UBS must pay a former client $4.4 million in the latest FINRA arbitration award assessed even as the firm’s U.S. wealth management arm reports record profits.

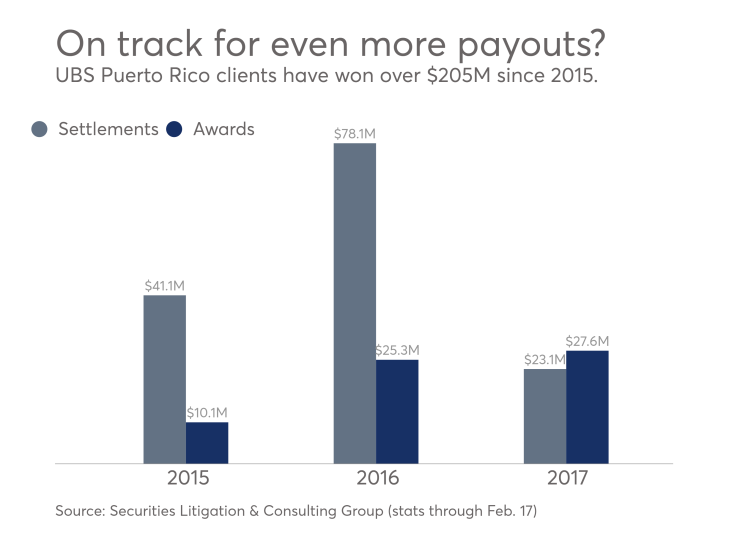

The Swiss firm, which has faced more than 75% of the claims related to Puerto Rico municipal bonds, has paid at least $205.6 million in settlements and awards from 1,476 filings, according to the Securities Litigation and Consulting Group. Yet UBS still

The

Cummings, an anesthesiologist, had a “pretty normal account” with UBS Puerto Rico until the firm changed his repo financing into margin loans, according to his lawyer, Luis Miñana. UBS was preparing for looming credit downgrades a year before the municipal debt crisis, he says.

“The point is that the firm knew that something was about to happen, and they decided to take themselves out of the equation and pass that risk to the client,” Miñana says.

“He got no explanation. He was highly concentrated in Puerto Rico like everybody else was. He needed diversification, and they never provided it.”

Stocks and Puerto Rican bonds are the focus of many cases among clients, advisers and firms.

UBS 'DISAPPOINTED'

The March 29 ruling amounts to as much as a $12 million judgment against UBS, according to Miñana, because the panel voided all purchases in Cummings’ accounts since December 2013 and all of his loans and debt. Miñana and UBS argued the case in 24 hearing sessions following the March 2015 claim.

The company is “disappointed and strongly disagrees with the decision to award any damages in this case,” a UBS spokeswoman said in a statement.

“Dr. Cummings was an experienced investor who made a fully informed decision to leverage his investments and invest a substantial part of his portfolio in Puerto Rico securities, including UBS Puerto Rico closed-end funds, because of their long history of providing excellent returns and substantial tax advantages.”

One of the arbitrators, a Wellington, Florida-based attorney named Robert Ostrov, dissented from the judgment but did not include any explanation. He didn’t return phone calls to his office Tuesday.

-

An arbitration panel ordered the wirehouse to settle the latest dispute stemming from client investment losses tied to the island commonwealth's massive debt crisis.

December 6 -

The wirehouse alleges two arbitrators failed to disclose key information about their professional and personal histories.

January 9 -

The arbitration award comes a month after the wirehouse had to pay a similar amount to clients stemming from the sale of debt from the island commonwealth.

January 13

PROFITS UNHARMED

Clients like Cummings have filed 1,874 arbitration claims since the bonds’ disappearing value wreaked havoc on leveraged accounts in 2013, according

A FINRA arbitration panel leveled

Neither UBS nor the consulting firm, which reported 827 pending claims in February against UBS and “many more being filed each quarter,” project the litigation to slow down. Clients have filed claims of roughly $2 billion, with about 40% of the total resolved, the wirehouse disclosed last month.

Without admitting or denying the findings of SEC and FINRA investigations, UBS agreed to pay $33.5 million in separate 2015 settlements, according to the firm’s latest annual report. The following year, pretax adjusted profits at UBS Wealth Management Americas jumped 43% to a record $1.3 billion.

MORE TO COME

The Puerto Rican government’s shaky finances and additional federal oversight, however, could “increase the number of claims against UBS concerning Puerto Rico securities, as well as potential damages sought,” according to a note on the firm’s liabilities in the report.

The total cost to UBS “cannot be determined with certainty based on currently available information and accordingly may ultimately prove to be substantially greater (or may be less) than the provisions that we have recognized.”

Miñana, a San Juan-based attorney, estimates the total number of filings against all firms could potentially triple to 6,000 claims. Cummings’ successful case against UBS focused on his investment and retirement accounts, but he has yet to receive any damages related to his investment trust, according to Miñana.

“Right now, there’s another case that we have to file,” he says, “and that’s for the trust.”