Top performance from a leading active manager typically comes at a price. For the funds in this ranking, however, it may be hard to justify not paying the premium.

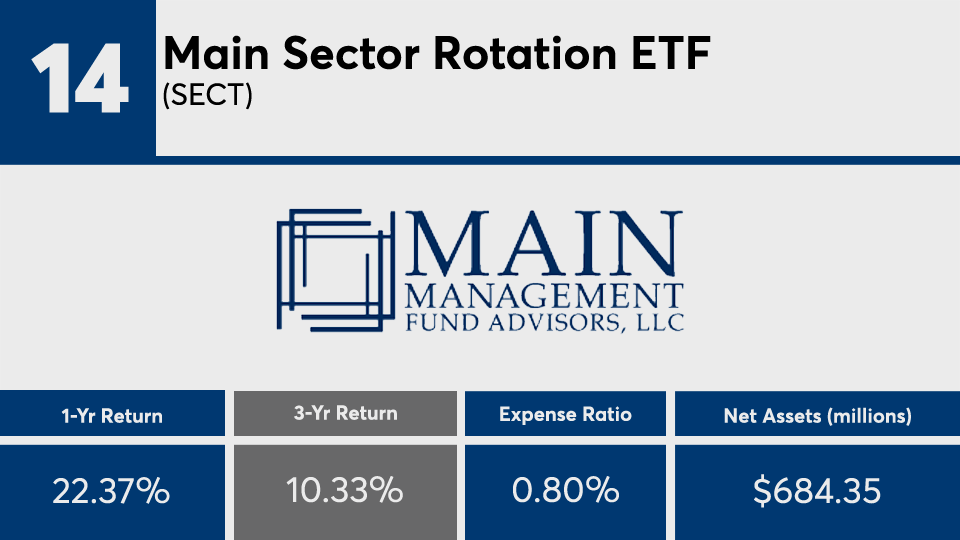

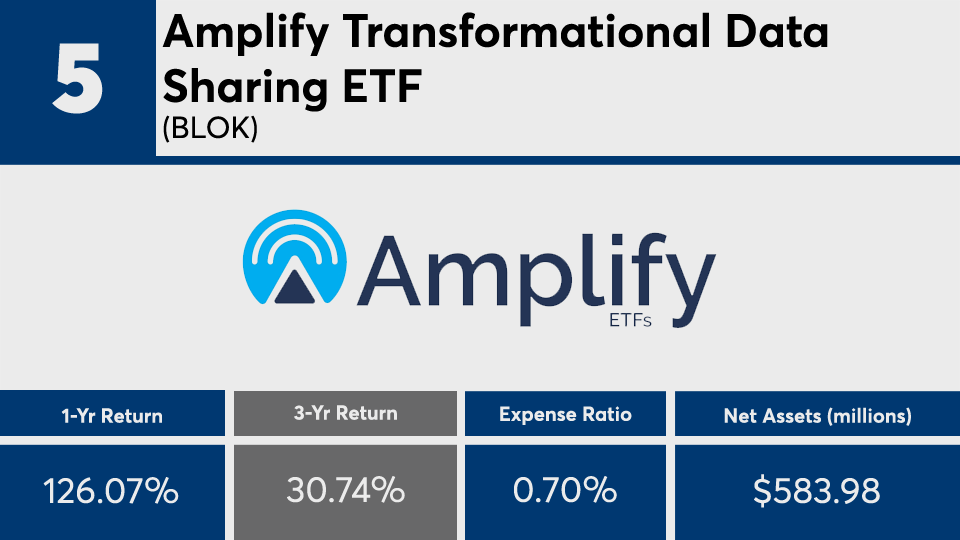

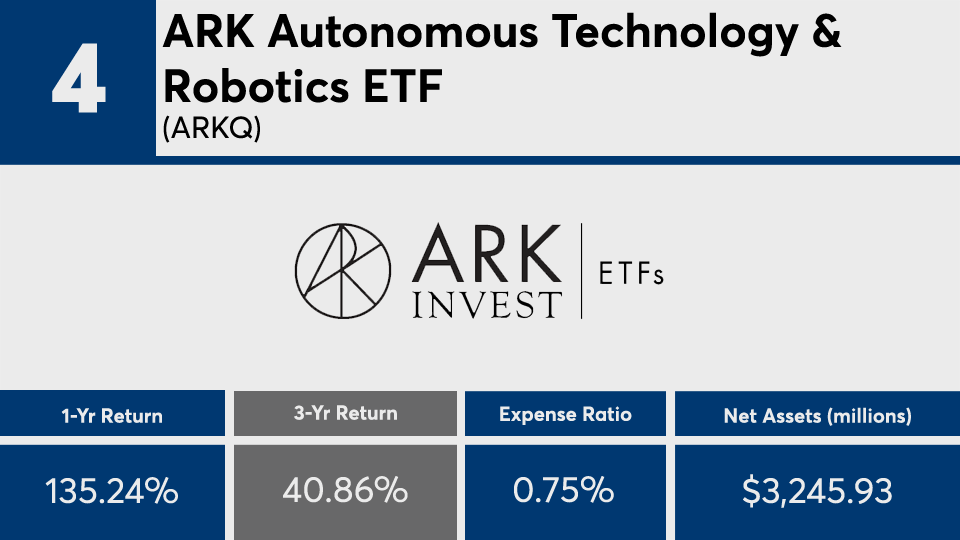

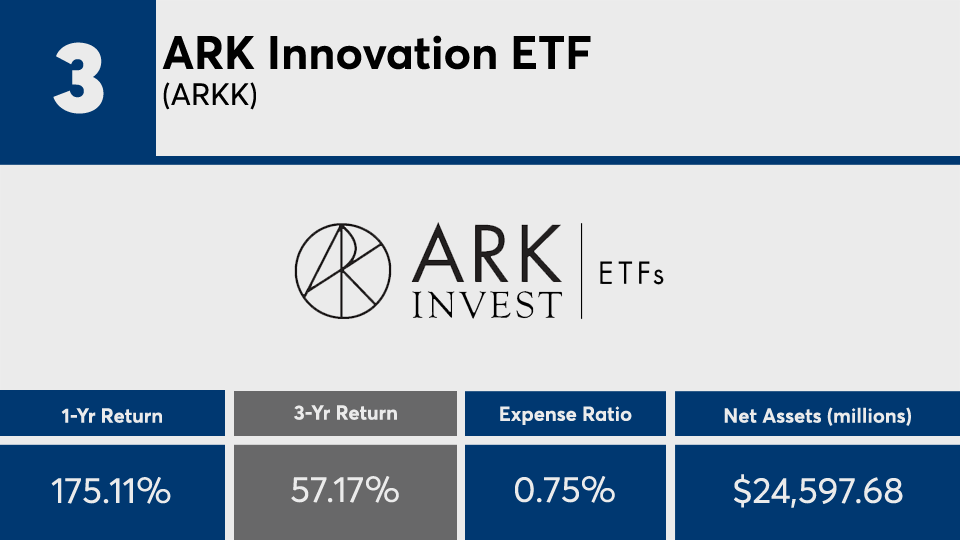

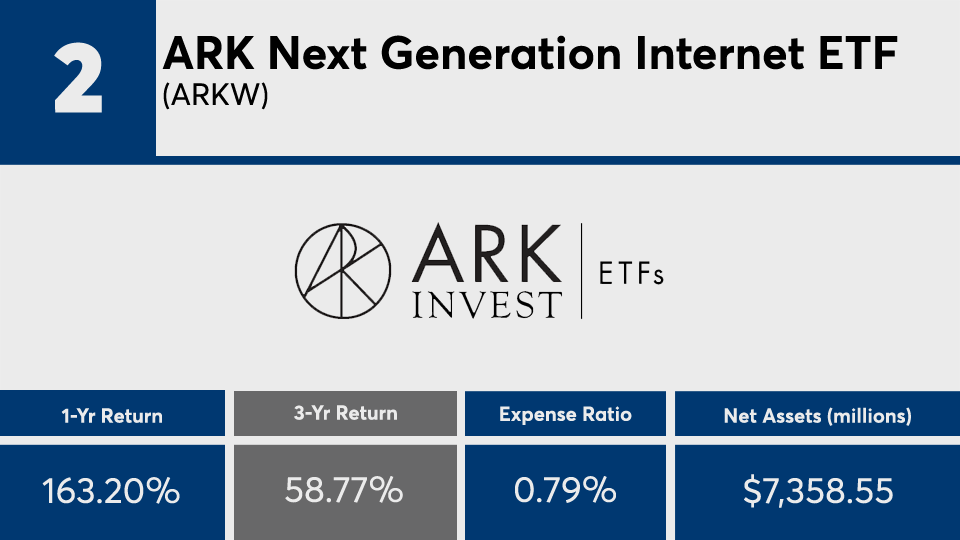

