CHICAGO -- Price was the main driver of target-date fund popularity last year, a new report finds.

In 2018, target-date mutual funds actually receded in assets for the first time in a decade, according to Morningstar’s 2019 target-date fund landscape report. Their cheaper cousins, target-date collective investment trusts — which the research firm began tracking for the first time last year — recorded net growth of $30 billion to nearly $660 billion, pushing overall target-date universe to a combined $1.7 trillion in assets. Mutual funds accounted for $1.09 trillion of those assets, down from $1.11 trillion in 2018, according to the report.

"Though growth of target-date mutual funds stalled in 2018, the target-date market continues to expand into newer areas like CITs, reflecting retirement plan sponsors' desire to meet demand for the low-cost strategies," said Jeff Holt, director of multi-asset and alternative strategies at Morningstar.

Although Morningstar doesn’t track the fees associated with CITs, analysts say by nature the products are a lower-cost option. Holt says that is because the products are under the regulatory purview of the Office of the Comptroller of the Currency (OCC), which allows institutions to negotiate their fees.

-

Which funds that are approaching their target year have had the best five-year returns?

May 10 -

When retirement is still nearly two decades off, which funds posted the best five-year returns?

May 11 -

These funds have the luxury of time to be more aggressive – which had the best five-year returns?

May 12 -

Funds targeting the industry's youngest retirement investors often take the most aggressive allocation strategies – which had the best five-year returns?

May 17

Most inflows in the target-date space went to low-cost products with over 80% of their assets in index funds. An estimated $57 billion of flows last year went to investment vehicles with expense ratios less than or equal to 20 basis points, while those with expense ratios higher than 60 basis points recorded outflows of $37 billion, Morningstar reports. Because of this move to lower-cost share classes, the average asset-weighted expense ratio among target-date products had dropped to 0.62% from 0.66% in 2017.

“There’s a drastic shift from assets going to the low-cost funds and coming out of the higher cost funds across all target-date mutual funds,” Holt said at a press briefing at the Morningstar Investment Conference in Chicago. “That phenomena — the demand for lower cost funds — has really shaped the competitive landscape because target date providers have responded to that … demand.”

At the end of 2018, there were roughly 39 firms offering target date funds. Fourteen decided to launch a new series and nine of those were a lower-cost option, often attained by investing more in index funds, Holt said. “In all nine cases, the lower-cost fund saw higher flows than the legacy higher cost option,” he said.

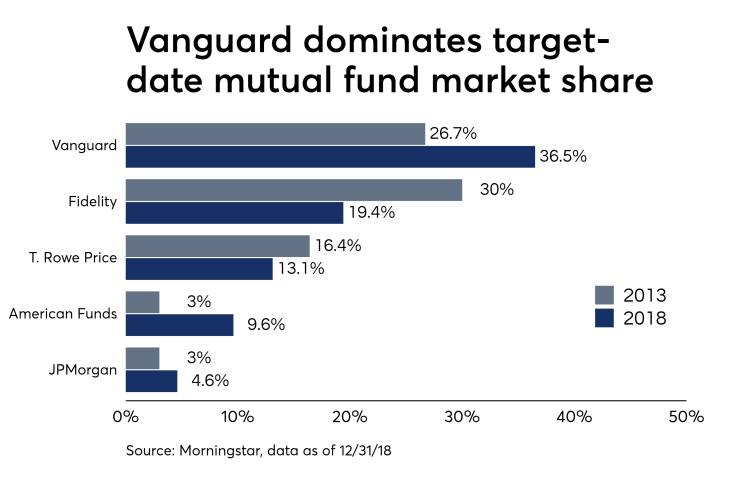

It should come as no surprise that Vanguard dominated the space. With 36.5% of the target-date mutual fund universe under its management realm, Vanguard leads its peers in overall market share. Fidelity Investments came in second with a 19.4% market share, followed by T. Rowe Price with 13.1%, according to the report. When you factor in CITs, that number is even higher for Vanguard pushing their total target-date strategy market share to 37.8%. Their next nearest competitor, when combined with CITs, is Fidelity at 14.2% market share.

“You’re seeing flows across the whole glide path,” Holt said. “Flows tend to be higher for investors in the more mature part of their career… as you get to retirement you’re seeing outflows, which you would expect as they’re either rolling it over to an IRA or whether they’re using it for income in retirement.”