Our weekly roundup of tax-related investment strategies and news your clients may be thinking about.

Tax rules for rental properties remained almost the same under the Tax Cuts and Jobs Act, however there are still some facets that can be complicated for clients, MarketWatch reports. A vacation home is classified as a rental property if the owners rent it out for more than two weeks within the year and use it for personal purpose for not more than 14 days — or 10% of the days the property is rented out. The allocation of mortgage interest, property taxes and other expenses between rental and personal use should be based on the actual days the vacation home is rented out and the days it is used by the owners.

Sometimes, seniors will be better off defying conventional wisdom to enhance tax savings when generating retirement income from their portfolio, according to this article on Kiplinger. For example, instead of tapping taxable account first, clients who are in a lower tax bracket may want to draw funds from their tax-deferred retirement accounts or take tax-free distributions from a Roth IRA to stay in a lower bracket and minimize the tax bite. They should also keep their taxable income below $38,700 ($77,400 for joint filer) to avoid paying taxes on long-term capital gains and qualified dividends.

-

These property tax deferral programs are available to older homeowners who want to postpone real estate taxes provided they remain living in their home.

August 28 -

Homeowners from both parties worry that rising property taxes could force them to sell.

November 14 -

The holidays are fast approaching, which means it is time to start doing some year-end tax planning.

December 3

A portfolio makeover creates an opportunity for clients to achieve greater tax efficiency, says Morningstar's Christine Benz. "For a lot of people, this is as simple as holding equity ETFs as well as municipal bonds and bond funds for their taxable accounts," Benz says. "Finally, for people who are already in drawdown mode, it makes sense to think about tax-efficient withdrawal sequencing."

Clients who are holding mutual funds in non-retirement accounts can expect a hefty tax bill before the year ends, as 517 of these funds announced that they have to distribute all capital gains realized this year, according to this article from The Wall Street Journal. Many mutual funds are forced to sell investments to pay outgoing investors who are switching to index funds. Mutual fund investors receive substantial payouts due to “the exceptional run in U.S. equities over the past decade or so,” an expert with Vanguard says.

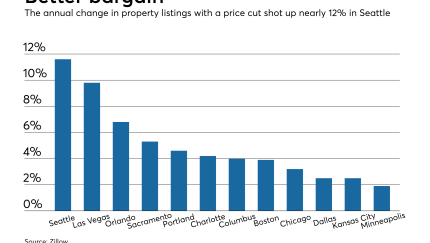

Clients on the hunt for a new home may find they have more leverage at the negotiating table.

Clients should make the most of higher contribution limits for retirement plans next year, according to this article on Motley Fool. Boosting the contributions can help reduce their taxable income and keep their tax bracket low. 401(k) participants should also review their investments, while retirees who turned 70 1/2 this year will have to take their first required minimum distribution from their 401(k) account by April 1. Failure to take the mandatory distribution will mean a hefty penalty on top of income taxes on the withdrawal.