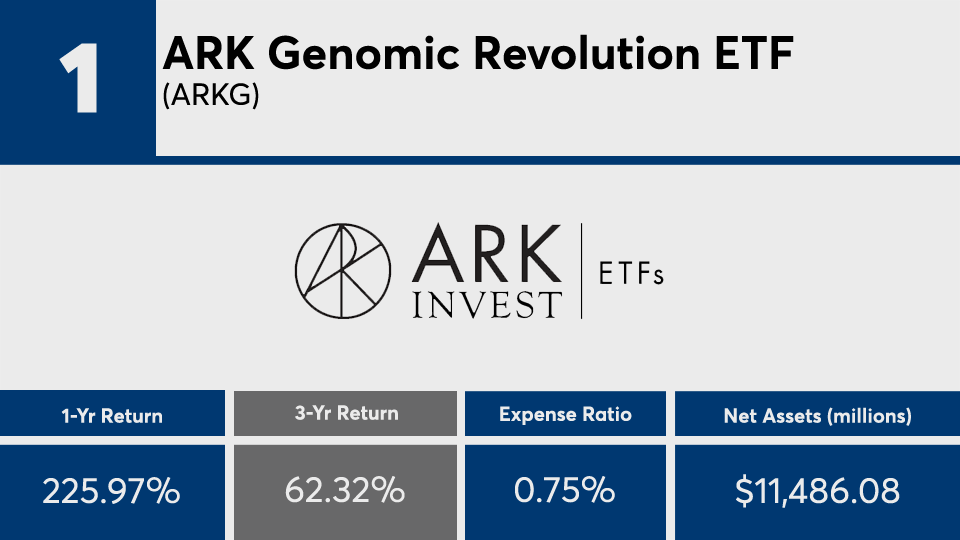

Sector weighting played a big role in the outsized gains produced by the 20 active ETFs with the biggest three-year annualized returns, Morningstar Direct data show. The top five notched figures well above 30% over the period, and more than 100% last year.

Nearly all of the managers in this ranking have been heavily focused on

“Asset allocation tends to be a major driver of investment performance, so it is not surprising to see a number of strategies focused on the technology sector in this list,” Kerr says. “The best active managers are willing to make significant deviations away from their benchmarks when they find attractive opportunities.”

Compared to the industry’s biggest index trackers, funds such as the SPDR S&P 500 ETF Trust (

Read more:

