Lawmakers revived a push to put annuities in Americans’ retirement plans, reintroducing a bill that would let companies make the complicated insurance contracts the automatic go-to when savers waffle about where to invest chunks of their money.

U.S. Reps. Donald Norcross, a New Jersey Democrat, and Tim Walberg, a Michigan Republican, reintroduced the Lifetime Income for Employees Act on Feb. 15, refreshing a bill they originally brought forth in late 2020.

Known as

Annuities are often cast as investment products, but they’re technically insurance contracts. Investors typically fork over a hefty sum up front in exchange for future income payments. In past decades,

Love me, love me not

The contracts live in a polarizing corner of the financial planning industry, with independent advisors either loving them or hating them —

David Stone, the co-founder and CEO of RetireOne, an annuities distributor based in San Francisco, countered that if the bill passes, it “will help plan participants have better access to a pension-like guaranteed income stream for life.”

By putting annuities in 401(k)s, the bill could blunt the impact of advisors who dislike them.

The bill originally emerged one year after the

Federal retirement plan laws from 1974 known as

Safeguards

The bill says that if a saver doesn’t select investment options for all of her 401(k) money, the undesignated part would be automatically “defaulted” into an annuity. No more than 50% of her 401(k) could hold the contracts, a threshold the legislation says would protect investors by keeping their portfolios diversified across stock and bond funds. The saver would be notified of the investment within 30 days and has the option to reallocate the money into a stock or bond fund within 180 days without incurring any financial penalties. The five-page bill doesn't specify what kind of annuity a retirement plan could offer, only that it provide "a general description of the annuity contract, including the duration of guaranteed payments and identification of the insurer."

Britton Burdick, a spokesman for Rep. Norcross, said in an email that the reintroduced legislation was “substantially the same as the original,” save for one element: a requirement that a retirement plan give savers a second notice 30 days before the initial automatic investment in an annuity. “We added an additional notification requirement to ensure additional consumer protections,” he said. The bill next goes to the House Education and Labor Committee, where both Norcross and Walberg are members, for review before being put to both the full chamber and the Senate for a vote. No deadlines have been set.

The retirement problem

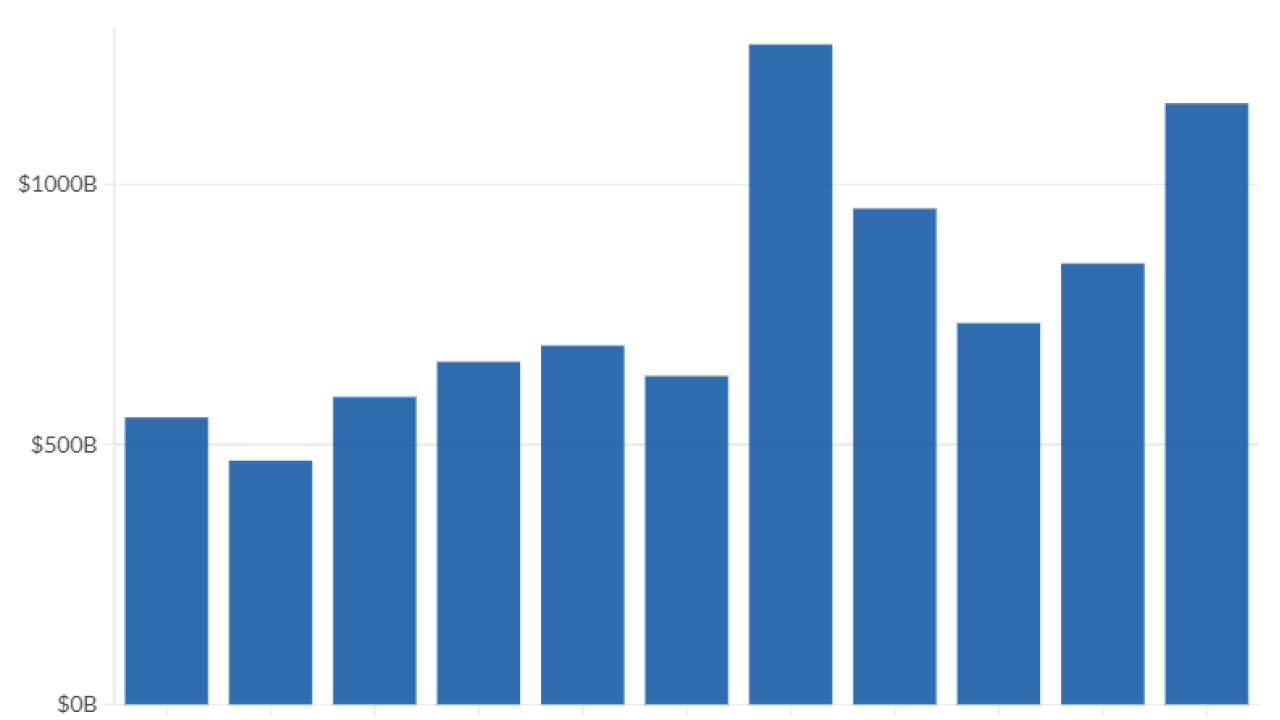

A steady drumbeat of scary news about Americans’ lack of financial readiness for retirement is helping to drive the bill. So are the demise of defined-contribution pension plans and longer lifespans.

“We know employees are increasingly relying on an employer-sponsored plan’s defaults, and we believe it’s high time that one of those default choices is annuities, which can provide a protected lifetime income stream that so many Americans need,” said Jason Fichtner, a senior fellow at the Alliance for Lifetime Income’s Retirement Income Institute.

But in referring to “default investment arrangements in annuities” that can shore up Americans’ retirement security, the bill walks a fine line in calling them neither an investment nor an insurance contract. “By creating ‘individual pensions,’ this legislation will provide hard-working Americans with a guaranteed income so they can retire with dignity,” Rep. Norcross said in a Feb. 15

In a Feb. 15 letter, the Insured Retirement Institute, the industry’s main trade group and lobby,