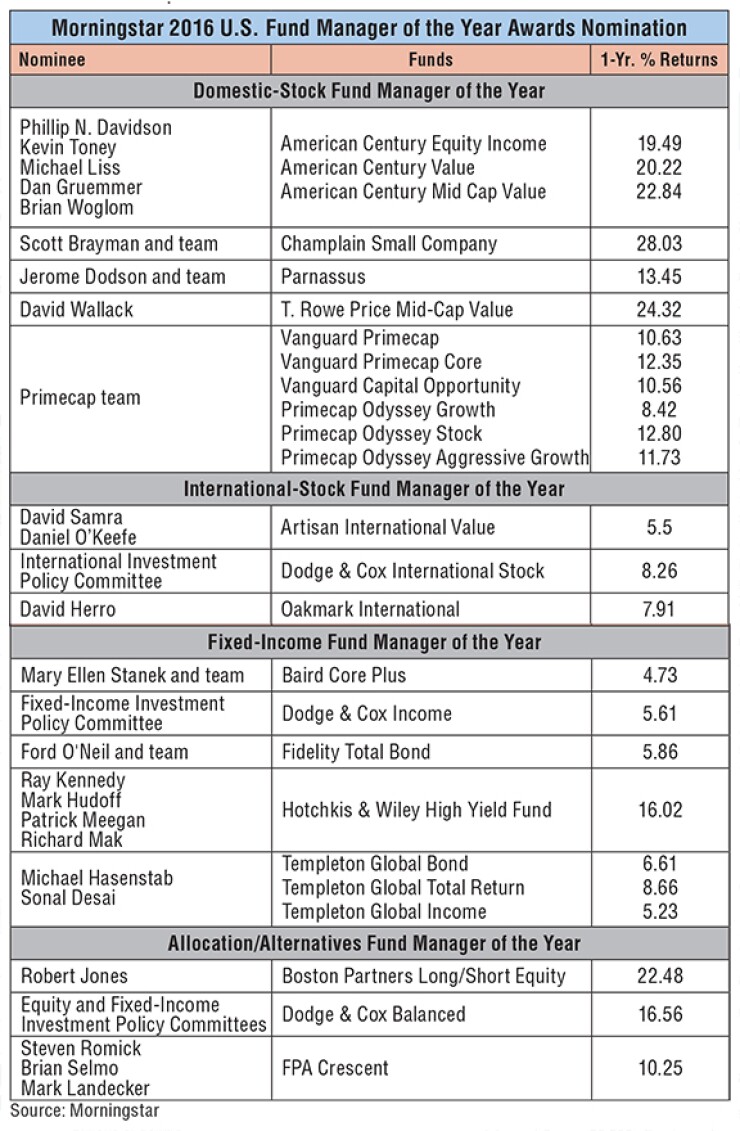

Some familiar names returned to the list of nominees for Morningstar’s U.S. Fund Manager of the Year awards.

These popular choices for asset allocation also have a history of solid performance.

Champlain Small Company stands out with the highest return on this year’s list, with a 28.03% return in 2016. Champlain’s competitors include Vanguard’s Primecap team, winner of the 2014 Domestic-Stock Fund Manager of the Year.

The chart above summarizes the performance of each fund in 2016.

The nominees, Morningstar says, generated outstanding, long-term, risk-adjusted returns.

"This year's crop of nominees not only managed to deliver strong returns to shareholders, but did so the right way – by sticking to their fundamental investing approach through thick and thin," said Laura Pavlenko Lutton, Morningstar's director of manager research.

The research firm plans to announce the winners on Jan. 25.