In bonds, the iShares Core U.S. Aggregate Bond ETF (

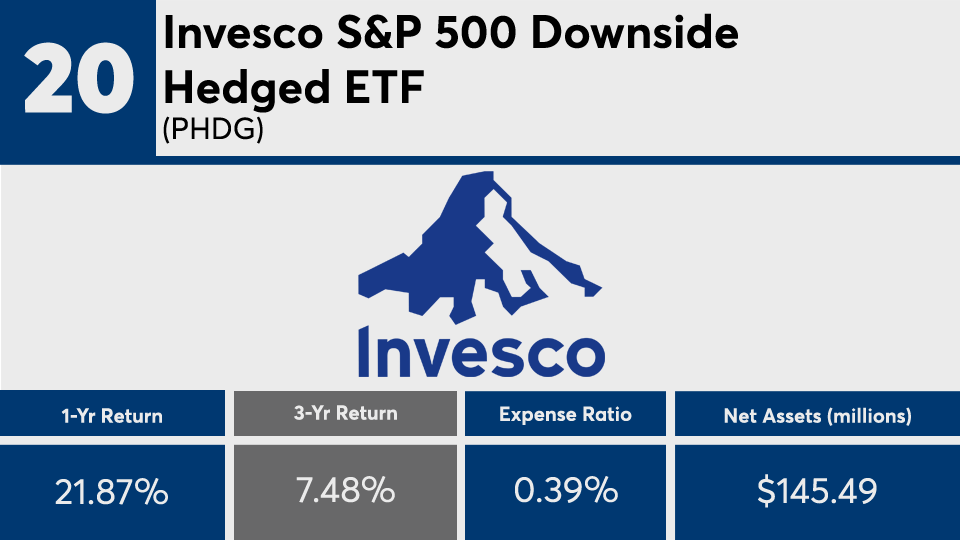

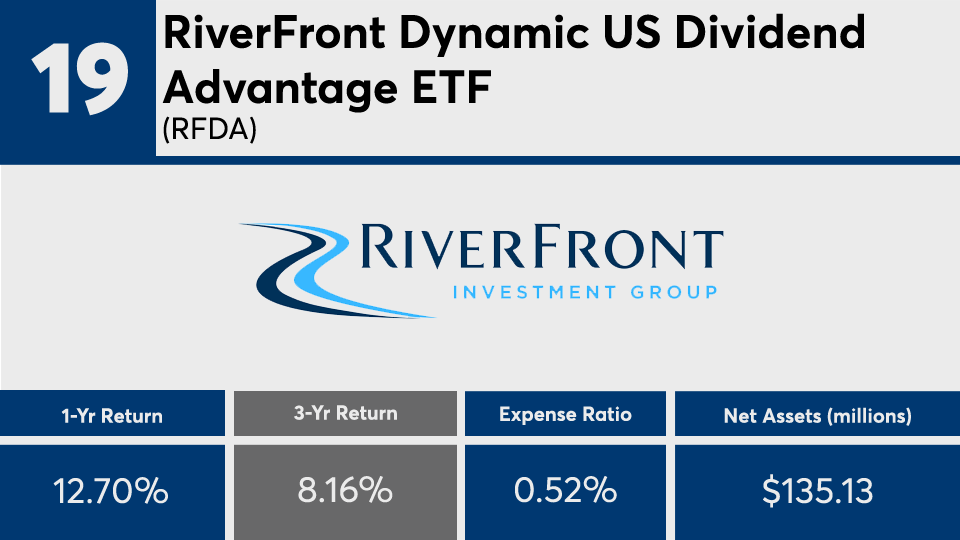

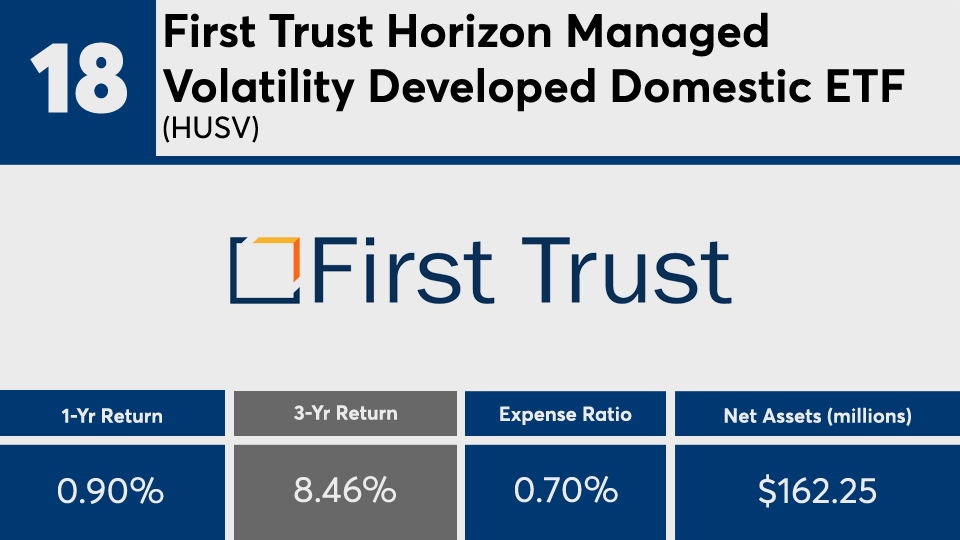

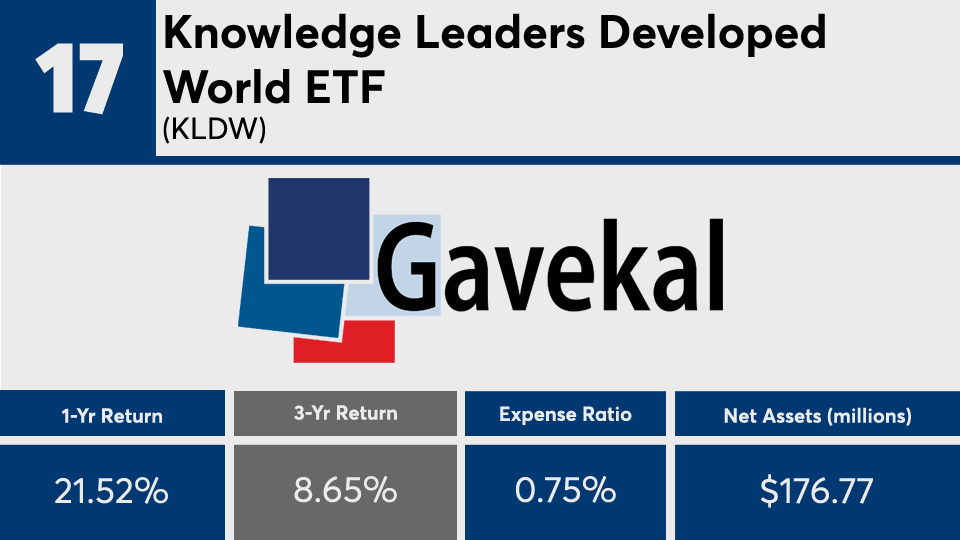

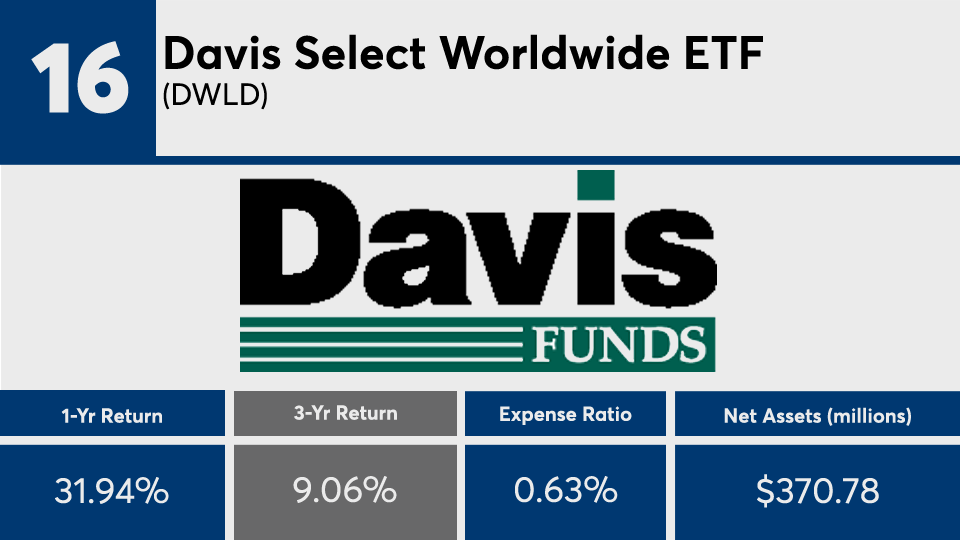

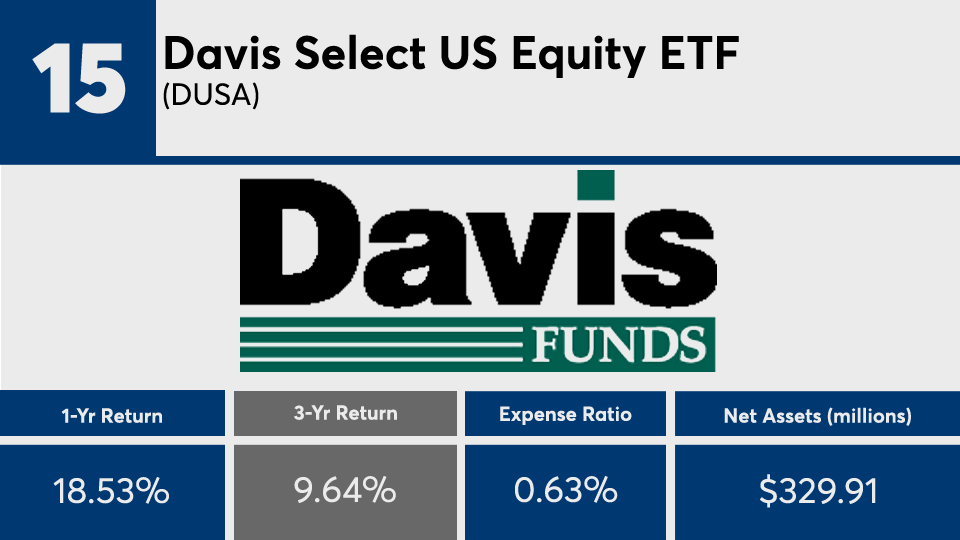

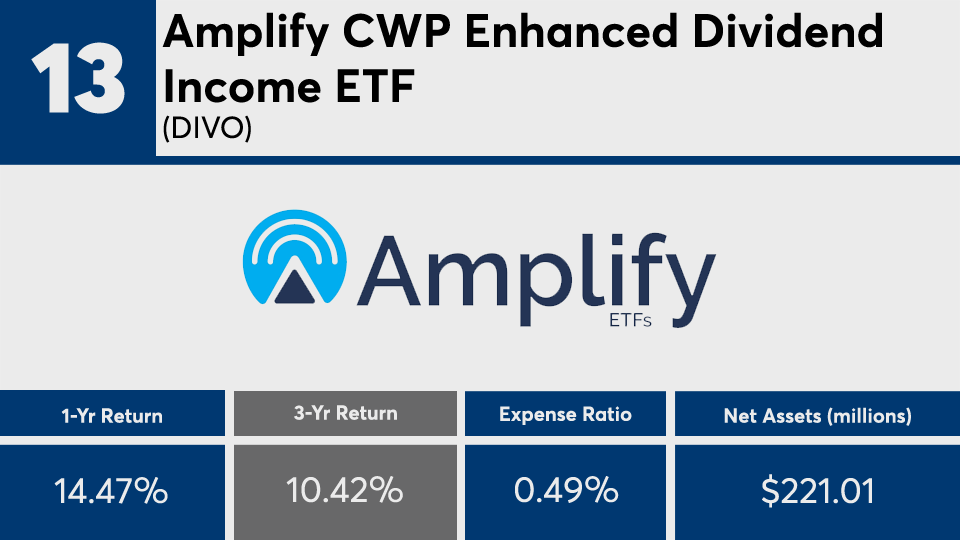

