With the SEC's new package of rules around investment advice

That message was amplified by the commission's addition of new interpretative guidance stipulating when brokers can provide investment advice that is "solely incidental" to their core business, a safe harbor provision that grants them an exemption from the more stringent fiduciary responsibilities under the Investment Advisers Act.

"I think they gave more clarity," says John Lukanski, a partner at the law firm Reed Smith in Princeton, New Jersey. "In imposing the new Reg BI, they're going to respect the hat you're wearing."

That addition expanded on the two-track approach for advisors and brokers that SEC Chairman Jay Clayton has

In general, the revisions incorporated into the final rule came around the edges, preserving the central elements of the original proposal, observes James Lundy, a partner at the law firm Drinker Biddle.

"Interestingly enough, there were not many meaningful changes," Lundy says.

Some investor advocates, who have long been critical of the SEC's approach to its overhaul of advice regulation, see the final rule as a mixed bag.

"We're wading through the details to see what got better and what got worse, but mostly they seem to take away with one hand what they give with the other," says Barbara Roper, director of investor protection at the Consumer Federation of America.

While she welcomes added language expressly prohibiting brokers from putting their interests ahead of their clients for the purposes of a compliance safe harbor, Roper has reservations about changes to provisions regarding conflicts of interest.

The final rule "appears to have significantly weakened the conflict requirement relative to the proposal," Roper says. "Conflicts now only have to be mitigated at the individual sales rep level, whereas firm level conflicts will only have to be disclosed."

-

It could be the most significant update to advisor standards of conduct in years.

May 24 -

With brokerage firms lining up in support of the SEC proposal, fiduciary planners aim to keep their differences from the BD channel intact.

May 17 -

The rule requires greater public input, an industry trade group says.

May 17

But for large firms with multiple branches and individual representatives, that conflict mitigation requirement will become a supervision issue, and in practice will likely lead to firm-wide policies on mitigating conflicts, according to Lundy.

"Practically, if you're going to develop a mitigation process at the rep level, I think you're going to see it at the firm level," he says.

Firms that don't "do so at their own peril," Lundy says, noting that his clients have generally indicated that they plan to establish firm-level policies to mitigate conflicts of interest.

At more than 700 pages in length, Regulation Best Interest will no doubt weigh on firms' compliance operations as they incorporate its strictures, though Lukanski argues that much of that spadework has already been done. Even though the Department of Labor's fiduciary rule was vacated by a court, many firms had already amended policies and procedures to comply with its mandates. With those changes in place, coupled with existing compliance with FINRA's suitability rule, many firms will already be more or less compliant with the SEC's Reg BI.

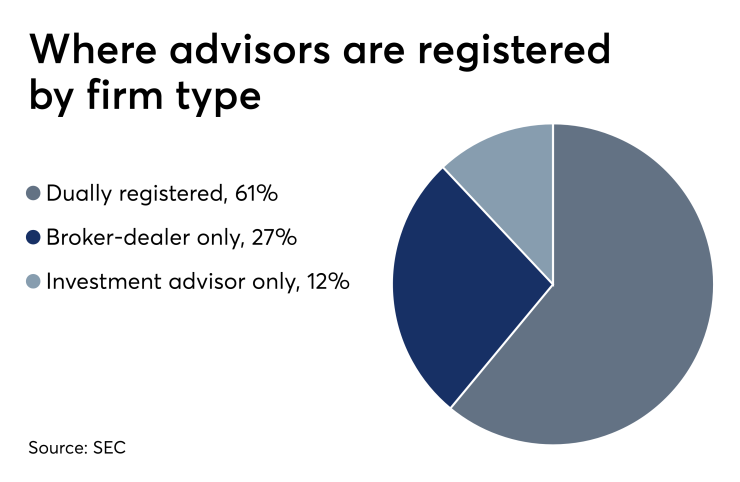

Then, too, there is the secular shift in the industry that has seen many dually-registered firms move accounts from the commission-based broker wing of the practice to the advisory side, Lukanski says.

"Just as a practical matter, I think that lessened the blow of having an enhanced duty on your broker-dealer function," he says.

Still, firms of all varieties will have work to do to achieve compliance. The new form CRS requires firms provide clients a summary of their practice, providing information about how they are compensated and whether they are bound by a fiduciary standard.

The commission's final regulation offers firms more latitude in describing their practice through form CRS than the proposal did. For advisors, that will mean a new third part added to their ADV forms.

Enumerating the basic elements of the practice — fees, compensation, conflicts, etc. — needn't be "a heavy lift" for advisors, Lundy says, but he urges them to take a close look at the SEC's guidance around the new form.

"They are going to have to look at their disclosures and make sure their disclosures align with form CRS," he says. The SEC's published framework on form CRS " is a really efficient tool for the RIA industry to make sure that everything is aligned with that guidance," Lundy says.

Form CRS, like the rest of the SEC's rule package, has come under fire from critics like Roper, who contend that it will do little to alleviate investor confusion.

"[T]he commission has a truly abysmal record when it comes to developing disclosures retail investors can actually understand," she says. "And providing firms with greater flexibility is going to make this mess worse, not better."

Anticipating that line of attack, Clayton offered a preemptive rebuttal in his statement at this week's meeting:

"This criticism misses the point of how much an improvement the relationship summary will be for retail investors over existing disclosures," he said in his

Firms will want to note other changes that the commission made in its final rule, including a provision that explicitly applies Reg BI to account selection, such as a recommendation to roll over a retirement plan or take a distribution. Also, the revamped proposal expressly bars sales contests and other incentive programs that could result in conflicted advice.

It remains an open question as to how the SEC and FINRA will approach examinations and enforcement once the rules take effect next June, but the final rule does include a new provision requiring firms to set formal policies and procedures relating to Reg BI. Lundy anticipates that there could be a sweep exam focused on compliance with the rules. But even if not, and examiners just incorporate the new regulation into their routine visits to firms, brokers and advisors should expect that it will be a major focus when their practice comes under review.

"Regarding the examination program, everyone should expect that soon after the implementation period, the examination of these aspects of this rulemaking package will be one of the top priorities for the examination program," Lundy says.

And it might not be too long before enforcement cases begin to materialize, according to Duane Thompson, senior policy analyst at Fi360, a fiduciary consultancy.

"A year or a year and a half after it goes into effect," Thompson says, "you're going to see the SEC or FINRA make an example out of a firm that failed to follow the policies and procedures it had in place."