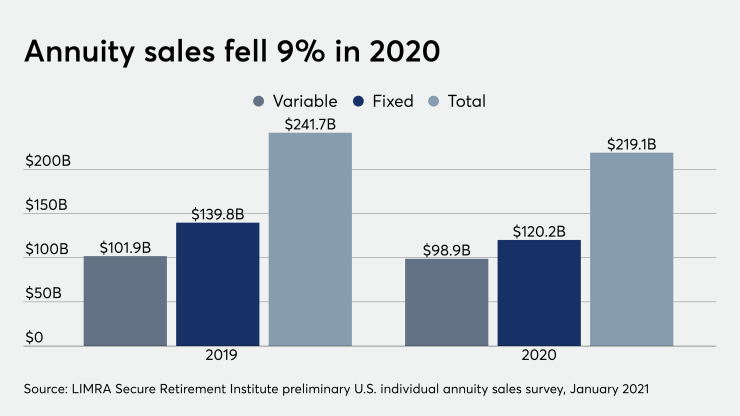

After a year of tumbling sales due to the impact of low interest rates, annuity issuers are focusing on relatively new product lines and making massive M&A deals.

Although structured or buffered variable products — also known as registered-index linked annuities — represent less than 11% of the market, RILAs have emerged as the fastest growing segment,

Most of the momentum in annuities so far this year revolves around growing partnerships aimed at RIAs and M&A deals such as MassMutual’s Jan. 27

And, in addition to the billions in sales among new RILAs

“There's a lot of opportunity for companies to differentiate their products from their peers,” she says. “The accumulation story is very strong, and they can’t really have an accumulation story with a product like fixed annuities right now.”

The structured products remain “an immature product line,” according to Moore, who notes writers have only just begun changing the index periods and crediting rates they offer in the products. Just two structured products have income riders, while 56 others don’t, she says.

Higher sales among RILAs and a rise of 9% year-over-year among fixed-rate deferred products stood out from the falling numbers in other segments. Fixed-index annuity sales dropped by nearly a quarter to $55.7 billion in 2020 after setting a record in 2019. Low interest and 10-year treasury rates also pushed down income annuity sales sharply, the institute notes.

Mega-Deals

More carriers will be crowding into RILAs this year, bringing competition that “breeds better client solutions,” according to Michael Robinson of The Blueprint Insurance Services. Robinson and Matt Meyer will reach many more clients after selling their firm — a third-party marketer working with RIAs and other planners — to Lockton Affinity, the parties

They didn’t disclose financial terms. Prior to the sale, Blueprint was working with more than 55 RIAs. After the transaction with the program administrator arm of the world’s largest independent insurance brokerage, the firm will be able to extend its services across 3,000 RIAs already using Lockton, Robinson says. Blueprint turned down at least a half dozen other suitors.

“We didn't really think any of them were a fit, except for Lockton,” he says. “The penetration of those RIAs is going to be substantial. We're working with some carriers right now on bringing some product innovation that they have to the RIAs.”

RIAs have been attracting significant capital and partnerships in recent years as insurers seek more distribution for their products in the channel. The trend is only picking up steam in 2021. Sammons Financial Group agreed last month

Also in January, Eldridge Industries and Atlas Merchant Capital invested

MassMutual itself unveiled a deal in December to buy

“They're not reaching critical mass through the independent agent distribution, nor through the banks,” Moore says. MassMutual's deal, she adds, is essentially saying of Great American, “‘They have the distribution that we don't, and they have the products that we don't.’”