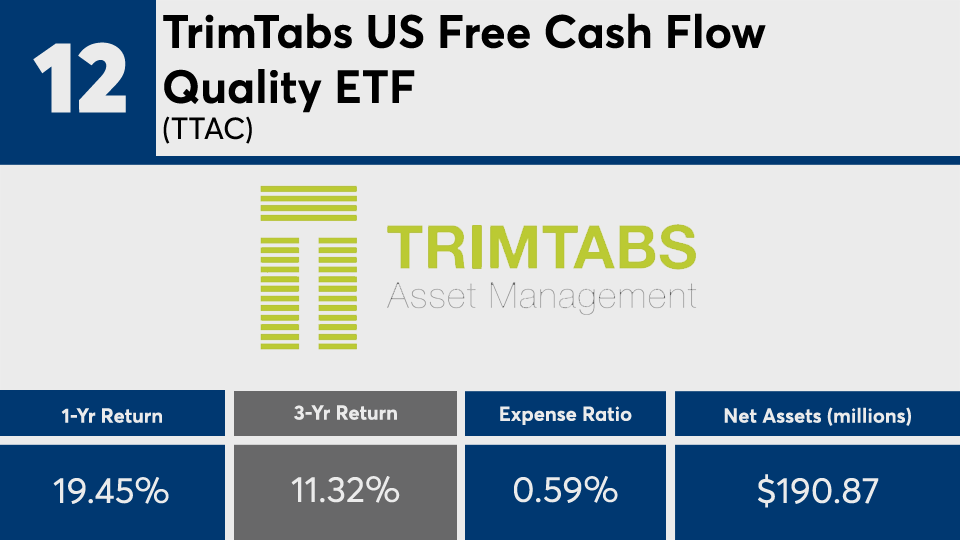

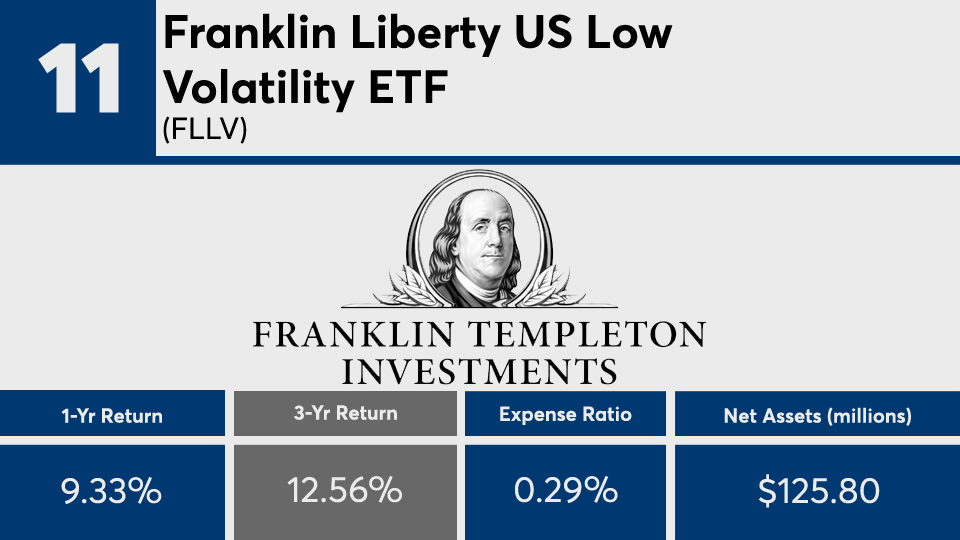

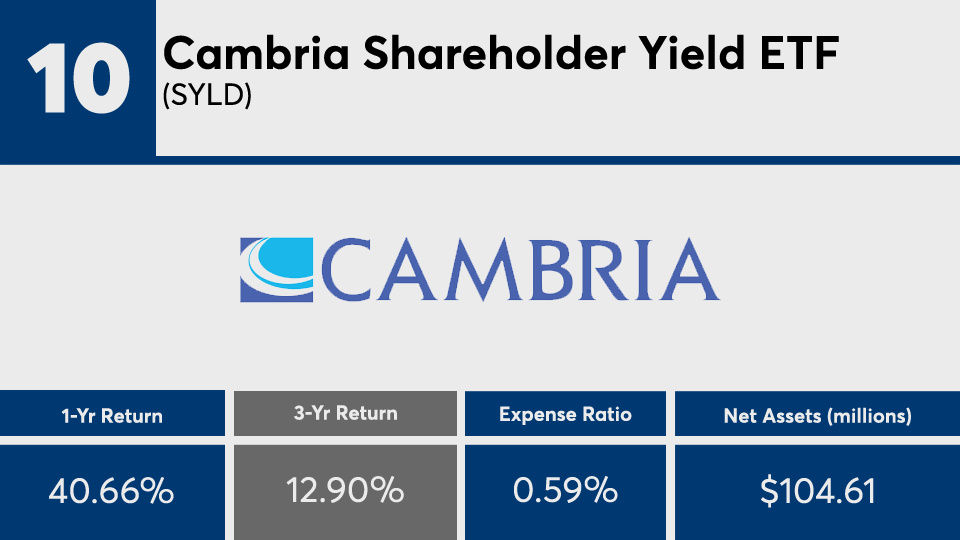

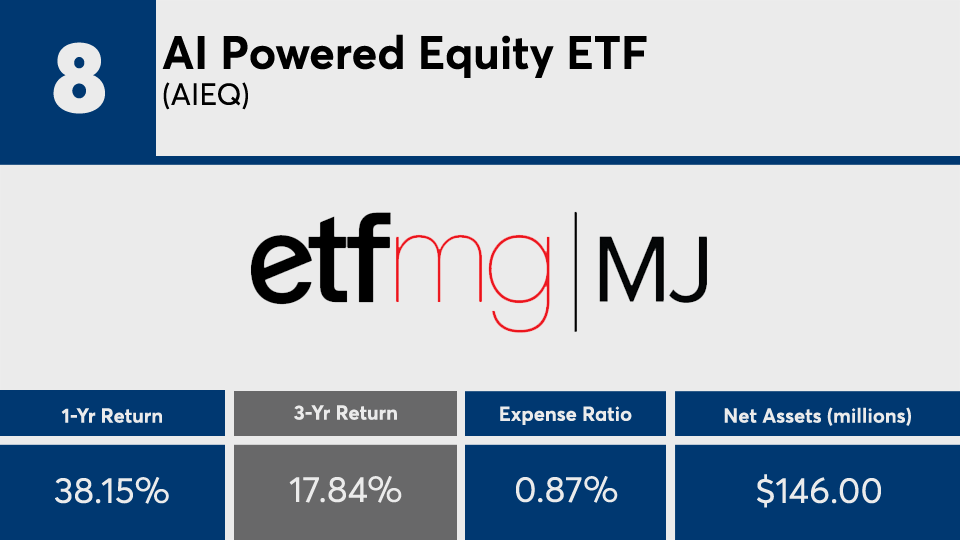

Overall, the active funds in this ranking carried net expense ratios well above the broader industry. With fees averaging around 0.65%, these ETFs were 20 basis points more than the 0.45% investors paid for fund investing in 2019, according to

Despite their outsized gains, advisors must consider their clients’ risk tolerance levels, says Jennifer DeSisto, chief investment officer at Anchor Capital.

“I always suggest to clients that not every strategy is going to work all the time and you should balance out different types of market exposure whether that is growth, value, large, mid, small, dividends,” DeSisto says. “While it is easy to be excited by the latest hot dot, it is important to look at a manager’s performance over a longer cycle and try to understand when they perform well and not so well.”

Scroll through to see the 20 actively managed ETFs with more than $100 million in AUM and the biggest three-year annualized gains. Assets and average expense ratios, as well as one-, three- and five-year returns through Feb. 4 are also listed for each. The data show each fund's primary share class and current portfolio manager or managers. All data is from Morningstar Direct.