An independent broker-dealer and an LPL Financial advisor have accused a retreating variable annuity issuer of breach of contract in two lawsuits filed in the same week.

The filings, which both seek class-action status, come after Cincinnati-based insurance firm and IBD Ohio National Financial Services decided to stop writing new VA contracts and cut off commission trails on Dec. 12 for products with a guaranteed minimum income benefit rider. LPL has

Advisor Lance Browning followed LPL’s rhetoric with action, alleging that he’s entitled to $89,000 in trails for next year alone under LPL’s selling agreement with the issuer.

Meanwhile, Veritas Independent Partners, a much smaller IBD, also accused Ohio National of breaching its selling agreements over the trails.

Annuity sales

“While Ohio National has the right to discontinue future sales of the annuities, it may not unilaterally terminate its obligation to pay trailing commissions on existing annuities,” according to Browning’s filing.

“The case is of significant importance to the hundreds of independent broker-dealers and their representatives who devoted significant time and resources to building a book of business with the expectation they would be paid the trail commissions they earned through their dedication and efforts,” Geoffrey Moul, an attorney representing Veritas, said in an email.

-

LPL slammed the move by the exiting major issuer to cut off trails for advisors in certain existing contracts.

October 17 -

Reg BI would boost sales because the products fill a pressing need for income over long lifespans, the executives say.

October 12 -

Revenue from FIAs surged to well over the existing mark in the second quarter, while VAs stabilized after 17 straight quarterly declines.

August 24

The largest firms’ combined VA and FA revenues hit a three-year low in 2017, but the products still make up a significant portion of their businesses.

Ohio National spokeswoman Angela Meehan said the firm does not comment on pending litigation. The firm has pledged to maintain its support for existing VA contracts by changing most of the selling agreements to so-called service agreements, although advisors will not receive compensation.

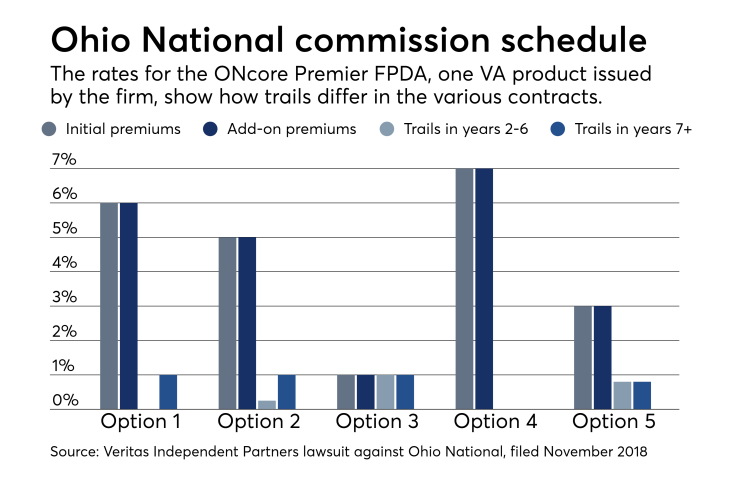

The trails vary based on the product, the length of the deposit, the amount paid by clients in upfront commissions and other factors, with a maximum of 100 basis points in trails under the lowest initial and add-on premiums, according to commission schedules included in the Veritas lawsuit.

Neither filing names a specific amount of requested damages, but the Veritas lawsuit claims VAs amount to $23.6 billion in assets under management at Ohio National, or 56% of its AUM.

The firm has “not even implemented this unfair and improper policy evenly across the board as to all broker-dealers,” according to Browning’s lawsuit, which states that advisors at Morgan Stanley and Ohio National’s BD will still receive commission trails despite the different arrangements with other IBDs.

The plaintiffs filed their civil lawsuits in the U.S. District Court for the Southern District of Ohio, with Veritas’ Nov. 8 lawsuit arriving two days after Browning’s filing. The Veritas suit named the parent firm and three other entities as defendants, while Browning’s covers three Ohio National entities.

In addition to breach of contract, the advisor accused Ohio National of unjust enrichment, tortious interference and promissory estoppel while seeking declaratory relief. Veritas also alleges breach of contract and tortious interference, along with requesting declaratory and injunctive relief.

The judge will next determine whether the Veritas lawsuit becomes coordinated with any other actions, Moul said, noting that combining several related lawsuits is not uncommon.