A big LPL enterprise just got bigger.

Bleakley Financial Group grabbed four advisors with nearly $500 million — boosting the enterprise’s assets above $6 billion.

Bleakley uses LPL as its broker-dealer and Private Advisor Group as its RIA. In addition to the recruiting grabs, Bleakley also hired a portfolio manager this summer who was formerly a partner at billionaire hedge fund manager Leon Cooperman’s Omega Advisors, according to Managing Director Vince Nauheimer.

The New Jersey-based enterprise was launched in 2015 by ex-Northwestern Mutual representatives and has recruited

Advisor Joseph Sreshta opened Bleakley’s newest office in Houston last week after 36 years with Northwestern Mutual, where he managed $250 million in client assets.

About half of Bleakley’s advisors affiliated with the enterprise after leaving insurance BDs, Nauheimer says. He notes the enterprise had one office in Fairfield only three years ago.

“We're continuing to establish a national footprint for the firm,” he says.

In an emailed statement, Northwestern spokeswoman Betsy Hoylman confirmed Sreshta’s departure from the firm.

“Northwestern Mutual remains committed to recruiting, developing and retaining advisors interested in comprehensive planning that helps clients achieve financial security through insurance and investments,” Hoylman said.

Sreshta affiliated with LPL and Private Advisor on Sept. 16, according to FINRA BrokerCheck. Two staff members also made the move with him.

In aligning with Bleakley, the team followed a sister-brother practice out of Boca Raton, Florida, with $125 million in client assets. Michelle and Christopher Mackin

The decision “was based on researching a better opportunity for both us and our clients,” Christopher Mackin said in a statement. He cited the practice’s focus on the planning process, saying Bleakley enables “leveraging tools and resources we didn't have access to previously."

FCG didn’t respond to a request for comment on their move.

Another practice with $120 million in client assets committed to joining Bleakley in coming weeks, according to Nauheimer. In July, portfolio manager David Mandelbaum joined the Westport, Connecticut, outpost of Bleakley to manage healthcare investment sleeves for the enterprise’s advisors. The office is led by the firm’s

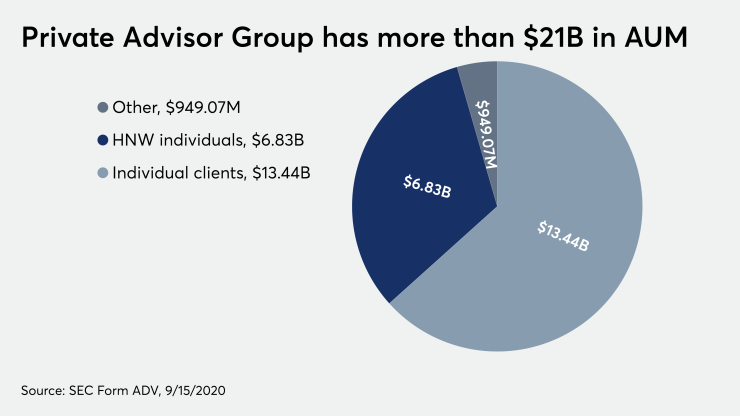

Bleakley’s hybrid RIA and office of supervisory jurisdiction, Private Advisor, has reached more than 650 advisors, 55,000 clients and $21 billion in assets under management. Under a rebranding

Private Advisor “is growing, and we're developing new solutions that enable our audience to continue to work towards their own growth and success,” Managing Director Berta Aldrich said in a statement.