As more and more of its clients push for ESG investing strategies, RBC Wealth Management is boosting its support for financial advisors who help clients put their money where their principles are.

“It's definitely become a more strategic initiative over the last two or three years,” says Kent McClanahan, vice president of responsible investing at RBC Wealth Management. “We've had a bunch of different pockets of people working on it over the last few years, but now it's really to come to the forefront.”

RBC is determined to put more focus on ESG following demand from its clients, as well as an

To measure the demand from its own client base, the company recently surveyed more than 1,000 of its clients, 43% of whom were high net worth and 72% who were 60-79 years old.

“We wanted to really get our own head around what RBC clients think about this,” he says.

Overall, about one-third — or 31% — of the company’s clients said they feel it’s important to invest in companies that are integrating ESG factors into their policies and decisions, according to the survey.

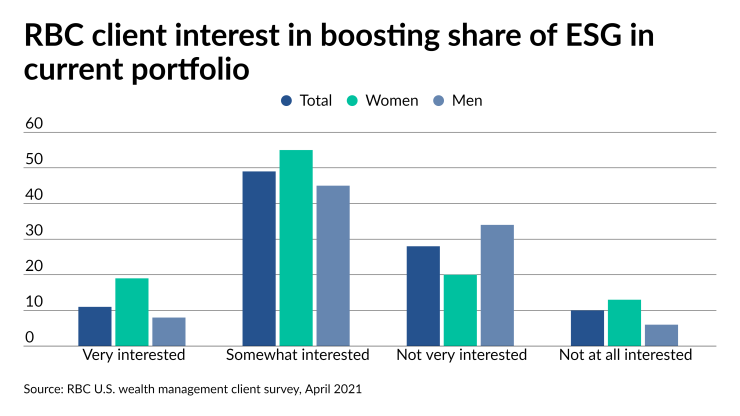

RBC’s women clients, in particular, are driving much of the interest. Female clients were nearly twice as likely to say it’s important for companies to incorporate ESG factors into policies and decisions, with 43% of RBC’s female clients saying it is important, compared to 24% of male clients. 74% of women said they were interested in increasing their share of ESG investments in their portfolio, compared to 53% of men, according to the data.

Notably, McClanahan says, RBC’s women advisors have driven interest for ESG within the firm as well.

“I definitely think female advisors have been the leaders so far,” he says, noting that a majority of the questions he fielded early on came from women employed at the firm, although it has evened out in recent months.

Over the last year, specifically, there has been particular attentiveness to responsible investing, especially after the social turmoil of 2020. McClanahan paid careful attention to this; he lives outside of Minneapolis, where George Floyd was murdered last year, spawning Black Lives Matter protests and sparking attention to policing across the country and other parts of the world.

Following the election, “climate change is really kind of coming back into the fore as well,” he says.

As for how RBC’s clients are already invested, McClanahan says demand for sustainable investing strategies has been on the rise. Assets in ESG funds, separately managed accounts and portfolios at RBC have grown by 152% in the last year, he says.

More fund managers are entering the exchange-traded sector. Investors are following.

Importantly, about 86% of surveyed RBC clients said they plan to turn to their advisor to learn more about sustainable and responsible investing. McClanahan says the firm has been rolling out education materials and resources — emails, videos, fact sheets and training documents — to make sure its financial planning employees can field those questions.

The company is working on ways to quantify and show clients the impact of their investing strategies, such as measuring pollution levels and data on gender-relationed compensation gaps, McClanahan says, which will be contingent on companies standardizing the way they release data to the public. The SEC recently

Ultimately, McClanahan wants RBC advisors to be talking through the social impact of their clients’ investments, right alongside the discussion of risk and return.

“That's where I want us to get as a firm — is where all of this is normal and part of every conversation we have with every client,” McClanahan says.