Amid a flurry of recent recruits, the six financial advisors who left Ameriprise for Securities America stand out for their choice of RIA.

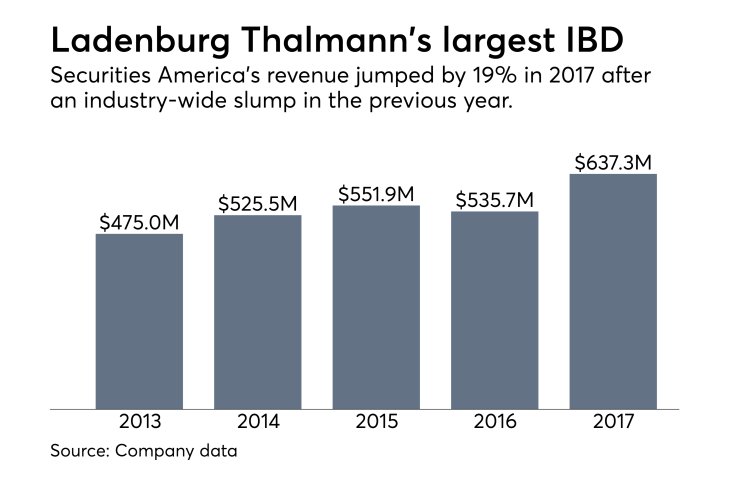

Securities America’s alternate corporate RIA has topped $2 billion in assets under management after adding the group. Ladenburg Thalmann’s largest independent broker-dealer also says it recruited more than 300 advisors across its platforms in 2018.

Thomas Burke’s Syntegra Private Wealth Group brought $459 million in client assets from Burke’s IBD of 26 years to Securities America. The three-office, St. Louis-area team opted for Arbor Point Advisors rather than opening their own RIA or going with Securities America's traditional corporate RIA, Securities America Advisors.

Arbor Point offers more custodial choices than Securities America, according to the firm’s Form ADVs. Clients can use TD Ameritrade, Pershing, Charles Schwab and Fidelity, compared to Fidelity or Pershing offered by the main corporate RIA. Additionally, Orion Advisor Services parent firm NorthStar Financial Services Group owns a minority interest in Arbor Point.

Ladenburg’s second-largest IBD Triad Advisors offers a similar

Email surveillance, cybersecurity and data collection required for recent years’ enhanced regulatory scrutiny is creating “additional burden and risk” for RIAs, says Gregg Johnson, Securities America’s executive vice president of branch office development and acquisitions. The strain is leading to a lot more interest in corporate RIAs, he says.

Advisors are finding there are “more things than maybe they anticipated” to running an RIA, Johnson says. “It's not just about doing a regular update on the ADV. There's a lot more to it that comes into play.”

-

Commissions and cash-sweep revenue jumped by more than a combined $100 million in 2018 — even as the parent firm’s longtime chairman left the company.

March 15 -

The group with $175 million in client assets opted for a Ladenburg IBD they think is less likely to change hands in the future, the OSJ manager says.

March 14 -

The network’s parent disclosed the results of its first year under a new accounting standard affecting the top line at many large U.S. businesses.

March 8

Firms’ head counts show how they’re responding to a challenging time in which experts predict the number of advisors to fall in coming years.

The latest advisor to opt for a corporate RIA had spent his entire career with Ameriprise before joining Securities America on Jan. 3, according to FINRA BrokerCheck. The group also includes Director of Financial Services Colleen Beckemeyer and advisors Sarah Burkemper, Joe Strike, Terry Moyers and Jeffrey Fiehler. Six other members of the team serve as support staff.

“We’ve found a partner that can help us scale up our offerings and support our growth,” Burke said in a statement.

A spokeswoman for Ameriprise declined to comment on the practice’s exit.

Burke’s practice is among Arbor Point’s largest. Securities America added 323 advisors with $2.1 billion in AUM to the firm in 2018, according to Johnson, who notes the figure is gross rather than net. The IBD has roughly 2,600 advisors out of 4,400 at Ladenburg’s five IBDs.

Johnson says Arbor Point has exceeded $2 billion in AUM, while the main corporate RIA reported $22.2 billion on its last ADV filing in late September. The amount of AUM held by affiliated hybrid representatives who have their own RIAs was not immediately available.

TD Ameritrade reimburses Arbor Point for the first year’s annual fee charged by Orion for each new account opened through TD Ameritrade Institutional, according to Arbor Point’s ADV. Arbor Point keeps the entire reimbursement.

Last month, Securities America also ramped up practice management tools

“The number of advisors that are considering or looking at that has also been growing, so we thought it was important to expand our offerings,” Johnson says. “It opens up another market for our recruiting of OSJs or super OSJs, as well as advisors who are looking to acquire to grow.”