motors and Ford.

Private equity in 401(k)s may face significant liquidity strains, reducing returns and complicating plan management, according to new Morningstar research.

This would put them at the bottom of the 15% tax bracket, and would actually mean any qualified dividends (and long-term capital gains) are eligible for a

if the retiree waits to tap the IRA until the later years, the tax bracket is driven up again because retirement cash flows must be almost fully funded from IRA distributions.

Similarly, if the retiree waits to tap the IRA until the later years, the tax bracket is driven up again because retirement cash flows must be almost fully funded from IRA distributions. For instance, after 15 years, the inflation-adjusted spending need would be nearly $125,000, and the requisite gross IRA withdrawal would be over $150,000. Of course, by definition at this point, any passive portfolio income from interest, dividends and capital gains would be eliminated — as the brokerage account was assumed to be spent down first — and the tax brackets and standard deduction and personal exemptions would be higher due to inflation adjustments as well. Still, while the portfolio withdrawals dip down to the bottom of the 10% bracket, they are mostly taxed at a blend of 15% and 25%.

BLENDING WITHDRAWALS

Given that full distributions from the IRA up front can drive the couple into higher tax brackets, and full distributions from the IRA in later years will do the same, the solution is actually remarkably simple: Take distributions from each account along the way.

By partially tapping the IRA each year, the distributions can occur at only the 15% bracket without ever reaching the 25% bracket. Yet by taking at least some withdrawals from the IRA every year, the brokerage account lasts longer before it is ever depleted, thereby avoiding the point where the retiree must take all distributions from the IRA because there’s no other money left. For instance, the chart below shows the results when the retiree takes half the desired spending from each account every year, assuming their tax-savvy withdrawals keep them in the 15% tax bracket throughout.

Taking the blended-distribution approach helps the portfolio lasts significantly longer than either of the preceding examples. This is driven by both the fact that most of the IRA still enjoys tax-deferred growth for an extended period of time, and more significantly because the annual distributions are modest enough to avoid hitting the 25% bracket.

Notably, the spend-brokerage-account-first scenario still had a higher final account balance, but this is due to the IRA still having a significant looming tax liability that will have to be spent someday. That is, the still-intact IRA will be subjected to taxes. On a net after-tax basis, the split strategy that allows the IRA withdrawals to be blended across the 10% and 15% brackets — assuming an average rate of just 13% — actually fares better than either of the alternatives.

PARTIAL ROTH CONVERSIONS

While the strategy of taking partial distributions from an IRA earlier rather than later can be an effective means to enhance the longevity of the portfolio by reducing the average tax rate paid on the IRA, the one caveat to this strategy is that it still depletes a tax-preferred account earlier than may have been necessary. In other words, the strategy faces a fundamental tension between the desires to take withdrawals earlier to avoid wasting unused low tax brackets in the early years, versus the desires to benefit from tax-deferred compounding growth by leaving the money in the IRA to compound tax-efficiently over time.

The resolution to this dilemma is to recognize that it’s possible to fill up the lower tax brackets in the early years from the IRA, without actually liquidating the tax-preferred account. The solution is to engage in

The end result of this approach is that the brokerage account will still be depleted throughout the first half of retirement, but the retiree’s tax rate isn’t driven up because distributions can be partially supported from the newly created Roth IRA. In this example, distributions are assumed to come 50/50 from the Roth and traditional IRAs. Once the brokerage account is depleted, all Roth conversions stop at that point.

Thus, by engaging in partial Roth conversions, the retiree can have the benefits of the split strategy to keep IRA distributions from ever reaching the 25% tax bracket, but in a manner that still spends down the brokerage account first and allows tax-preferred IRA and Roth IRA accounts to compound as long as possible.

The combination of taking advantage of lower tax brackets and avoiding higher brackets, plus the additional tax-favored compounding in the traditional and Roth IRA accounts, ultimately means that the partial Roth conversion strategy produces greater net after-tax wealth than the aforementioned scenarios do.

MAXIMIZING BY MINIMIZING

Another benefit of the approach of spending taxable/brokerage accounts first while doing partial Roth conversions is that if there are enough funds in the brokerage accounts such that the IRA may not be needed at all, doing partial Roth conversions still helps to maximize long-term wealth by minimizing the future impact of Required Minimum Distribution (RMD) obligations.

For the retiree who doesn’t need the IRA account, taking no distributions from the IRA and allowing the account to compound can actually create less wealth in the long run. As noted earlier, taking large IRA distributions all at once can drive up the retiree’s tax bracket. And this is equally true regardless of whether those IRA distributions are taken because the retiree needs the withdrawal, or simply is being forced to take it as a required minimum distribution.

For the retiree who doesn’t need the IRA account, taking no distributions from the IRA and allowing the account to compound can actually create less wealth in the long run.

By contrast, doing partial Roth conversions not only ensures that the distributions themselves occur at more favorable tax rates in the early years, but can whittle down the IRA to the point that by the time the RMDs actually kick in, the IRA has been reduced to the point that the RMDs aren’t actually very large — which allows the retiree to remain in that lower tax bracket.

Additionally, the fact that a Roth IRA does not have any RMD obligation also allows more dollars to stay in a tax-preferred account for a longer period of time, which indirectly

STRIKING THE OPTIMAL DRAW-DOWN BALANCE

Ultimately, the key concept to recognize in the tax-efficient liquidation of retirement accounts is that there really is such thing as too much tax deferral. An IRA, 401(k) or other pre-tax retirement account that is allowed to compound long enough might eventually become so large that the retiree is driven into even higher tax brackets just trying to tap the account, whether to generate retirement spending or simply because the distributions become compulsory when RMDs begin.

Accordingly, the fundamental goal to spend from the portfolio in a more tax-efficient manner is to find constructive ways to whittle down a pre-tax account and stop it from growing too large, either by taking distributions outright at an earlier phase, or by doing partial Roth conversions. Of course, if too much is withdrawn or converted in the early years, retirees may drive up their tax rates now, which don't help the situation, either. The end goal is to find the balance point between the two.

Ultimately, the key concept to recognize in the tax-efficient liquidation of retirement accounts is that there really is such thing as too much tax deferral.

Of course, where that balance point is will depend on a retiree’s overall income and wealth levels. For some, the objective may be just to fill up the 15% ordinary income tax bracket and avoid any rates of 25% or higher. For those with more significant retirement accumulations, the sheer size of the family balance sheet may make it impossible to avoid being in at least the 25% bracket, and the goal will just be to stay there and not drift up into the 28% or 33% brackets. For those with very significant wealth, any tax bracket that’s less than the top 39.6% may be appealing to fill with partial Roth conversions.

Nonetheless, the strategy for the tax-efficient spend-down of a retirement portfolio remains the same: to allow for maximum tax-preferred growth in retirement accounts by spending from taxable brokerage accounts first, but not letting low tax brackets go to waste by filling them with partial Roth conversions along the way.

So what do you think? How do you execute liquidations from retirement accounts and coordinate amongst taxable, tax-deferred, and tax-free accounts? Are partial Roth conversions part of your retirement spending strategy? Please share your thoughts or questions in the comments section.