A financial advisor who bolted from JPMorgan Chase Bank says many in the bank channel hesitate to go independent from their longtime branches and well-known brands.

“It's really important that bank channel advisors know that they have the ability to do so. They just have to be honest with themselves about their practice,” says Joseph Mazzucco, who just launched Purchase, New York-based Stonebrook Wealth Management.

“When you have a skilled experienced advisor that genuinely cares about his or her clients,” he adds, “it's much more about the individual than it is the name behind them."

Mazzucco — who managed more than $100 million in client assets at JPMorgan — had spent three years affiliated with the bank's broker-dealer before switching to LPL Financial on Aug. 23, according to FINRA BrokerCheck.

The change came as part of eight recruiting grabs over a seven-week span in which LPL added two dozen advisors managing more than $2.2 billion in combined client assets. The flurry of moves followed those of the advisors with a combined $8.5 billion who LPL said it recruited

Going indie had been “an aspiration” since he started his career, says Mazzucco, who relocated from a JPMorgan branch in Rye Brook, New York. The 14-year veteran with prior stints at Citigroup and Wells Fargo Advisors chose LPL because of its scale and its lack of proprietary products or sales goals, he says.

“They look at me as a client to them, and their goal is just to help me support my business, which in turn is helping me support my clients,” Mazzucco says. “LPL provides me with the flexibility I need to run my business. I think a lot of the banks and the wirehouses that are affiliated with banks — they've become really cookie cutter.”

Representatives for JPMorgan declined to comment on his departure.

Stonebrook’s client base includes corporate executives, business owners, medical professionals and retirees in New York and South Florida. About 90% of its client assets come from advisory accounts, which are migrating to LPL’s corporate RIA, Mazzucco notes.

“We welcome Joseph to LPL, and look forward to supporting his independent practice for years to come,” Rich Steinmeier, LPL’s head of business development, said in a statement.

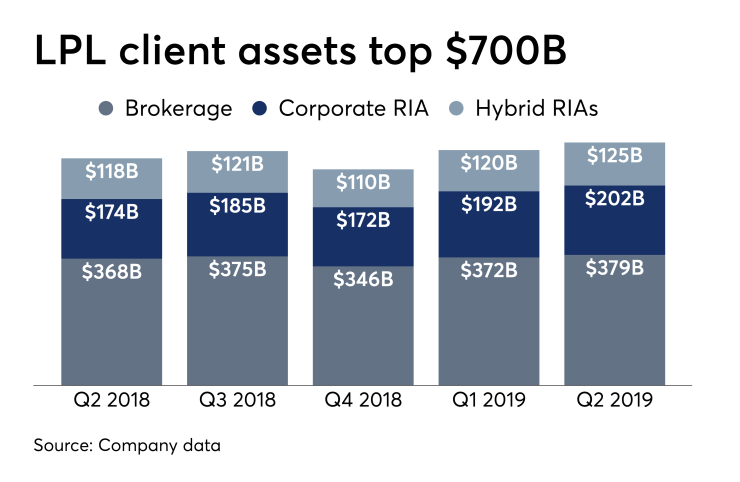

Like Mazzucco, six of the seven other moves since mid-August brought more advisors to LPL’s corporate RIA, which has $202 billion in assets under management. The other new advisors left prior affiliations with competitors Advisor Group, Ameriprise, Kestra Financial and Wells Fargo Advisors Financial Network, among other firms.

- The 10 advisors of Financial Solutions Group, an Alexandria, Louisiana-based enterprise with $1 billion in client assets,

aligned with LPL on Oct. 2, according to FINRA BrokerCheck. Founder Greg O’Quin and his sons Patrick and Philip, alongside seven other advisors, operate the group out of two offices with eight other support staffers. - Rocklin, California-based advisor Nic Delyon

affiliated on Sept. 16 with LPL and another large enterprise named The Financial Services Network. The 30-year-old practice manages about $115 million in client assets. - Advisor Todd Wilhoit of Stevensville, Maryland-based Chesapeake Investment Planning

aligned with LPL on Sept. 5. Fellow advisors Jay Bogaczyk, Jeremy Meyer, Tommy Painter and Adair Tyler also work out of the practice, which manages $150 million. - LPL also added Mount Vernon, Ohio-based Lambert Investment Group, whose second-generation owner Joshua Lambert

affiliated on Sept. 3. His father started the firm in 1984, and it has since grown to some $130 million in client assets. - Advisors Bill Urbanik, Tony Slezak and Jessica Marazza of Latrobe, Pennsylvania-based SecondHalf Coach Wealth Management

affiliated with LPL on Aug. 28. Urbanik and Slezak formed the practice, which manages $210 million, when they merged in 2010. - The only hybrid RIA move of the bunch came courtesy of advisor Kurt Yndestad, who

affiliated on Aug. 26 with IHT Wealth Management and the No. 1 IBD. Yndestad manages about $200 million in client assets. - Las Vegas and Gardenia, California-based advisors Mark and Gary Sudol, who are brothers, and a third advisor, Jeffery Lavin,

aligned with LPL on Aug. 15. Their practice, The Sodul Group, manages around $300 million in client assets.