Pretax profits rose and advisor headcount fell at UBS’s wealth management business, which is preparing some major technology upgrades over the next 18 months.

The drop in headcount was expected as the wirehouse continues to place greater emphasis on productivity and maintains its selective posture on recruiting.

The firm reported that pretax profit rose to $766 million for the fourth quarter from $327 million for the same period a year ago as a result of lower expenses and slightly higher revenue. Advisor headcount for its Americas wealth unit dropped to 6,549 for the fourth quarter from 6,850 for the year-ago period. The figures include some advisors who operate outside the United States.

The firm’s shrinking brokerage force is now about half the size of its wirehouse rivals, and is smaller than that of Ameriprise, which reports earnings next week and has approximately 9,000 employee and independent advisors.

Despite its smaller headcount, UBS fields the most productive brokerage force at revenue per FA of $1.4 million. The firm also had record invested assets per FA of $214 million.

By contrast, Morgan Stanley has 15,468 advisors and reported $1.1 million in revenue and assets of $175 million per FA, according to that firm’s latest earnings release.

On a Tuesday earnings call, CEO Sergio Ermotti said UBS remains committed to improving productivity.

UBS also remains committed to selectively picking up advisors catering to its core high-net-worth and ultrahigh-net-worth client segments. Earlier this month,

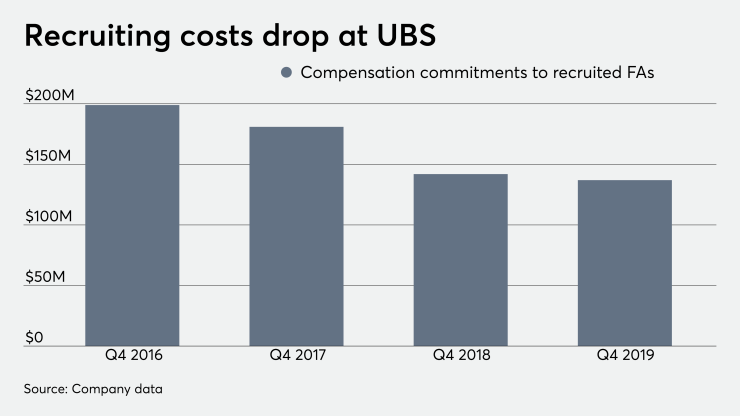

Still, the firm’s hiring efforts are a far cry from what they once were and recruiting cutbacks, which started in 2016, have lowered the firm’s costs. Compensation commitments with recruited financial advisors stood at $137 million in the fourth quarter, down from $142 million for the year-ago period and down from $199 million from the fourth quarter of 2016.

The firm’s recruitment loans to FAs are also lower, having fallen to $2.053 billion from $2.296 billion, as opposed to the $3.033 billion UBS reported for the end of 2016.

In lieu of recruiting, UBS says it is increasingly focusing on high-net-worth and ultrahigh-net-worth clients and the advisors who serve them.

In the coming year, the firm aims to better tailor services to client needs, push more decision-making closer to the client-level and strengthen the bonds between the bank’s different business units.

Top executives also highlighted plans to leverage investment banking capabilities for wealth management clients during UBS’s

To create greater scale through partnerships, they spotlighted an effort in the U.S. in which UBS has teamed with Broadridge Financial on a major update to its technology platform for wealth management. The wirehouse will replace core systems — some of which date back to PaineWebber — by June 2021.

UBS reported client assets of $2.6 trillion and net outflows of $4.7 billion for its global wealth management unit. The outflows mainly occurred in the Americas and included two single large outflows that amounted to $5.4 billion,